It is a phase from the 0xResearch publication. To learn full editions, subscribe.

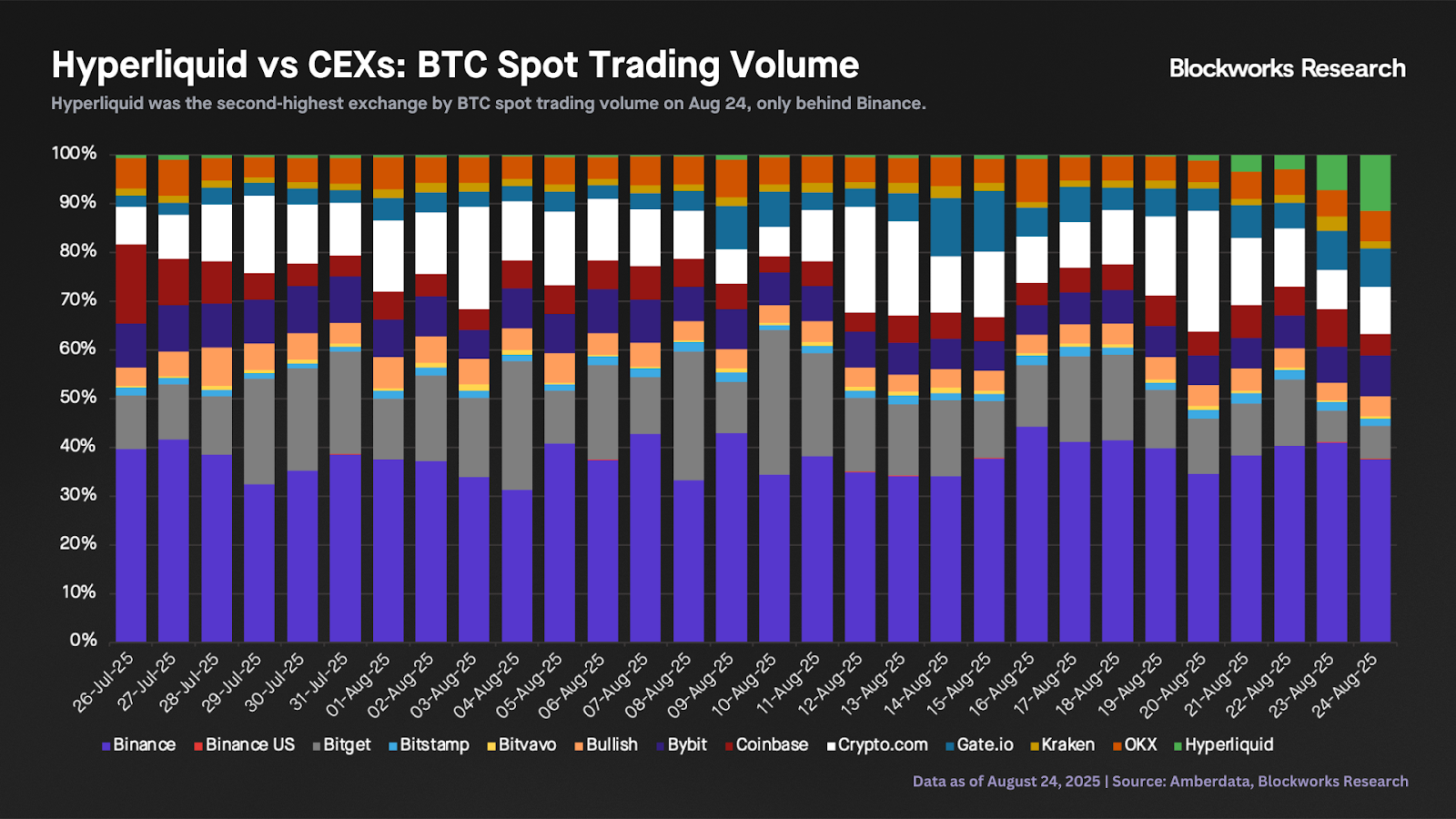

Hyperliquid’s spot volumes have seen a major rise, significantly when in comparison with CEXs. Over the weekend, an unknown entity deposited and bought ~22.1k BTC to rotate into ~555k ETH, valued at over $2.4 billion. This surge in spot volumes positioned Hyperliquid because the second-highest trade by BTC spot buying and selling quantity on Aug. 24, with a 12% market share, behind solely Binance (38%). It is a substantial improve from Hyperliquid’s 30-day common each day market share of ~1%.

