Canaan Inc. (CAN), one of many modern mining and information middle corporations, rallied to a six-month excessive. The corporate introduced a 2.5MW capability for a brand new mining middle in Canada, utilizing extra gasoline flares for crypto mining.

Canaan, Inc. (CAN) launched a pilot program for mining crypto utilizing extra pure gasoline flares for power. The corporate will construct a 2.5MW information middle, appropriate for 700 Avalon A15Pro miners. The info middle will purpose for 90% uptime whereas using extra pure gasoline.

Canaan hopes to make use of the surplus power for additional duties, switching between mining and AI computation. Canaan will associate with Calgary-based Aurora AZ Vitality Ltd.

Large milestone for Canaan!

We’ve formally launched a gas-to-compute pilot in Calgary, Canada — turning stranded & flared gasoline into clear power for Bitcoin mining and AI computing.

– 700 Avalon A15 Professional miners

– 2.5MW capability

– 12–14K tons CO₂ lowered yearly

– 90% uptime…— Canaan Inc. (@canaanio) October 13, 2025

Fuel flares are one of many much less frequent sources of power for BTC mining. Canaan Mining will ship the tools on to gasoline wellheads, instantly changing the gasoline to electrical energy at under business prices.

“By integrating localized pure gasoline technology with our modular computing methods, we’re remodeling beforehand wasted assets into productive power,” mentioned Canaan CEO Nangeng Zhang within the announcement.

The surplus electrical energy might be both used for mining or computation, or offered to the grid throughout information middle downtimes.

Canaan’s shares unfazed by tariff speak

Canaan Mining has proven its adaptability to diverse market circumstances. CAN shares have traded for the reason that firm’s IPO in 2019, permitting the corporate a footprint within the USA. As Cryptopolitan reported, Canaan Mining has been profitable in securing revenues from rig gross sales and direct mining.

The mining firm achieves 9.3 EH/s as of September. Moreover, the corporate offered greater than 50K A15 Professional models to a US-based agency, regardless of earlier tariffs on merchandise or elements from China.

Canaan Mining is ranked within the prime 15 of corporations combining mining, information facilities, and extra BTC treasuries. The corporate has been the runner-up to ASIC manufacturing, nonetheless claiming recognition with its Avalaon model. Canaan was additionally the producer of the primary ASIC chips, which introduced BTC mining to a brand new aggressive period.

CAN shares rally to a six-month excessive

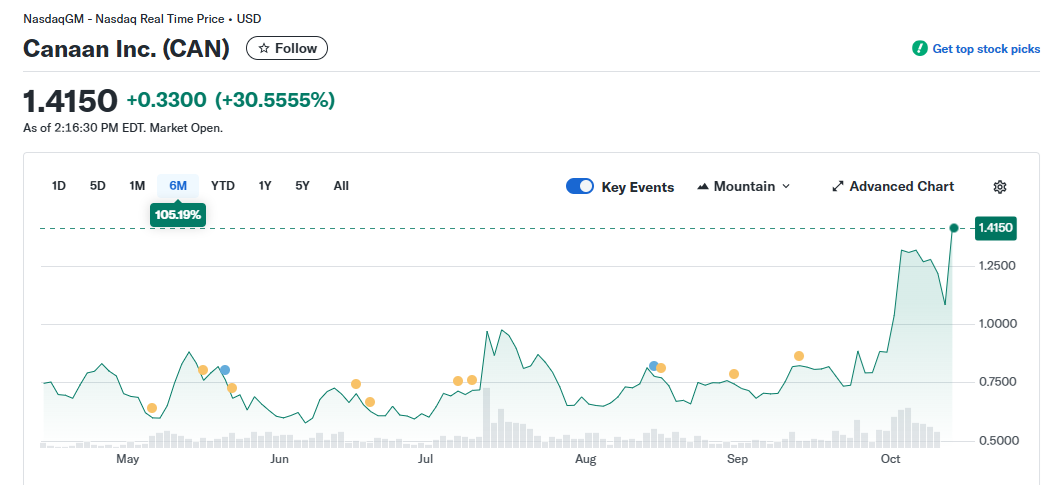

CAN shares expanded on the information of profitable mining and treasury development. CAN expanded to $1.42, returning to ranges not seen since February.

CAN rallied to a six-month excessive, following the information of a brand new partnership for gasoline flare mining. CAN additionally recovered together with different mining shares, as the specter of one other commerce battle with China dissipated. | Supply: Yahoo Finance

Canaan shares rose by over 28%, increasing sooner in comparison with different mining corporations with further reserve narratives.

The mining rig producer didn’t profit straight from the treasury firm frenzy, as a result of its concentrate on mining. Canaan is just not a ‘playbook’ firm and doesn’t search further BTC purchases. Nonetheless, Canaan nonetheless has the thirty ninth largest BTC treasury, with 1,547 BTC accrued as of October 2025.

CAN additionally adopted the final development of main mining corporations, increasing by over 10% on common previously day. Different mining shares rallied throughout the board, recovering quickly after the diminishing chance of one other commerce battle with China.

Over the previous months, BTC mining continued to broaden, with new information facilities created, regardless of the looming worry of tariffs on elements or ASIC rigs.