Ethereum (ETH) has moved again above key help after a short breakdown, with the asset recovering towards $4,150. The transfer comes after a 24-hour acquire of over 8%, although ETH stays down greater than 8% over the previous week.

Sample Repeats After False Breakdown

A chart shared by Dealer Tardigrade outlines a recurring value sample: a false breakdown, adopted by a reclaim of help, after which a rally.

$ETH/day by day#Ethereum has reclaimed above the earlier low, which was marked as a help, after a false breakdown.

It’s following this sample:

🔴 False breakdown

🟡 Reclaim

🟢 RallyWe would see a Rally shifting above the earlier excessive quickly 🚀 pic.twitter.com/BEJTQda0oY

— Dealer Tardigrade (@TATrader_Alan) October 13, 2025

The precise sequence has occurred a number of instances over the previous yr. In every case, the breakdown led to a pointy restoration. The newest setup reveals ETH reclaiming the $3,650 zone. The sample factors to a attainable transfer again towards the $4,800 degree if momentum continues.

Chart Targets $7,000 by Mid-2026

Investor Mike Investing posted a weekly ETH chart projecting a long-term value goal of $7,000 by Might 2026. The chart reveals ETH buying and selling nicely above its 200-week shifting common, now close to $2,447. This degree has acted as a base throughout earlier market cycles.

Remarkably, the submit claims that throughout the current correction, giant corporations together with BlackRock, BitMine, and Vanguard elevated their ETH holdings. Whereas this exercise isn’t confirmed in public filings, the chart suggests a powerful return is feasible over the following a number of months if ETH holds above help.

I’m formally calling it…$ETH had its last exhausting pullback beneath $4,000 earlier than it begins its multi month incoming rally.

Throughout the current pullback establishments like BitMine, Blackrock, & Vanguard all loaded collectively billions in $ETH.

$7000+ by Might 2026.

Mark my phrases… pic.twitter.com/m0xCGA0pb1

— Mike Investing (@MrMikeInvesting) October 12, 2025

You may additionally like:

- Establishments Scoop Up BTC and ETH After Crypto’s Largest Liquidation Occasion

- Bitcoin Soars Past $114K, Ethereum Spikes 6% as US-China Tensions Ease

- Altcoin Massacre: ETH, XRP, SOL, DOGE Crumble as Liquidations Close to $900M

As well as, a separate chart from Mister Crypto compares Ethereum’s present construction to its 2016–2017 cycle. The side-by-side view reveals that each charts skilled a breakout, adopted by a brief pullback. Within the earlier cycle, this setup led to a steep multi-month rally.

The submit claims, “This $ETH setup appears to be like a lot prefer it did in 2017,” inserting the present part simply earlier than a serious leg up. Merchants watching fractals typically use these historic patterns as tough guides, however outcomes can differ.

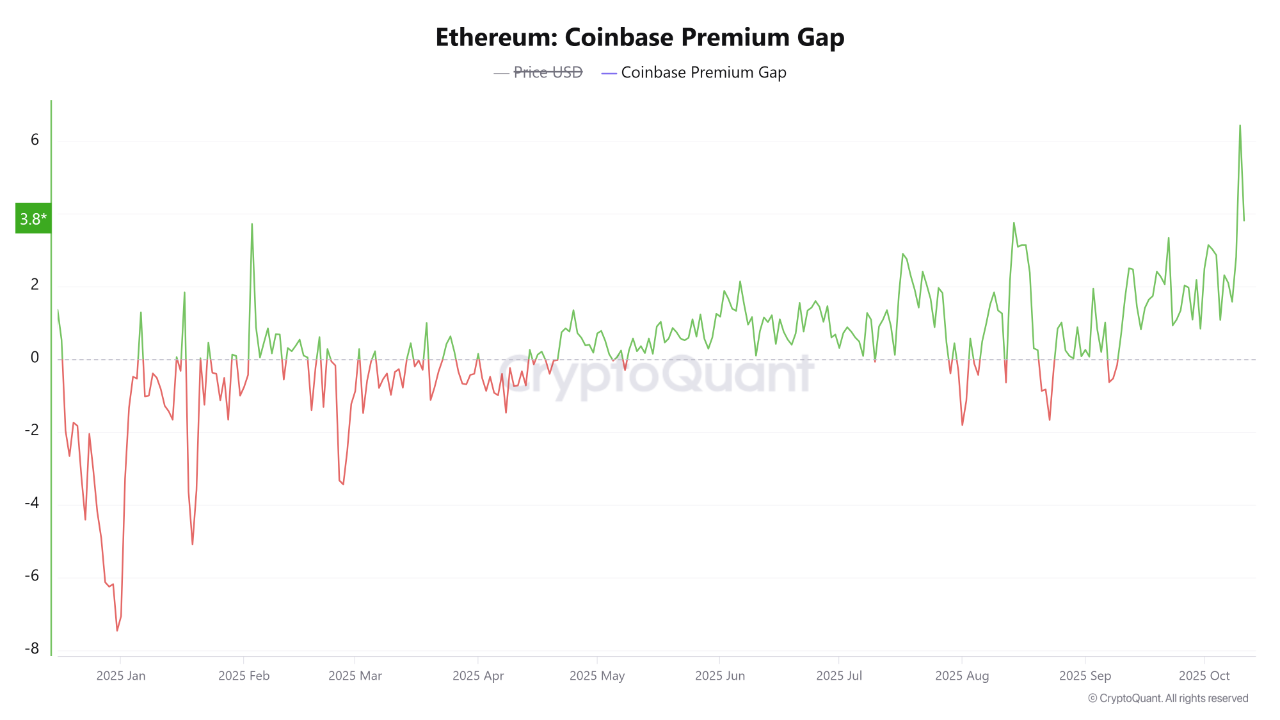

Coinbase Premium Hits 12 months-Excessive

On-chain analyst CryptoOnchain reported a pointy spike in Ethereum’s Coinbase Premium Hole, hitting +6.0 on October 10. This reveals ETH was buying and selling a lot larger on Coinbase than on international exchanges like Binance, typically an indication of robust U.S. demand.

“Whereas the worldwide market was promoting, an overwhelmingly aggressive wave of shopping for was going down on the Coinbase trade,” the submit stated.

This sort of shopping for typically displays institutional curiosity, particularly when it reveals up throughout market corrections.

The info means that main traders are positioning throughout dips, making a attainable flooring round present value ranges.