It is a section from the 0xResearch e-newsletter. To learn full editions, subscribe.

Crypto centralized exchanges have been quickly shifting their companies onchain of late.

And to get there, they’re all leveraging their greatest trump card: distribution.

Case examine primary.

Bybit introduced Byreal on Sunday, a DEX on Solana that’s set to launch later this 12 months. Together with the DEX can be a yield product (Revive Vault) and a token launchpad (Reset Launch).

Byreal will route liquidity from its CEX by a hybrid RFQ (request for quote) + CLMM (concentrated liquidity market maker) mannequin, so onchain customers can commerce onchain with a CEX’s liquidity depth.

My guess is Bybit customers may also be capable to entry Byreal from the principle CEX app.

Case examine quantity two.

Coinbase introduced just a few days later the direct integration of Base DEXs onto its alternate enterprise, set to roll out this week. DEXs from different chains may also be built-in ultimately.

This opens up gas-less buying and selling entry to hundreds of altcoins for thousands and thousands of Coinbase customers (although they’ll nonetheless pay the same old CEX buying and selling price).

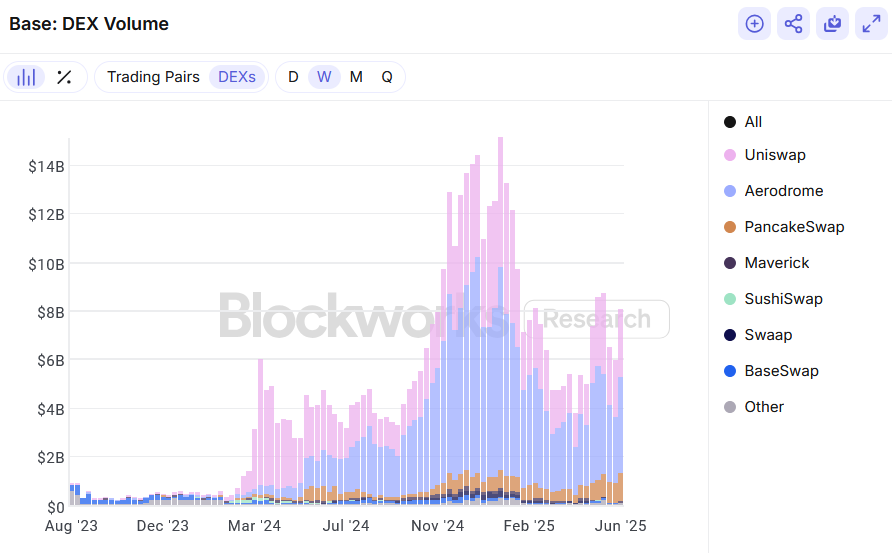

It’s a big tailwind for DEXs on Base, specifically its largest one: Aerodrome. The AERO token — which accrues revenues from DEX buying and selling charges — has pumped 52% in worth because the announcement.

