In one of many sharpest examples of meme-coin mania this 12 months, a crypto dealer reworked a $68,700 wager into roughly $9.4 million in simply 48 hours.

On September 30, the pockets handle 0xce5ad0ff16863f54a0daa27ff831177ad1144c07 spent 68 BNB ($68,700) to amass 63.07 million items of $4, a newly launched token on PancakeSwap. By October 2, the place was valued at over $9.4 million, a staggering 135x return.

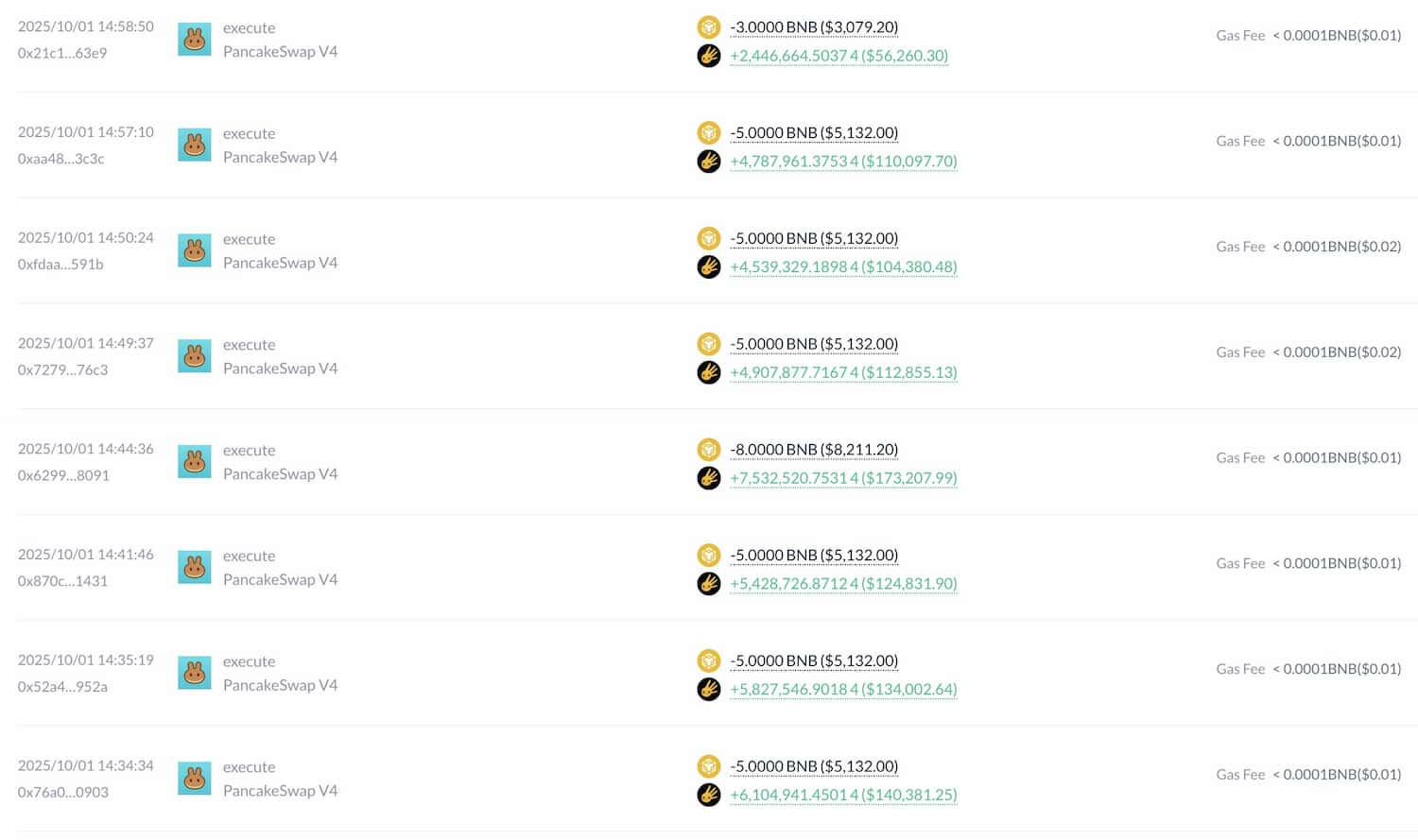

Blockchain knowledge exhibits a rigorously sequenced collection of buys: a number of tranches of 5–8 BNB (BNB) swapped by PancakeSwap V4, accumulating thousands and thousands of $4 tokens at costs between $0.00008 and $0.00014.

Buying and selling quantity cllimbed above $118 million

The buys coincided with a sudden surge in exercise: every day buying and selling quantity exploded to $118.8 million, whereas 24-hour value efficiency peaked at +168%, with liquidity swimming pools briefly holding $2.8 million.

The commerce unfolded towards a backdrop of retail-driven hype on X (previously Twitter). Screenshots shared by merchants present the $4 neighborhood touting Binance’s personal Changpeng Zhao’s meme-like hand gesture because the coin’s branding.

That branding caught fireplace in Telegram channels and Dexscreener feeds, with greater than 166,000 transactions recorded in simply two days. The consequence was textbook reflexivity: because the $4 token’s market cap swelled to $148.4M FDV, extra speculators piled in, pushing the token increased and magnifying the early dealer’s unrealized positive aspects.

But even amid the jaw-dropping earnings, the dangers are plain. On-chain knowledge highlights how skinny liquidity swimming pools can exaggerate valuations, making it troublesome for whales to totally exit with out crushing the value.