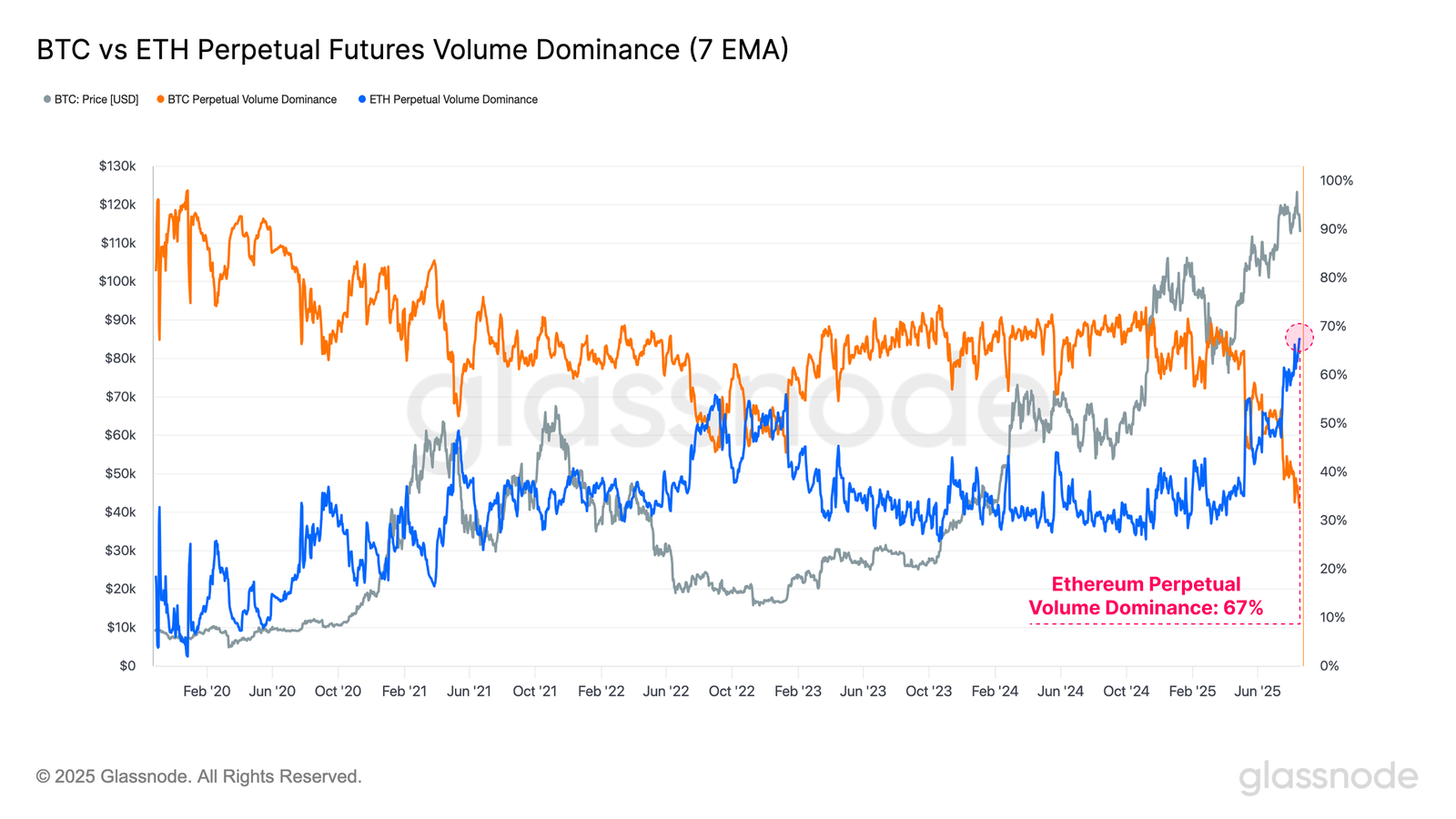

Ethereum’s perpetual futures buying and selling quantity share hit a historic excessive of 67% over the previous week. In different phrases, two-thirds of all crypto perpetual futures buying and selling concerned Ethereum.

This means that crypto traders are unusually favoring high-risk investments, even amid a market downtrend prompted primarily by issues over rising US inflation.

BTC-ETH Open Curiosity is Very Shut

Glassnode launched its weekly report, “A Derivatives-Led Market,” on Wednesday. It defined that whereas Bitcoin’s value lately hit a brand new all-time excessive earlier than correcting, the crypto derivatives market primarily drove the market’s course.

Regardless of the correction, Glassnode identified that market members nonetheless contemplate this a bull market, which is mirrored within the rising open curiosity dominance of ETH, a key “bellweather asset“

As of Thursday morning UTC, the spot dominance hole between Bitcoin (59.42%) and Ethereum (13.62%) is about fourfold. Nonetheless, the open curiosity dominance is far nearer, with Bitcoin at 56.7% and Ethereum at 43.3%. This means that leveraged traders are displaying considerably larger curiosity in ETH.

This pattern is much more pronounced in buying and selling quantity. Ethereum’s perpetual futures buying and selling quantity share has reached an all-time excessive of 67%.

BTC vs ETH Perpetual Futures Quantity Dominance(7 EMA). Supply: Glassnode

Glassnode defined that these figures spotlight the excessive degree of investor curiosity within the altcoin sector and point out that traders are actually keen to tackle larger funding danger.

So, might the worth of ETH rise additional and function a stepping stone to an “altcoin season”? Finally, the important thing seems to lie within the attitudes and rate of interest selections of the US Federal Reserve (Fed) officers.

One of many predominant causes for the current crypto value correction is the uncertainty surrounding the Fed’s rate of interest cuts because of renewed US inflation. If Fed Chair Jerome Powell’s speech on the Jackson Gap assembly on Friday indicators a transfer towards rate of interest cuts, ETH is predicted to rise a lot sooner than BTC.

The submit ETH Open Curiosity Reaches ATH, Signaling Potential for Additional Beneficial properties appeared first on BeInCrypto.