America controls the biggest share of the Bitcoin circulating provide, India holds the second-largest share, whereas Europe follows carefully behind.

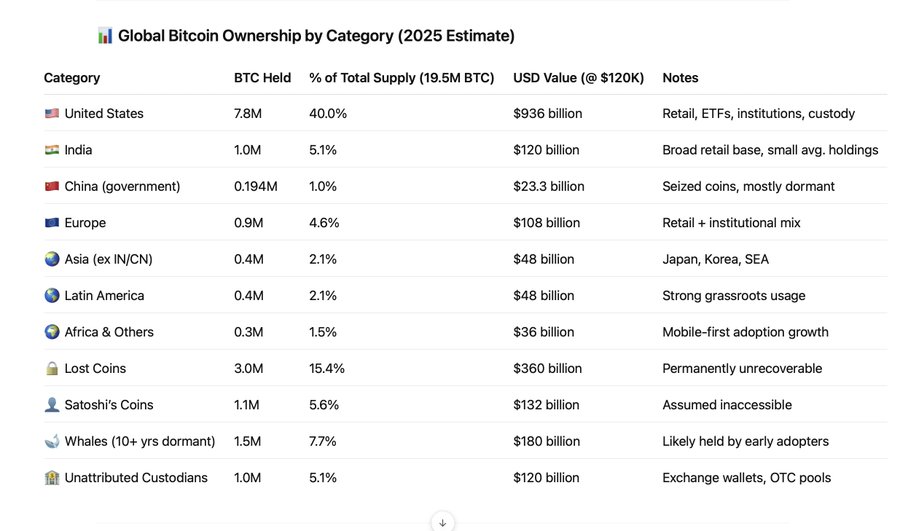

In accordance with the 2025 estimate shared by Fred Krueger, the USA’ Bitcoin holdings are value an estimated 7.8 million BTC out of the 19.5 million in circulation. This represents 40% of the circulating provide. A mix of retail buyers, institutional funds, ETFs, and custodial providers fuels the nation’s dominance.

Bitcoin possession by class

At $120,000 per BTC valuation, the U.S. holdings are valued at roughly $936 billion. Whereas Bitcoin trades decrease than this valuation, this determine displays an growing adoption via regulated merchandise like Bitcoin ETFs. For context, U.S. Bitcoin ETFs noticed web inflows of $6.02 billion in July, making it the third finest month after February and November 2024.

India Bitcoin Holdings Rank Second with Retail-Pushed Development

India holds 1 million BTC, accounting for five.1% of the overall provide. Whereas the nation’s regulatory surroundings stays unsure, its consumer base continues to develop quickly.

Most Indian holders are retail buyers with small common balances. Nonetheless, the nation’s quantity locations it forward of Europe, China, and different international areas. India’s Bitcoin holdings are valued at $120 billion based mostly on the identical value assumption.

Europe, China, Latin America, and Asia Path Behind in Bitcoin Management

Notably, Europe holds an estimated 900,000 BTC, or 4.6% of the availability, value $108 billion. The area exhibits a mixture of retail and institutional possession, although it stays behind India in complete quantity. Fred opines that the continent just isn’t considerably concerned compared to the U.S.

In the meantime, the Chinese language authorities holds round 194,000 BTC, or 1% of the overall. These cash had been seized and are principally dormant. The worth of those holdings is estimated at $23.3 billion.

Latin America and Asia (excluding India and China) every maintain about 400,000 BTC (2.1%). Their holdings, valued at $48 billion every, are attributed primarily to sturdy grassroots utilization. In the meantime, Africa and different areas mix for 300,000 BTC, representing 1.5% of the overall.

Dormant and Misplaced Bitcoin Reduces Energetic Provide

A good portion of Bitcoin is now not in energetic circulation. An estimated 3 million BTC (15.4%) is believed to be completely misplaced, which may very well be because of misplaced personal keys or inactive wallets.

In the meantime, Satoshi Nakamoto’s recognized wallets include 1.1 million BTC (5.6%), which have by no means moved. These cash are assumed to be inaccessible.

One other 1.5 million BTC (7.7%) have remained dormant for over 10 years, seemingly held by early adopters. Collectively, these three classes account for about 28.7% of the overall provide, severely limiting out there liquidity.

An extra 1 million BTC (5.1%) is held by unattributed custodians, together with alternate wallets and over-the-counter (OTC) swimming pools. Third events management these cash and usually are not immediately attributed to particular person customers.