Company treasuries proceed to quietly scoop up Bitcoin even because the market retraces latest features. Establishments bagged greater than 7,700 BTC final week, hinting that they nonetheless have an urge for food whereas retailers again off.

A bullish rally triggered after the US Fed chair Jerome Powell’s Jackson Gap handle witnessed a significant correction. Bitcoin, which went on to hit $117k final mid-week, dropped again to the $112K zone on Monday. BTC dominance hovers round 57.6%. The cumulative crypto market cap fell by 2.4% over the past 24 hours to face at $3.89 trillion. Its 24-hour buying and selling quantity spiked by 81% to hit $243 billion.

Corporates load up on Bitcoin

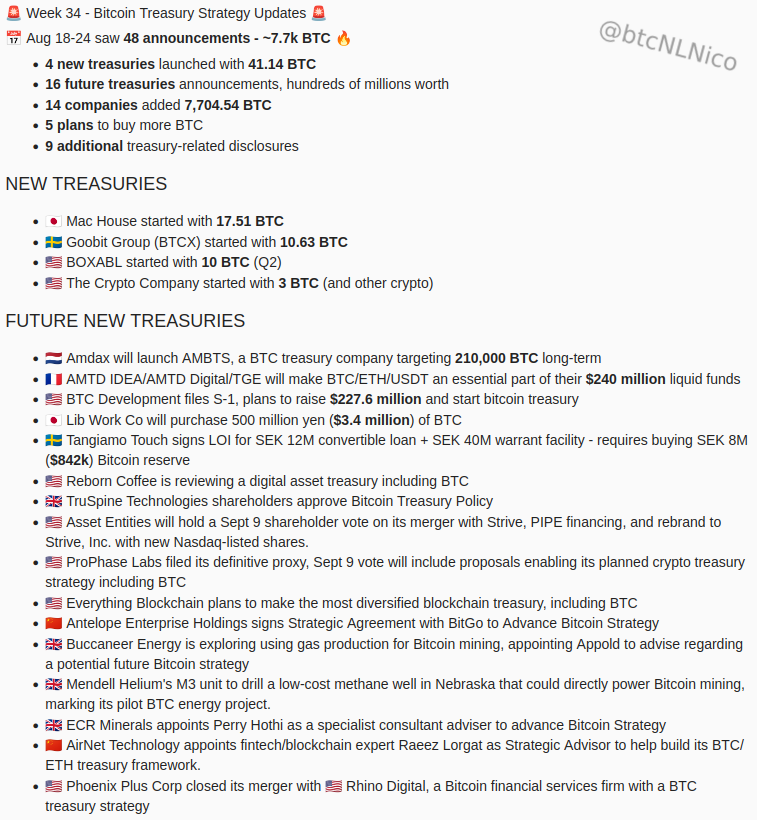

From August 18–24, at the very least 48 treasury bulletins have been made globally, as proven by knowledge compiled from firm disclosures. It highlighted that 4 new treasuries have been launched, collectively holding greater than 41 BTC. Nonetheless, 16 extra corporations signaled plans to construct reserves, and 5 deliberate to purchase extra of Bitcoin.

August 22 noticed a Japanese trend model, ANAP Holdings, growing its Bitcoin holdings by 6.26 BTC. One other Japanese firm scooped 200 BTC, pushing its holding to 364.93 BTC on the identical day. Nonetheless, Rep. Migz Villafuerte filed HB 421 for a Philippine Strategic Bitcoin Reserve. It intends to purchase 2,000 BTC/12 months for five years (10,000 BTC complete).

Supply: Information compiled by NLNico

US-listed bitcoin treasury firm, DDC Enterprise, purchased 100 Bitcoin on August 21. Japan’s Japanese attire retailer Mac Home made its first acquisition of 17.5 BTC. They known as this a “proof of idea” and can see if they’ll proceed shopping for. Earlier, it introduced that its Treasury Technique goal is 1,000 BTC.

On August 20, US homebuilder BOXABL disclosed a treasury of 10 BTC at a mean worth of $107.8k in its Q2 submitting. Sweden’s Goobit Group (BTCX) revealed its first 10.6 BTC purchase, with a goal of 210 BTC. H100 Group picked up 102 BTC and now holds a complete of 911.29 Bitcoin.

Technique scoops extra

Amid the contemporary market drop, Metaplanet acquired one other 103 Bitcoin, taking its complete holdings to 18,991 BTC. Remixpoint added 41.5 BTC, ANAP 11.7 BTC, and Agile Media Community 0.6 BTC. Def Consulting additionally introduced it can start constructing a treasury.

Smaller corporates additionally stepped in as DDC enterprise bagged one other 200 BTC on August 25, bringing its stash to 888 BTC. Empery Digital added 13 BTC, taking its holdings previous 4,000 BTC. Florida-based LM Funding America purchased 164 BTC, lifting its complete to 311 BTC. Vanadi Espresso added 5 BTC to succeed in a fair 100 BTC.

MicroStrategy continued to steer the cost. It reveals the acquisition of three,081 Bitcoin for $356.9 million at a mean worth of $115,829. The agency now holds 632,457 BTC and is by far the biggest company treasury.

Bitcoin is coping with heavy promoting strain, and stability sheet patrons are rushing up their “Purchase The Dip” methods. BTC worth dropped by greater than 3% over the past 7 days, opening a window so as to add extra. The largest crypto is buying and selling at a mean worth of $112,472 on the press time. Its 24-hour buying and selling quantity jumped by 70% to face at $87.8 billion.