Public Keys is a weekly roundup from Decrypt that tracks the important thing publicly traded crypto corporations.

This week: Why Bitcoin treasury champion Technique is drawing so many similar lawsuits, Coinbase hits a brand new peak closing value as U.S. perps close to, and different keys from the week in crypto.

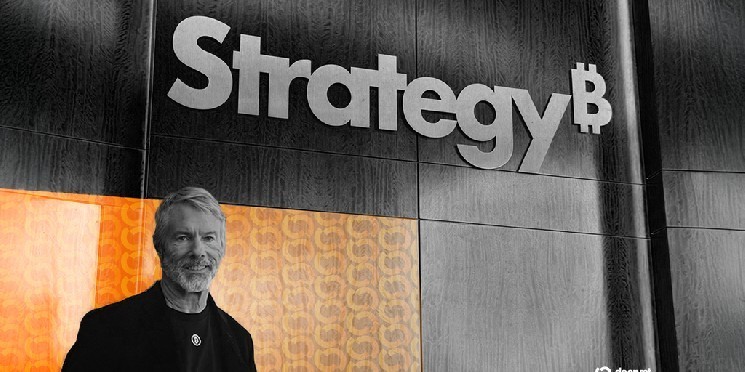

Technique’s déjà vu

You might have heard that Bitcoin large Technique is the topic of a category motion lawsuit. It accuses the corporate of misrepresenting the dangers related to its BTC shopping for plans. Then possibly you heard concerning the go well with once more, and once more, and once more, and once more.

That’s as a result of there are at the least 5 completely different legislation corporations which have filed copycat class motion lawsuits towards Technique (previously MicroStrategy), which trades on the Nasdaq underneath the MSTR ticker. Two legislation professors who spoke with Decrypt mentioned the similar filings are how every agency indicators curiosity in main the case as soon as they’re consolidated into one single class motion.

When there are a number of class motion filings, it falls to the courts to decide on a lead plaintiff, the professors mentioned. That normally comes all the way down to who’s bought probably the most pores and skin within the sport—making giant establishments like pension funds seemingly candidates. And as soon as a lead plaintiff has been chosen, it’s as much as them to nominate counsel.

Not one of the legislation corporations that filed lawsuits responded to requests for remark from Decrypt. However the legislation professors spelled out the motivation fairly plainly: “The charges could be very profitable,” College of Michigan’s Adam Pritchard mentioned—“tens of hundreds of thousands of {dollars} and infrequently extra within the greatest instances.”

An necessary Tolkien replace: At right now’s costs, Technique’s $63.3 billion Bitcoin treasury is now value greater than the gold that Smaug, the final nice dragon, had stockpiled within the Lonely Mountain.

File excessive and perps for COIN

Traders eagerly watched as crypto alternate Coinbase approached after which set a brand new all-time excessive shut value Thursday, when COIN was buying and selling for $375.07. It was an enormous milestone—however the firm hasn’t taken its eye off the prize.

Main as much as the brand new excessive water mark, Benchmark analysts known as the corporate “transformative” and gave it a $402 value goal. And Bernstein analysts mentioned COIN is “misunderstood,” setting an excellent loftier value goal of $510.

This time subsequent month, Coinbase mentioned will probably be providing U.S.-regulated perpetual-style futures for Bitcoin and Ethereum. Merchants have been wanting perps for a very long time. And it’s no marvel: Crypto perps have accomplished almost $10 billion in quantity previously day and $382 billion previously month, in keeping with crypto knowledge aggregator DeFi Llama.

That’s simply counting quantity from DeFi protocols like Hyperliquid, Jupiter, and ApeX Protocol. Issues might get much more fascinating if Coinbase enters the chat.

In the meantime, Base, the Ethereum layer-2 community that it incubated, has added Cardano and Litecoin to the wrapped property it already affords on the community, together with Dogecoin, XRP, and Bitcoin. This makes it simpler for holders of Cardano or Litecoin to utilize Ethereum’s extra sturdy decentralized finance (DeFi) ecosystem, giving customers the chance to work together with well-liked Ethereum-based protocols like Aave, Compound, and Curve.

Different Keys

- Subsequent up: Bitcoin treasury firm: Bakkt has by no means stopped reinventing itself. Earlier this 12 months, the corporate bought its failing crypto custody enterprise to its father or mother firm for $1.5 million and employed a brand new co-CEO to work on a “stablecoin funds” product. Simply this week, it began elevating $1 billion so as to add Bitcoin to its stability sheet. NFT assortment, subsequent?

- Altcoin summer time: Issues are trying sunny for Bitwise’s Dogecoin and Aptos ETF filings, which bought amended S-1 filings this week. Typically talking, issuers replace their registrations to replicate suggestions from the SEC, Bloomberg analyst Eric Balchunas informed Decrypt. “There’s been a lot engagement,” he mentioned. “It is a fully new perspective from the SEC.”

Edited by Andrew Hayward