Ethereum has skilled a robust upward rally over the previous two weeks, pushing from the $1,500s to above $2,600. Nonetheless, indicators of exhaustion are starting to floor. Whereas increased timeframes stay bullish for now, short-term warning is warranted.

Technical Evaluation

By ShayanMarkets

The Every day Chart

ETH has hit a technical ceiling just below the $2,900 resistance, which aligns carefully with the 200-day transferring common. This zone beforehand acted as a significant breakdown level in February and is now serving as a provide space. The RSI additionally just lately entered overbought territory, suggesting that momentum is fading as worth approaches this resistance.

A rejection from right here might result in a pullback towards the $2,200 assist zone and the 100-day MA positioned close to the $2,100 mark. A confirmed breakout above $2,900 would shift the bias again to bullish, with a possible continuation towards the vital $4,000 zone.

The 4-Hour Chart

Dropping decrease on the 4-hour timeframe, Ethereum is exhibiting indicators of weakening momentum. After the explosive transfer above $2,100, the worth has been consolidating inside a slender vary close to the $2,500–$2,600 area.

A transparent bearish divergence is now confirmed on the RSI, with worth making increased highs whereas RSI makes decrease highs. This usually signifies a possible correction forward. If ETH loses the $2,450 assist, a retracement towards $2,200 and even $2,050 turns into probably. On the flip aspect, reclaiming $2,600 with robust quantity might invalidate the bearish indicators and open the trail for a run on the $3,000 space.

Sentiment Evaluation

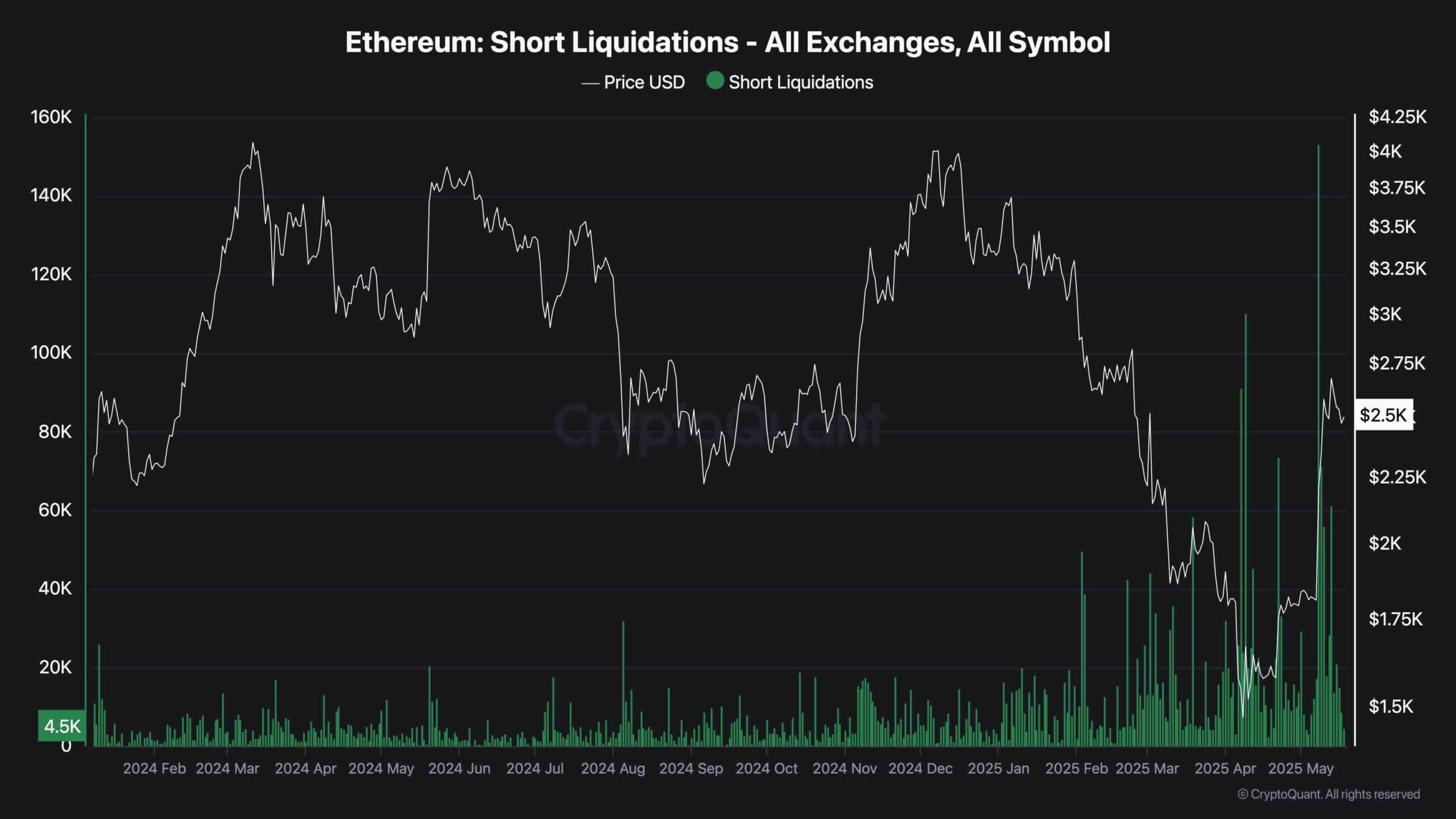

The latest rally triggered a pointy wave of brief liquidations, which helped gas the aggressive worth surge. As seen within the brief liquidation chart, the biggest liquidations occurred close to $2,400–$2,600, signaling a big portion of sellers have been compelled out of the market. This usually results in short-term cooling, because the “gas” for the rally will get exhausted.

The liquidation chart exhibits a transparent uptick in compelled closures over the previous week, aligning with Ethereum’s breakout. These spikes typically mark native tops, because the elimination of extreme brief publicity removes the momentum driver. With liquidations now really fizzling out, the worth might battle to push increased with out recent demand coming into the market. This context reinforces the concept ETH might consolidate or appropriate earlier than any significant continuation.