Amid international monetary volatility, Bitcoin is rising as a enterprise strategic asset. A report by Bitcoin funding agency River exhibits a big enhance in firms’ Bitcoin accumulation, with adoption rising 154% from 2024 to the current.

This text analyzes the expansion, the explanations behind this development, and the newest insights from consultants and firms.

Development in Bitcoin Accumulation Amongst Companies

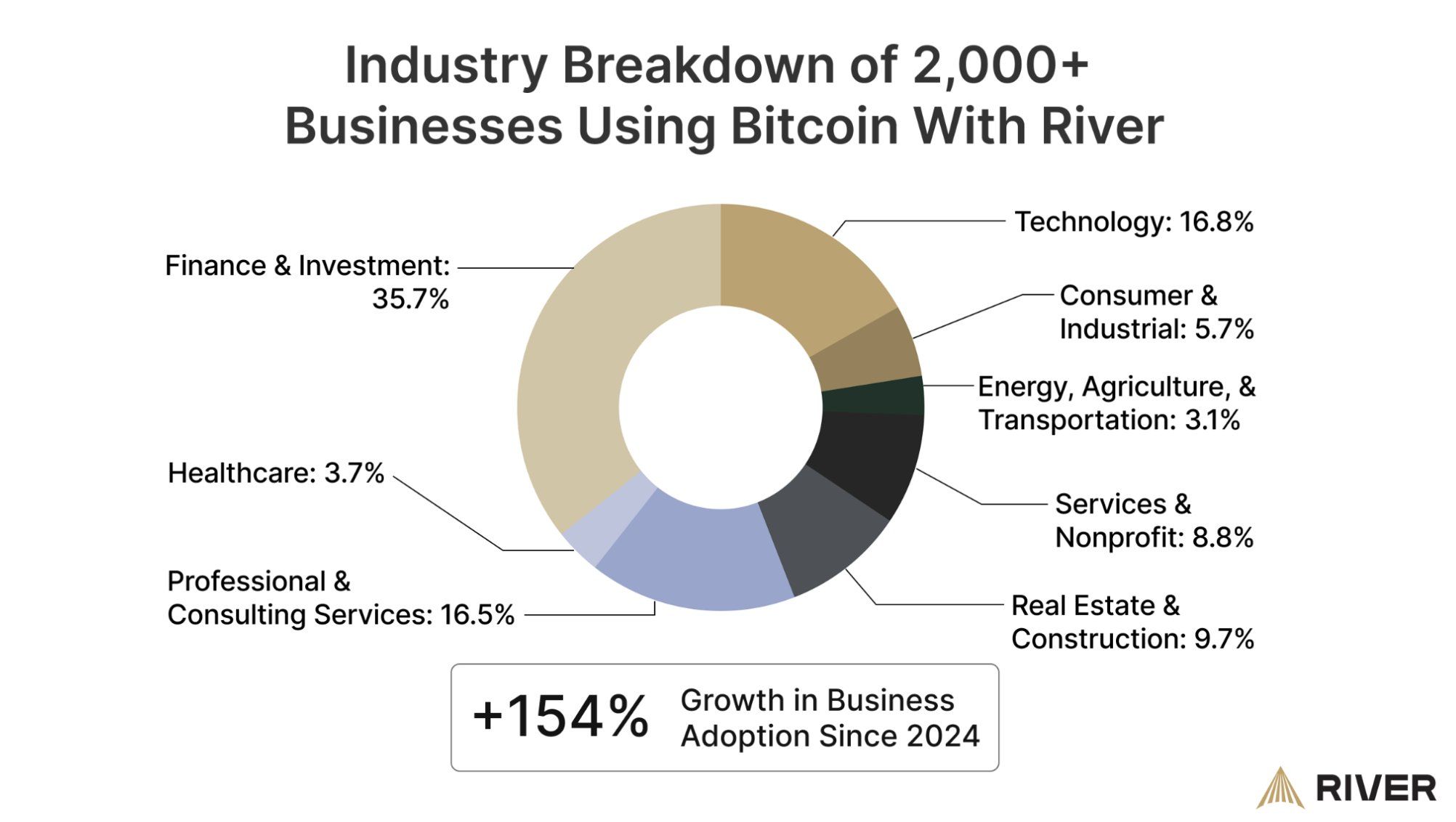

Based on River’s statistics, over 2,000 firms are utilizing the platform to build up Bitcoin, a powerful 154% development since 2024.

Main industries embody finance and funding (35.7%), know-how (16.8%), skilled & consulting providers (16.5%), actual property and building (9.7%), and sectors like healthcare (3.7%) and vitality, agriculture, and transportation (3.1%).

Trade Breakdown of Companies Utilizing Bitcoin. Supply: River.

This variety exhibits that Bitcoin is not restricted to high-tech sectors. It has expanded into a variety of industries. One notable instance is BlueCotton, a T-shirt printing firm that makes use of Bitcoin to assist its operations. Quick meals chain Steak ‘n Shake additionally started accepting Bitcoin funds in any respect US areas on Could 16, 2025.

