The third section of the CBDC pilot will contain implementing tokenization options that permit prospects to supply banks with visibility into their collateral belongings in Brazil. This, in flip, would simplify the method of assigning credit score inside an onchain, open, and shared finance ecosystem.

Central Financial institution of Brazil Seeks to Resolve Onchain Credit score in Drex’s CBDC Third Pilot Section

The Central Financial institution of Brazil has revealed the brand new route that its present central financial institution digital forex (CBDC) pilot, drex, will take within the quick time period. Rogerio Antonio Lucca, government secretary of the central financial institution, highlighted that the third and subsequent section of the challenge will give attention to tokenization and growing a system to assist credit score performance.

At Febraban Tech, one of many largest monetary tech occasions in Brazil, Lucca said:

The client should have ease of use and a way of safety to make sure that the nationwide monetary system develops providers and resolves issues similar to excessive debt in poor high quality credit score.

One of many concepts floated by the manager is to plan a platform enabling prospects to provide banks and different monetary establishments visibility on their belongings, incentivizing monetary inclusion and fixing the poor credit score availability downside.

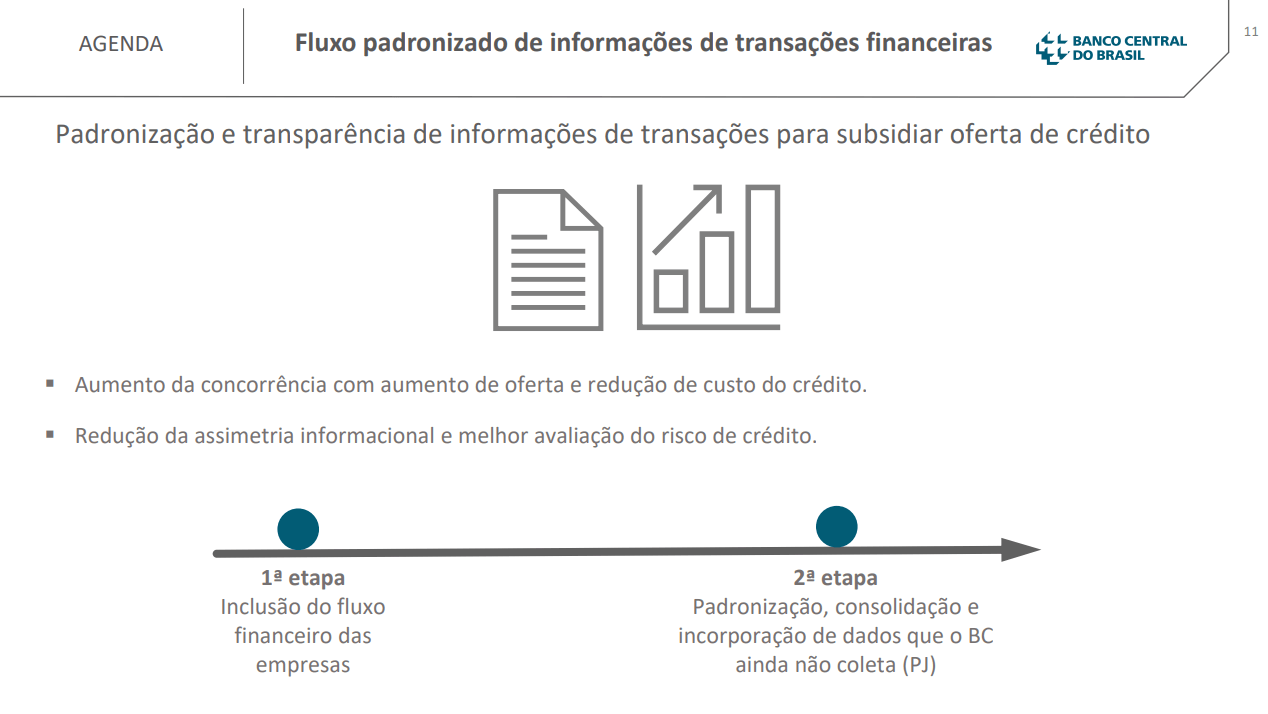

A slide from a presentation detailing the processes to create a credit score market. Supply: Central Financial institution of Brazil.

The manager identified that this new third section would begin within the second half of this yr, highlighting that it could tackle this downside, enabling banks to democratize credit score entry and scale back the charges they cost for his or her monetary providers.

“We’ll shut the second section and go deeper, however the route has been set,” Lucca concluded.

The drex pilot, presently in its second section, has encountered points that impression its viability. Its major roadblock has been the dearth of a privateness answer that fulfills all the necessities the financial institution wants to use financial institution secrecy-like legal guidelines to drex transactions, which means that transactions should be obfuscated from third events however seen for regulators.

Since February, when an official report detailed that not one of the proposed options solved this downside, there have been no public statements on the difficulty. No date for the final launch of drex has been introduced but.

Learn extra: Central Financial institution of Brazil: CBDC Privateness Drawback Nonetheless Unresolved