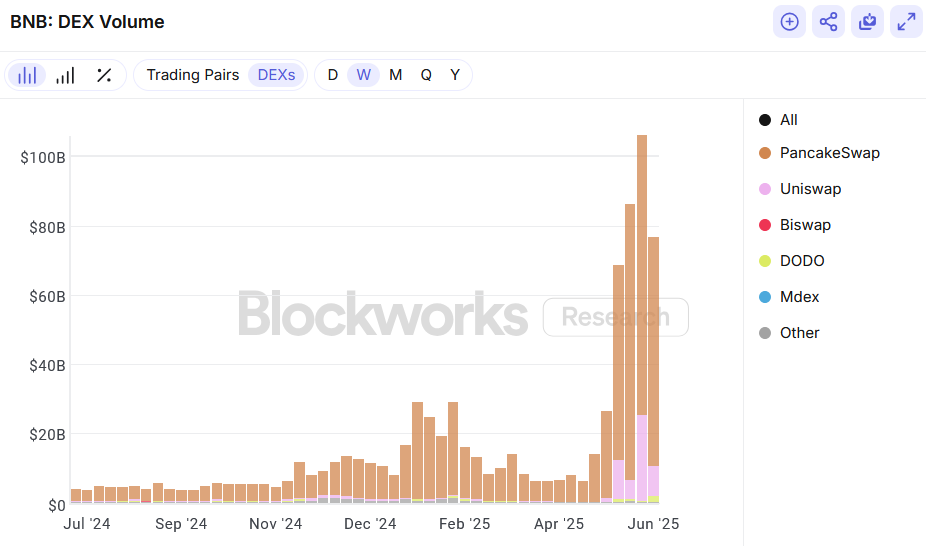

Supply: Blockworks Analysis

Supply: Blockworks Analysis

This isn’t Coinbase’s first try to push onchain with its distributional benefit. cbBTC, its wrapped bitcoin product was bootstrapped utilizing Coinbase as the principle distribution rail.

By integrating Base’s lending markets below the hood, cbBTC holders on Coinbase might simply borrow USDC towards their bitcoin collateral with out leaving the Coinbase app.

Loading Tweet..

Case examine quantity three.

Binance and its extraordinarily sophisticated Alpha marketing campaign, which has been working since Might.

Inside Alpha are dozens of “buying and selling competitions” that reward customers with “Alpha Factors” to commerce chosen property, which is able to in flip entitle you to airdrops. But, calling it a contest is deceptive — most of those factors are handed out based mostly on buying and selling volumes, not P&L standards.

That’s puzzling till you understand there’s a double-pronged technique at play right here.

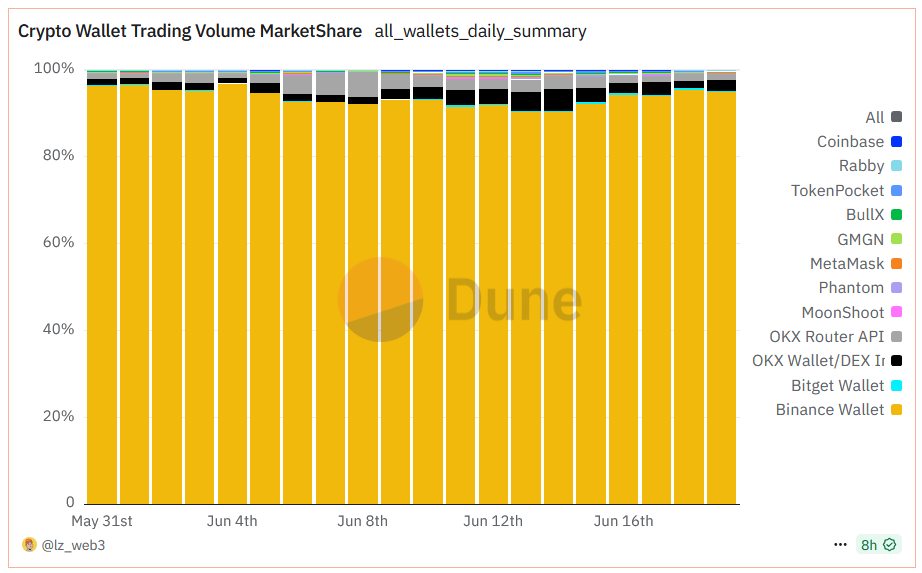

The primary prong is to drive Binance Pockets adoption. Alpha factors are eligible provided that one trades utilizing its keyless Binance Pockets. This has enabled Binance to utterly dominate crypto “pockets market share,” as seen under.

Supply: Dune

Supply: Dune

There are two caveats right here. For one, the exercise isn’t natural.

Second, these aren’t “Binance Pockets” customers a lot as they’re merely “Binance CEX” customers.

Merchants nonetheless pay the Binance CEX buying and selling price, so the income seize is completely different from that of a MetaMask consumer paying a price for utilizing its in-app buying and selling options. Calling it “pockets market share” might be deceptive.

Nonetheless, it has allowed Binance to drive adoption for its pockets and doubtlessly funnel customers onchain on a bit of infrastructure that they personal, which they will monetize later.

The second prong of the technique behind Binance Alpha is to bolster its personal onchain ecosystem on BNB Chain.

Powering the buying and selling of those Alpha tokens below the hood is PancakeSwap, which has exploded in volumes since Alpha kicked off in Might.