Ethereum’s value has been making larger highs and lows for some time now, climbing towards the important thing $4,000 mark.

Whereas each technical strategies and sentiment metrics level to extra upside, warning is suggested, because the market may be in for a pullback quickly.

By Shayan

The Day by day Chart

The each day chart demonstrates ETH’s upward path inside a big ascending channel. This uptrend started in the course of April, and the value has damaged a number of resistance ranges to the upside.

Each the 100-day and 200-day shifting averages are additionally positioned beneath the value now, with the 100-day MA having an upward slope following a bullish crossover earlier.

As issues stand, the market may be very more likely to push past the excessive of $4,107 and even towards a brand new all-time excessive within the coming months, if the channel is damaged to the upside.

Alternatively, nonetheless, a rejection from the upper trendline of the channel might push the value again towards the $3,200 space, which might be the deciding level for whether or not a short-term correction or a full-on reversal is on the desk.

The 4-Hour Chart

The 4-hour chart reveals an fascinating reaccumulation part happening, which largely happens after a rally. The value has been consolidating between the $3,500 and $3,800 ranges, with a pretend breakout and liquidity sweep occurring beneath the $3,500 zone.

At present, the value is on the verge of breaking above the $3,900 excessive, and in case of an impulsive follow-up, the market would probably start a brand new aggressive rally as ETH hunts for a brand new all-time excessive. The RSI can be round 67, confirming bullish momentum, but additionally hinting at a possible overbought situation occurring quickly. But, it won’t imply that the market will reverse decrease, a minimum of not earlier than a bearish divergence happens.

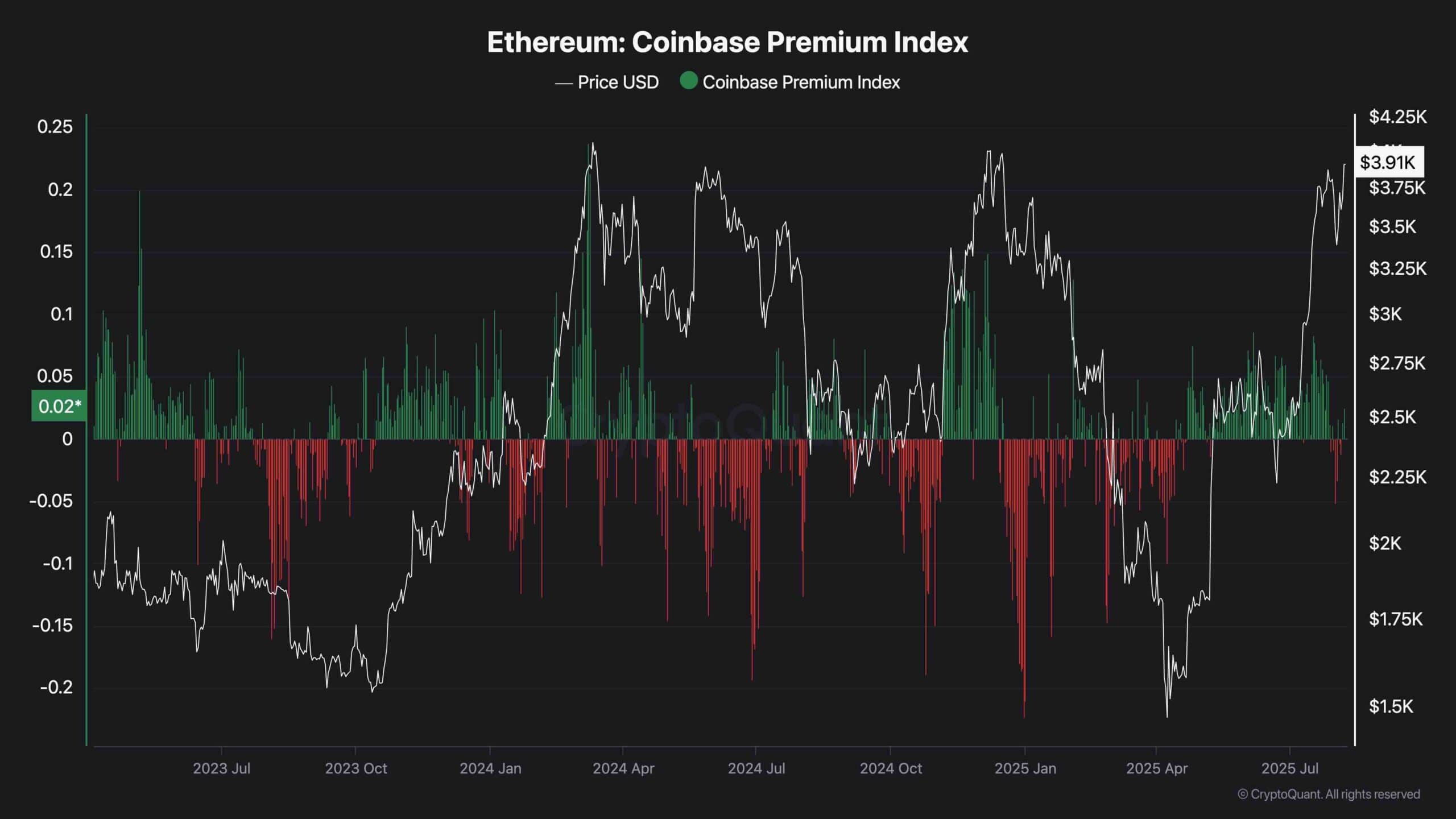

Coinbase Premium Index

The Coinbase Premium Index is a metric that measures the distinction between Bitcoin’s value on Coinbase and that of Binance. Because the chart reveals, the index has been largely printing constructive values because the starting of the present rally in April. This means that there’s appreciable demand from American Traders, in comparison with different international locations.

Trying to the previous, the Coinbase Premium Index demonstrates a constructive correlation with value motion, as constructive values have led to cost rallies as a rule.

Subsequently, as the present scenario suggests, the likelihood of additional bullish value motion is larger than a reversal, and market sentiment helps the upward value motion seen on technical charts.