Onchain perpetual futures have been one among 2025’s breakout market segments, with the sector recording one other all-time excessive in July.

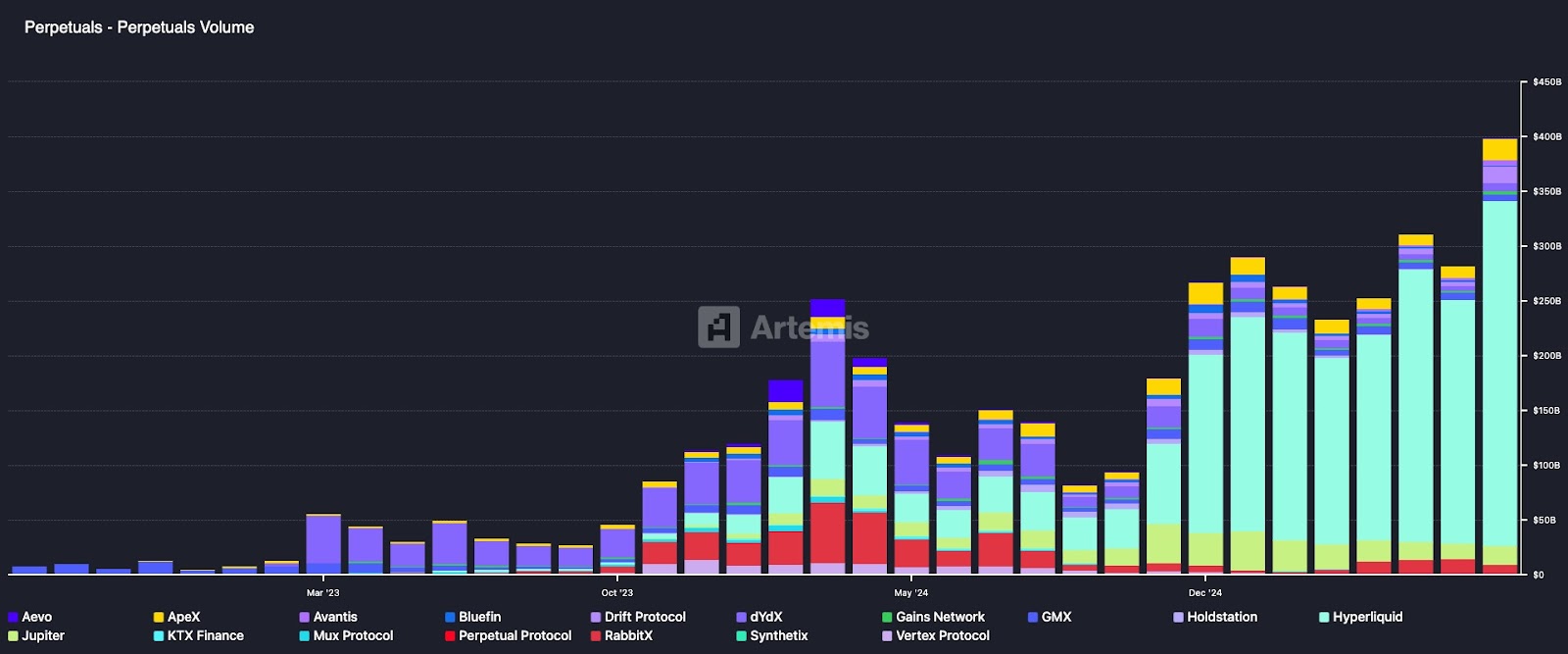

In keeping with analytics platform Artemis, decentralized perpetual protocols processed $399 billion of buying and selling quantity in July, outpacing their earlier all-time excessive of $311 billion in June by 28%.

Decentralized Perpetuals Quantity – Artemis

The sector is led by Hyperliquid, which accounts for practically 80% of onchain perpetuals volumes, adopted by protocols corresponding to ApeX, Drift, and dYdX. Hyperliquid’s quantity surged after its token technology occasion (TGE) in November 2024. Previous to its token launch, the change cleared between $25 and $35 billion in quantity per 30 days, whereas post-TGE volumes have ranged between $160 billion and $315 billion.

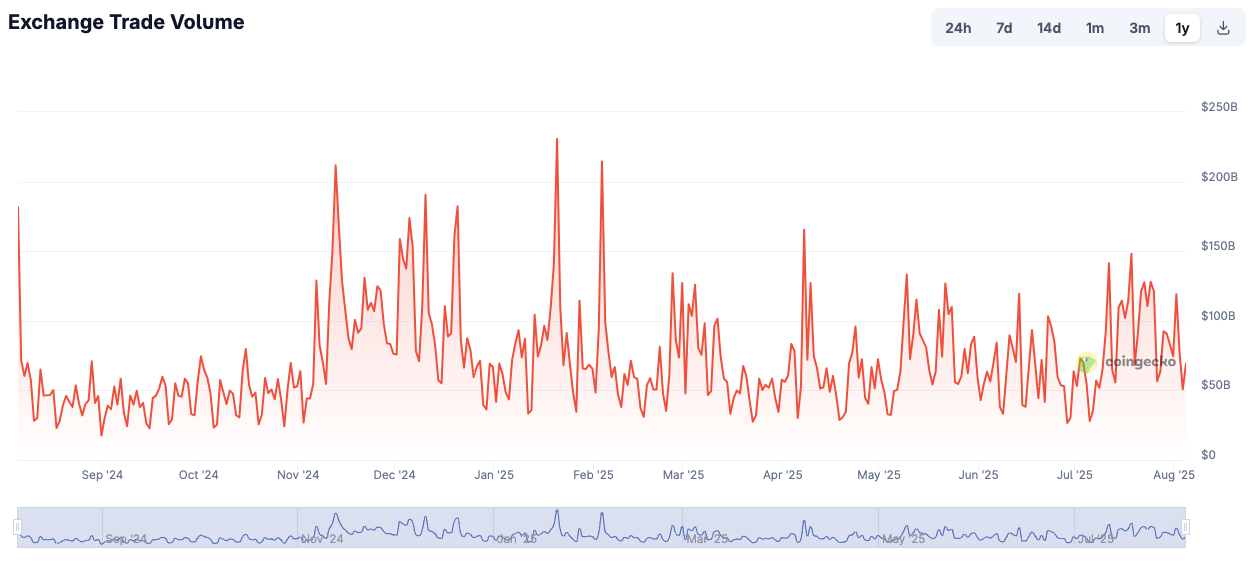

Whereas Hyperliquid’s development bodes effectively for DeFi adoption, main centralized exchanges (CEXs) proceed to dominate the general perpetuals market. Binance, the world’s main crypto change, processes day by day volumes of between $30 billion and $200 billion.

Binance Perpetuals Quantity – CoinGecko

The market sector’s enlargement comes as U.S.-based brokers and exchanges, corresponding to Coinbase and Robinhood, roll out their very own perpetual choices amid a friendlier regulatory local weather.

Coinbase launched the primary U.S.-regulated perpetuals platform in July, and Robinhood introduced in Could that it will supply perpetual derivatives to Europe-based clients in 2025.