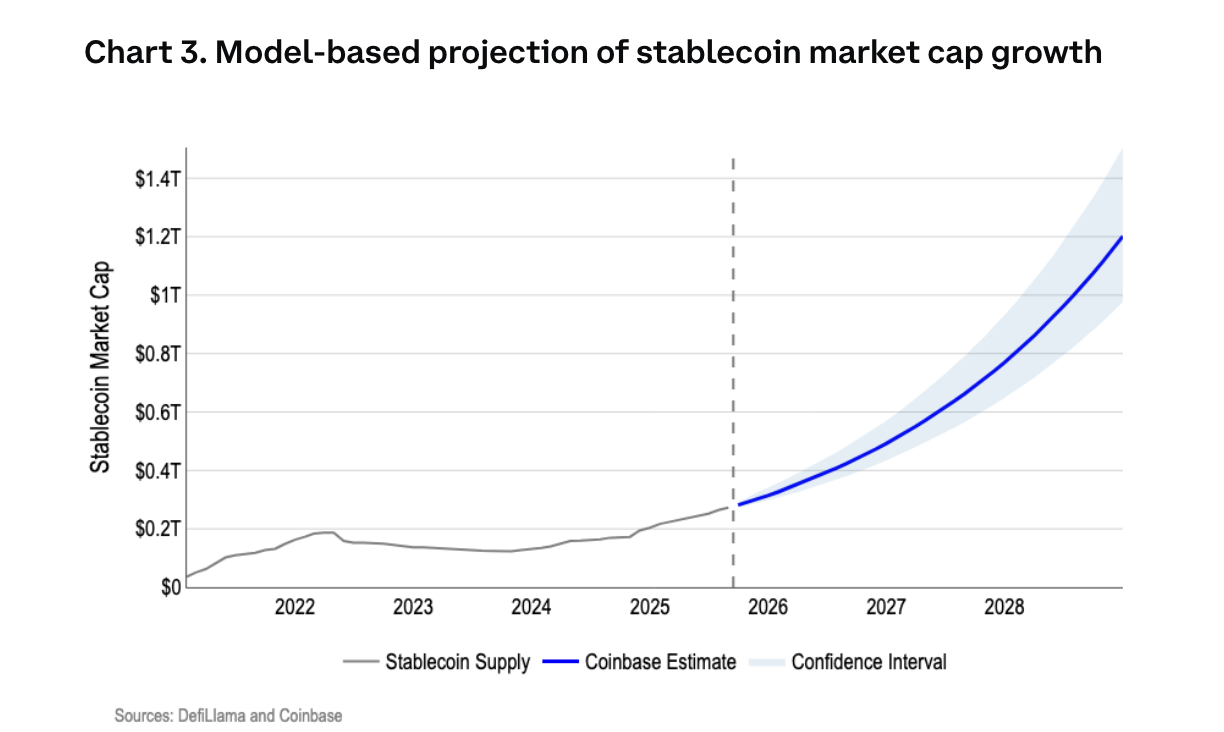

The overall US dollar-pegged stablecoin market is projected to swell to $1.2 trillion by 2028, spurred on by complete crypto laws in america, in response to crypto change Coinbase.

Coinbase stated the projections imply the US Treasury issuance must be $5.3 billion per week over the following three years to fulfill demand from stablecoin issuers, who use short-term US Treasury payments as backing collateral for his or her digital fiat tokens.

Projection of stablecoin market cap by 2028. Supply: Coinbase

This issuance schedule would trigger a minor and momentary drop in three-month Treasury yields of about 4.5 foundation factors (BPS), opposite to analyst predictions that demand from stablecoin issuers will considerably scale back the curiosity on US authorities debt. Coinbase wrote:

“We expect the forecast doesn’t require unrealistically massive or everlasting charge dislocations to materialize; as a substitute, it depends on incremental, policy-enabled adoption compounding over time.”

The passage of the GENIUS invoice, a complete regulatory framework for stablecoins within the US that can take impact in January 2027, is a catalyst for the expansion of the stablecoin market, Coinbase stated.

