Ethereum ($ETH) is at a decisive level on the charts. After weeks of volatility, the worth is consolidating round $4,300, balancing between sturdy technical help and stiff resistance. With the crypto market looking for course, Ethereum’s efficiency might set the tone for the following main altcoin transfer.

Key Help and Resistance Ranges

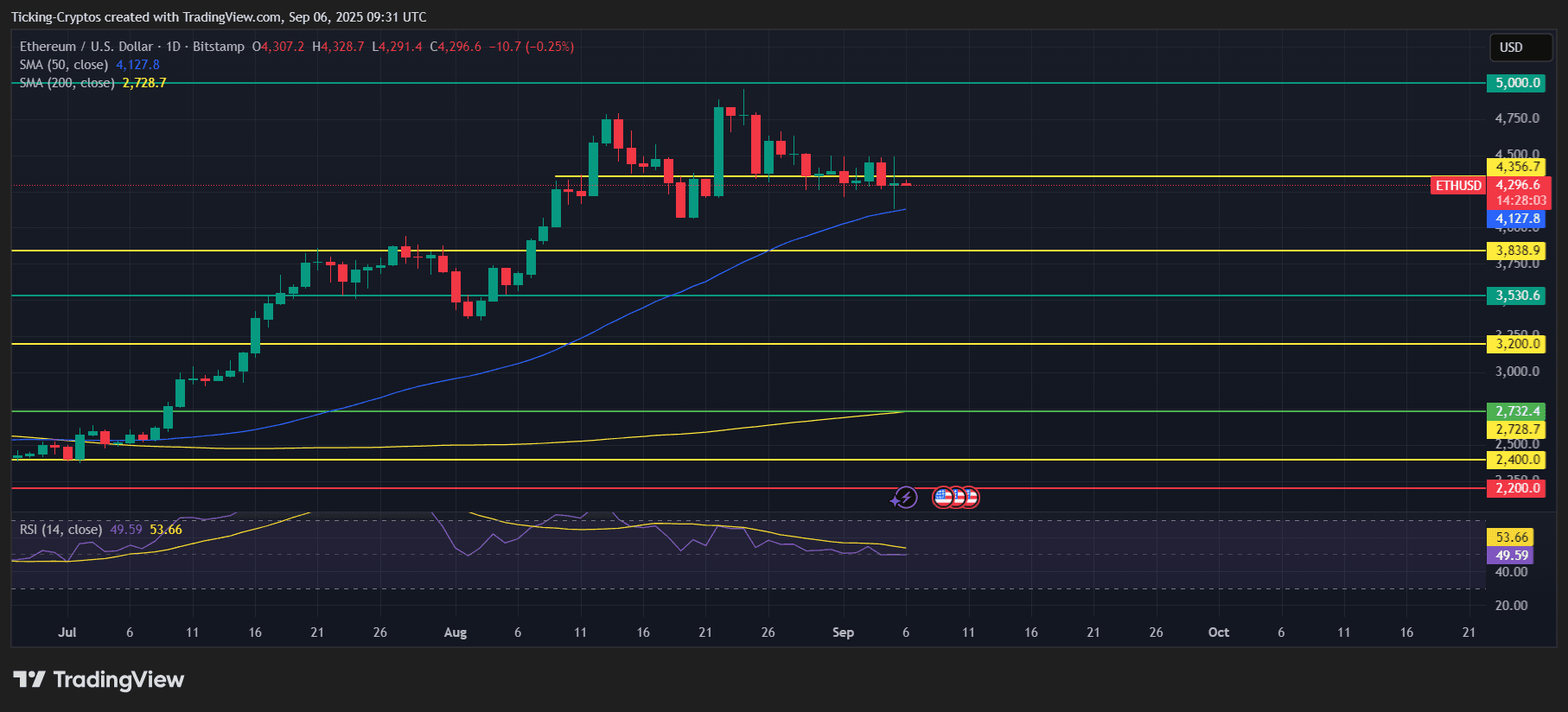

- Fast help: $4,127 (50-day SMA)

- Resistance zone: $4,356 – $4,500

- Secondary helps: $3,838 and $3,530

- Main help: $2,728 (200-day SMA)

- Upside goal: $5,000 psychological barrier

ETH/USD 1-day chart – TradingView

The chart reveals ETH repeatedly testing the $4,127 degree, the place the 50-day shifting common has been appearing as a cushion. A decisive bounce right here might gasoline a push again towards $4,356 and past, whereas a breakdown could open the door to $3,838 and even $3,530.

Momentum and RSI Indicators

Ethereum’s RSI is hovering close to 49–53, sitting proper on impartial floor. This implies the market is undecided, with neither bulls nor bears holding dominance. A break above RSI 55 might set off bullish momentum, whereas a slip beneath 45 could verify additional draw back stress.

A Portfolio Supervisor’s Tackle Ethereum Value

From knowledgeable buying and selling and portfolio administration perspective:

- Bullish Situation: If ETH holds above $4,127 and breaks previous $4,356 resistance, the trail to $4,750 and in the end $5,000 turns into extra seemingly. Portfolio managers might justify growing publicity if institutional inflows mirror Bitcoin’s energy.

- Bearish Situation: An in depth beneath $4,127 dangers accelerating promoting stress, dragging ETH again towards $3,800 or $3,530. Portfolio managers could think about trimming positions or hedging publicity if this help fails.

Danger administration stays essential, as ETH is consolidating close to its short-term trendline help.

Ethereum Value Prediction: What’s Subsequent for ETH Value?

Within the quick time period, $Ethereum is prone to commerce inside a $4,127 – $4,356 vary till a catalyst sparks momentum. Breaking out above $4,356 would arrange a retest of $4,750 and ultimately $5,000. On the draw back, shedding the 50-day SMA might set off a sharper correction towards $3,800 and $3,530 earlier than stabilizing.

For long-term traders, the $2,728 200-day SMA stays the road within the sand. So long as ETH holds above it, the macro uptrend stays intact.