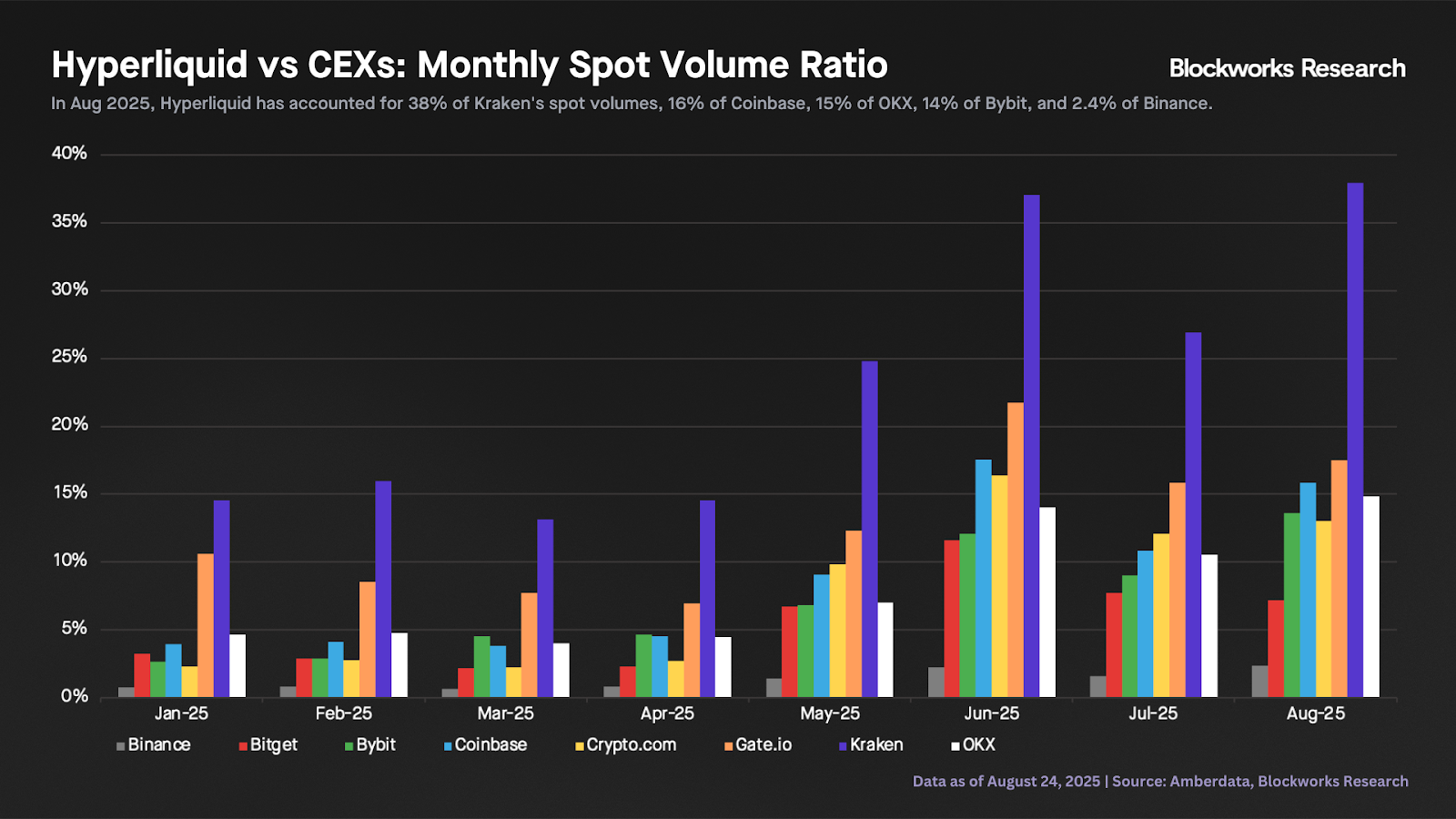

Stepping again, we are able to examine Hyperliquid’s month-to-month spot buying and selling volumes in opposition to numerous CEXs (together with all belongings, not simply BTC). We observe a constant rise in Hyperliquid’s share of spot volumes 12 months to this point. This month, Hyperliquid accounted for 38% of Kraken’s spot volumes, 16% of Coinbase, 15% of OKX, 14% of Bybit, and a pair of.4% of Binance. Though all figures characterize a major rise from the start of the 12 months, additionally they present that Hyperliquid nonetheless has an extended option to go to flip among the largest CEXs.

