Lately, Binance Alpha – a function inside the Binance Pockets that showcases early-stage crypto initiatives – launched a scoring mechanism known as Binance Alpha Factors. This method evaluates person exercise inside the Binance Alpha ecosystem.

This new scoring function has attracted a wave of curiosity from airdrop hunters and considerably boosted buying and selling quantity on Binance Alpha. Nevertheless, Binance Alpha Factors have sparked combined reactions.

Binance Alpha’s Day by day Quantity Surpasses $330 Million

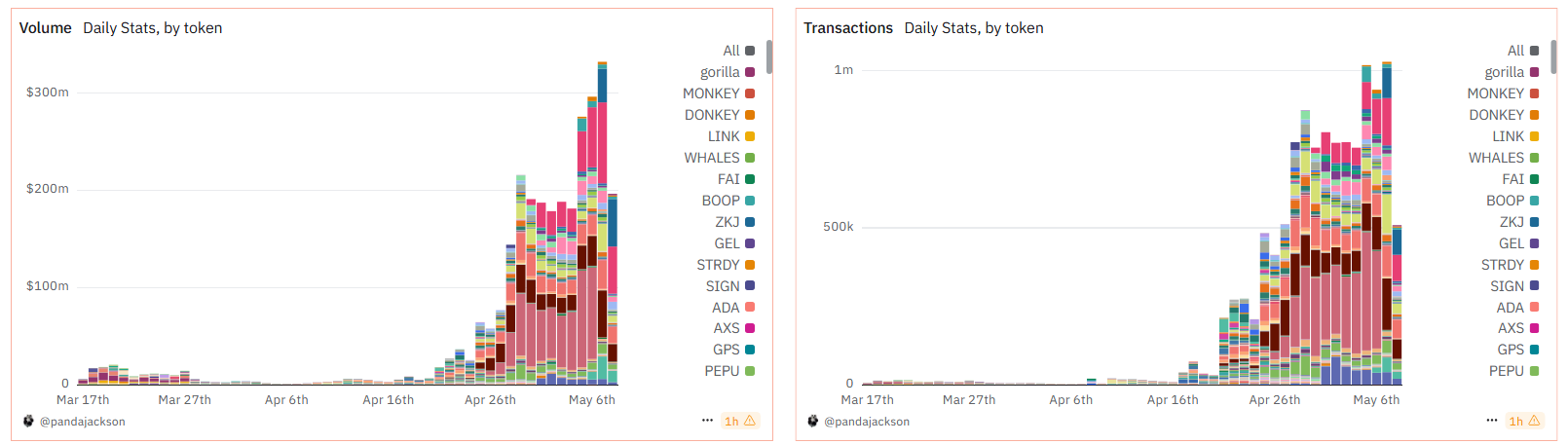

Information from Dune reveals that buying and selling quantity on Binance Alpha surged after Binance introduced the Alpha Factors on April 25.

By Might 7, buying and selling quantity on Binance Alpha had exceeded $330 million. On Might 5 and Might 7, the platform recorded over 1 million day by day transactions. The overall collected buying and selling quantity has now surpassed $2.8 billion, with almost 117 million transactions.

Binance Alpha’s Quantity And Transactions. Supply: Dune.

This achievement displays the sturdy enchantment of the Alpha Factors function. Extra customers are actively buying and selling to build up factors and improve their probabilities of receiving airdrops.

On the similar time, Binance has been saying new challenge listings on Binance Alpha extra regularly.

How Are Traders Responding to the Binance Alpha Factors Initiative?

Wonnie, the founding father of MBMweb3, is a vocal supporter of the Binance Alpha program. In a put up on X, Wonnie described this system as “a golden window” for customers to take part earlier than it turns into overcrowded.

He shared his technique for incomes 15 factors per day. He holds belongings value over $100,000, which supplies him 4 factors, and trades greater than $2,048 day by day, incomes him 11 factors.

Wonnie emphasised that the day by day price of sustaining this exercise is round $1 in fuel charges, highlighting this system’s sturdy revenue potential.

“Binance Alpha remains to be a golden window. Observe your rating. Reduce prices. And take your share whereas the rewards are flowing,” Wonnie stated.

Nevertheless, not all buyers share Wonnie’s optimism. Many have criticized Binance Alpha, calling it an “extraction scheme”.

One main level of controversy is that Alpha Factors solely depend exercise from the previous 15 days. Customers can not accumulate factors long-term, forcing them to commerce repeatedly to take care of their scores, creating important monetary stress.

As well as, the reward necessities have change into more and more strict. Initially, customers solely wanted 45 factors to obtain the AIOT airdrop. However now, Binance calls for 150 factors to qualify for the SXT airdrop.

Primarily based on Binance’s calculation methodology, customers should commerce as much as $131,072 to earn 17 factors.

This has led to customers paying transaction charges however nonetheless not incomes sufficient factors to qualify for an airdrop. Some customers even attain the required level threshold however fail the danger evaluation, so that they don’t obtain the airdrop.

“Binance Alpha – a scheme to rekt you with out you even noticing… Binance seems utterly grasping. Each time they give you one thing, belief me – they’re taking way more from you not directly,” investor Abhi criticized.

Regardless of these considerations, the variety of initiatives featured on Binance Alpha continues to develop. In accordance with CoinMarketCap, greater than 140 initiatives have been listed on Binance Alpha.

9 of these initiatives have performed airdrops by way of the Alpha Factors system.