Reviews additionally point out that companies have develop into the main patrons of Bitcoin, outpacing governments and exchange-traded funds (ETFs).

Why Are Companies Allocating Property to Bitcoin?

Companies accumulate Bitcoin primarily as a result of it could hedge in opposition to inflation and protect worth.

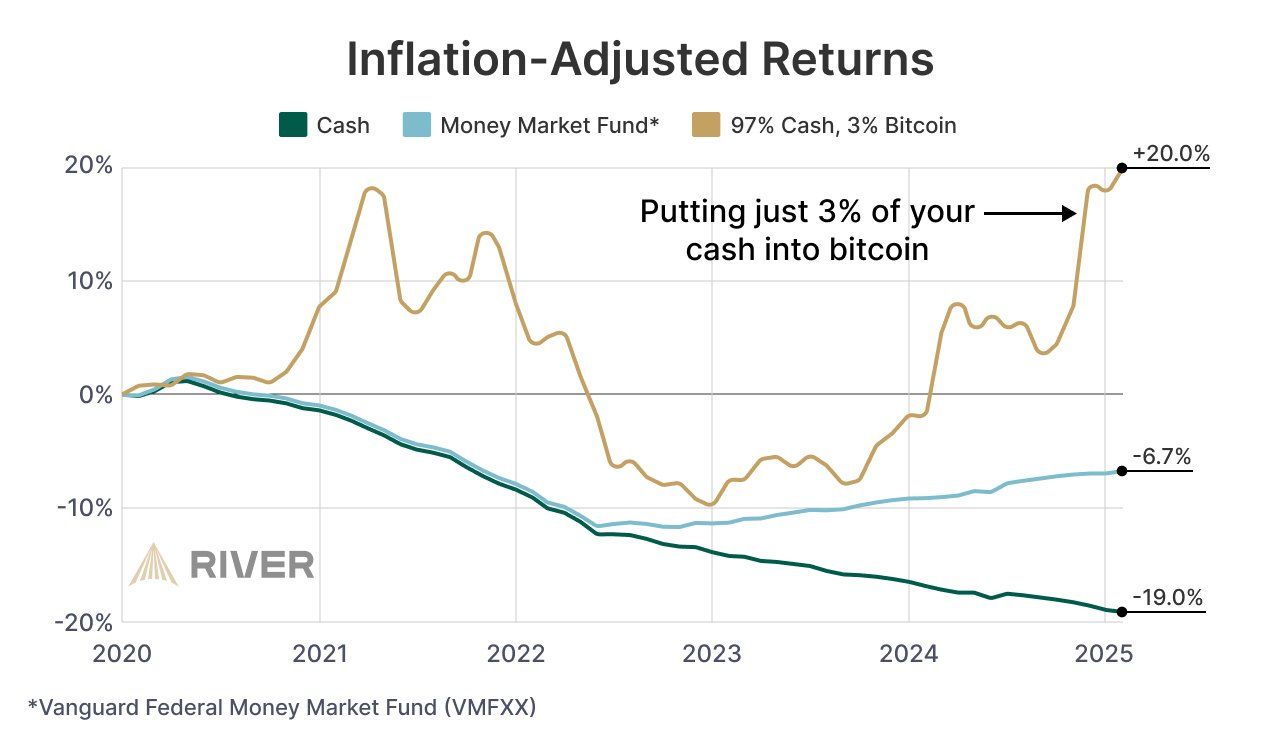

Money has considerably misplaced worth as inflation rises and governments proceed to print cash. River calculated that an organization investing 3% of its property in Bitcoin earned a 20% inflation-adjusted return between 2021 and 2025. In distinction, holding solely money led to a 19% loss, whereas cash market funds noticed a 6.7% loss.

Inflation-Adjusted Returns of Bitcoin Holding Firms. Supply: River

“Bitcoin gives a novel diversification as a liquid, scarce asset with a set provide of 21 million cash. This shortage has traditionally allowed Bitcoin to far outperform inflation, making it an efficient long-term retailer of worth,” River’s report states.

For instance, the Argentine firm Belo allotted 30% of its treasury to Bitcoin to fight the 211% inflation of the peso.

Bitcoin additionally provides 24/7 liquidity, giving companies entry to capital anytime. This proved particularly priceless throughout crises, such because the collapse of Silicon Valley Financial institution in 2023, when many firms couldn’t withdraw their money.

One more reason is the discount of threat from the standard banking system. Bitcoin permits companies to handle their property, minimizing third-party dangers.

Based on knowledge from BitcoinTreasuries, personal and public firms have accrued over 1 million BTC as of 2025. Commonplace Chartered predicts that the buildup exercise by firms, governments, and ETFs might drive Bitcoin to $120,000 in Q2 2025.