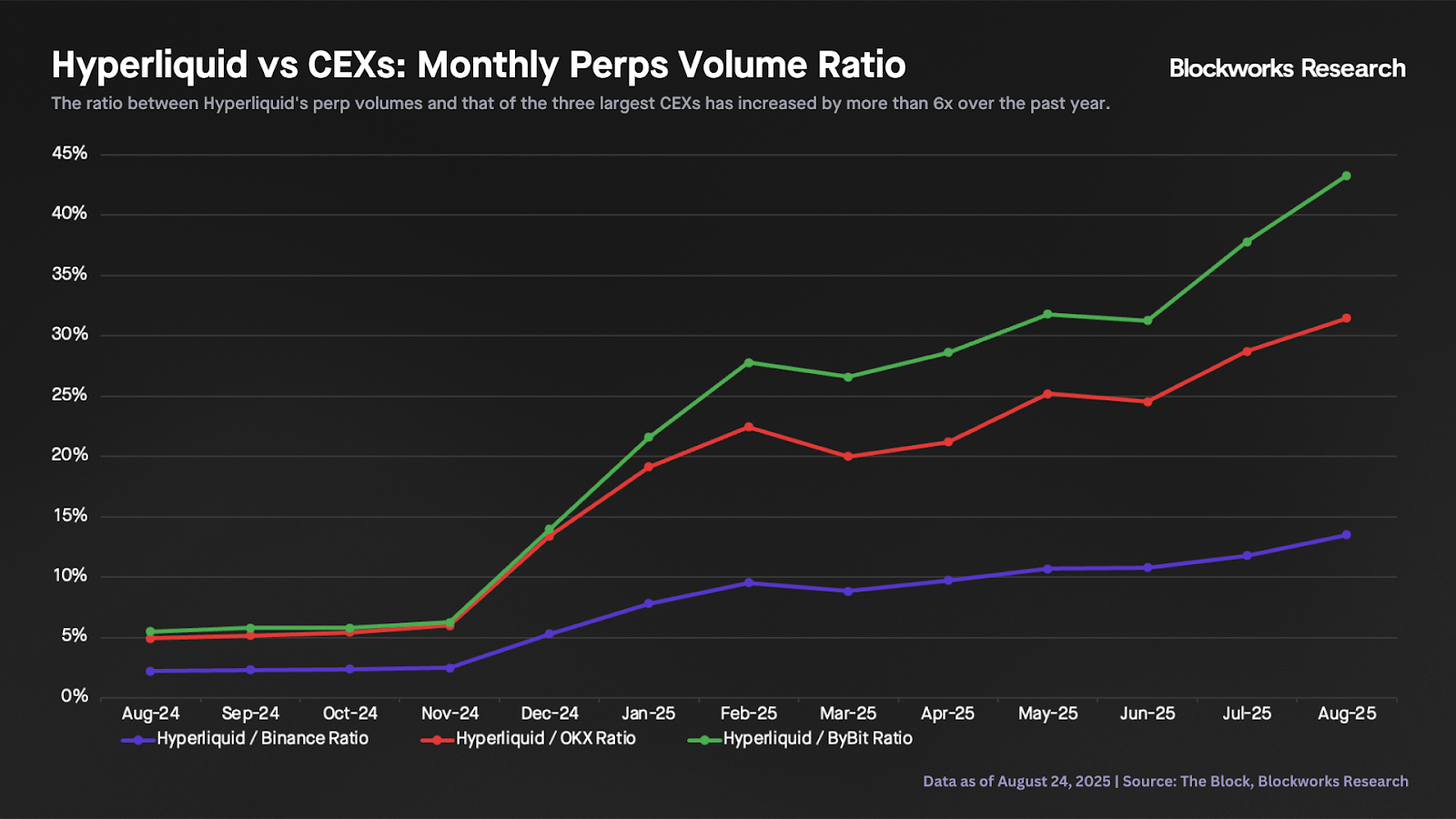

Concerning perpetual futures volumes, Hyperliquid has been rising considerably quicker than its centralized counterparts. The chart beneath exhibits that the ratio between Hyperliquid’s perp volumes and that of the three largest CEXs has elevated by greater than 6x over the previous 12 months. Hyperliquid’s month-to-month perps volumes now characterize virtually 14% of Binance’s futures volumes, up from simply 2.2% a 12 months in the past.