Cryptocurrency funding merchandise have been unable to maintain their two-week influx streak, with fund flows turning unfavourable final week following crypto’s “Black Friday” market crash.

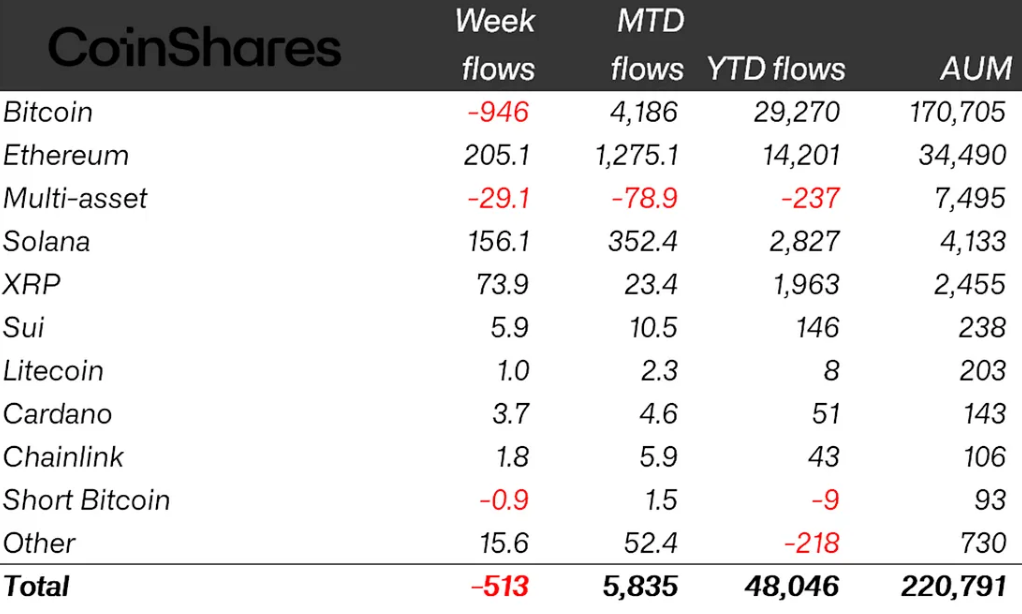

Crypto exchange-traded merchandise (ETPs) noticed $513 million in outflows final week, ending the two-week streak totaling $9.1 billion, CoinShares reported on Monday.

Addressing the full $668 million of outflows following the “Binance liquidity cascade” on Oct. 10, CoinShares head of analysis James Butterfill mentioned the ETP market noticed much less panic than the spot market.

He mentioned that whereas crypto ETP buyers largely “shrugged off this occasion,” onchain buyers have been extra bearish.

Bitcoin was the one main asset to see outflows

Bitcoin (BTC) was the first supply of losses in crypto ETPs final week, with outflows totaling $946 million. The outflows pulled down year-to-date inflows to $29.3 billion, considerably lagging behind final 12 months’s whole of $41.2 billion, Butterfill added.

However, Ether (ETH) continued to realize momentum as buyers have been shopping for the dip, with funds posting $205 million of inflows. The most important inflows have been seen right into a 2x leveraged Ether ETP totaling $457 million, Butterfill famous.

Crypto ETP flows by asset as of Friday (in hundreds of thousands of US {dollars}). Supply: CoinShares

Solana (SOL) and XRP (XRP) funds continued to see inflows amid the optimism on new ETP launches, with inflows totaling $156 million and $74 million, respectively. Solana ETPs particularly stood out, with inflows surging 67% in comparison with the earlier week.

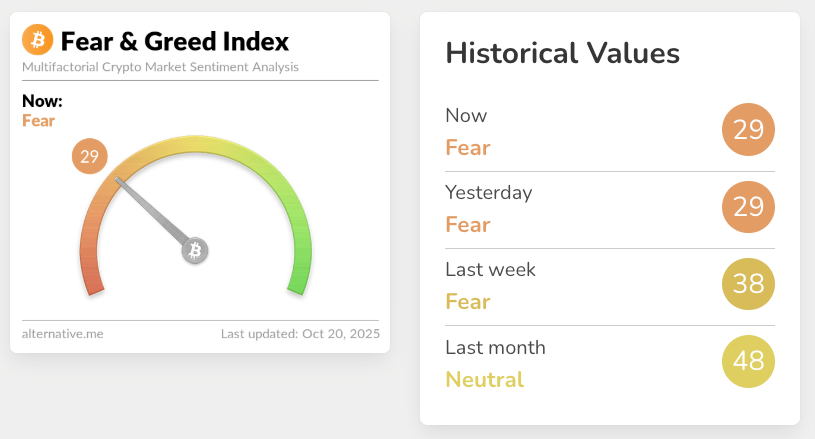

Crypto Concern & Greed Index drops to multi-month lows

The contemporary outflows from crypto ETPs got here amid the Crypto Concern & Greed Index — an indicator measuring the general sentiment of the cryptocurrency market — falling to ranges not seen since April.

In keeping with information from Different.me, the index dropped to a rating of twenty-two final Friday amid Bitcoin tumbling under $105,000, reflecting robust “Concern” by spot BTC buyers.

The Crypto Concern & Greed Index. Supply: Different.me

The “Concern” sentiment continued to prevail as of Monday with a rating of 29. The bottom index degree recorded in 2025 up to now was at a rating of 10 noticed in late February, when Bitcoin noticed a pointy slide from $96,000 to round $84,000, based on CoinGecko information.

Associated: What’s Bitcoin if not crypto? Rumored Satoshi Nakamoto weighs in

By publishing time, Bitcoin traded at $111,019, seeing losses of roughly 3% previously seven days, and down round 4% previously month.

Ether traded at $4,035, declining round 3% previously week and 9% over the previous 30 days.

Journal: Ether’s value to go ‘nuclear,’ Ripple seeks $1B XRP purchase: Hodler’s Digest, Oct. 12 – 18