Nevertheless, the laws within the US has pressured different international locations to think about legalizing their very own stablecoins to stay aggressive with the greenback within the digital age.

Associated: US Treasury requires public touch upon GENIUS stablecoin invoice

Stablecoin sector grows as different international locations sign they’re becoming a member of the race

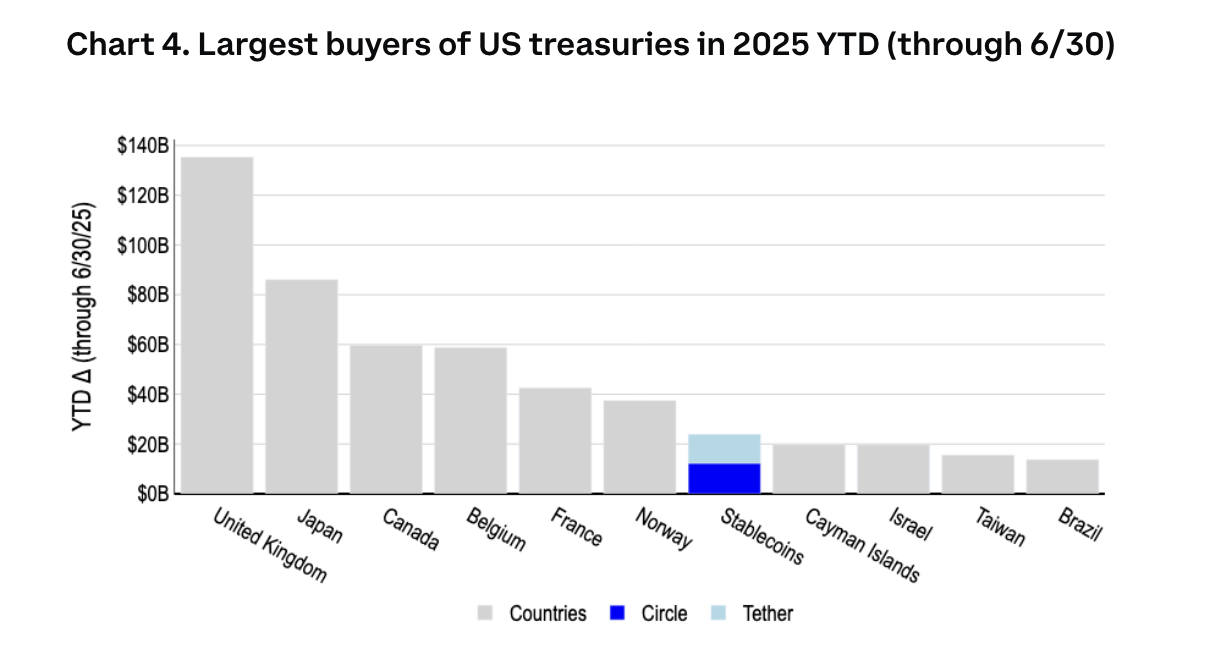

Personal stablecoin issuers like Tether and Circle have grow to be high consumers of US authorities debt, eclipsing international locations like South Korea, the United Arab Emirates (UAE), and Germany.

Stablecoins have grow to be a high purchaser of US authorities debt in 2025, beating out most international locations. Supply: Coinbase

Greenback-denominated stablecoins have dominated the market so far, however different international locations at the moment are exploring stablecoins as a complement to their conventional fiat currencies.

South Korea’s Monetary Providers Fee (FSC), a authorities regulator, introduced {that a} complete stablecoin regulatory invoice can be submitted to the legislature for consideration in October.

The federal government of China, which has a protracted historical past of opposing cryptocurrencies and privately issued cash, reportedly signaled that it could permit yuan-backed stablecoins to flow into available in the market.

Analysts and business executives say that any rollout of a yuan stablecoin would probably be restricted to particular financial zones in China, like Hong Kong, and worldwide foreign money markets.

Journal: Stablecoins in Japan and China, India mulls crypto tax modifications: Asia Categorical