Market Recap & Chart Learn

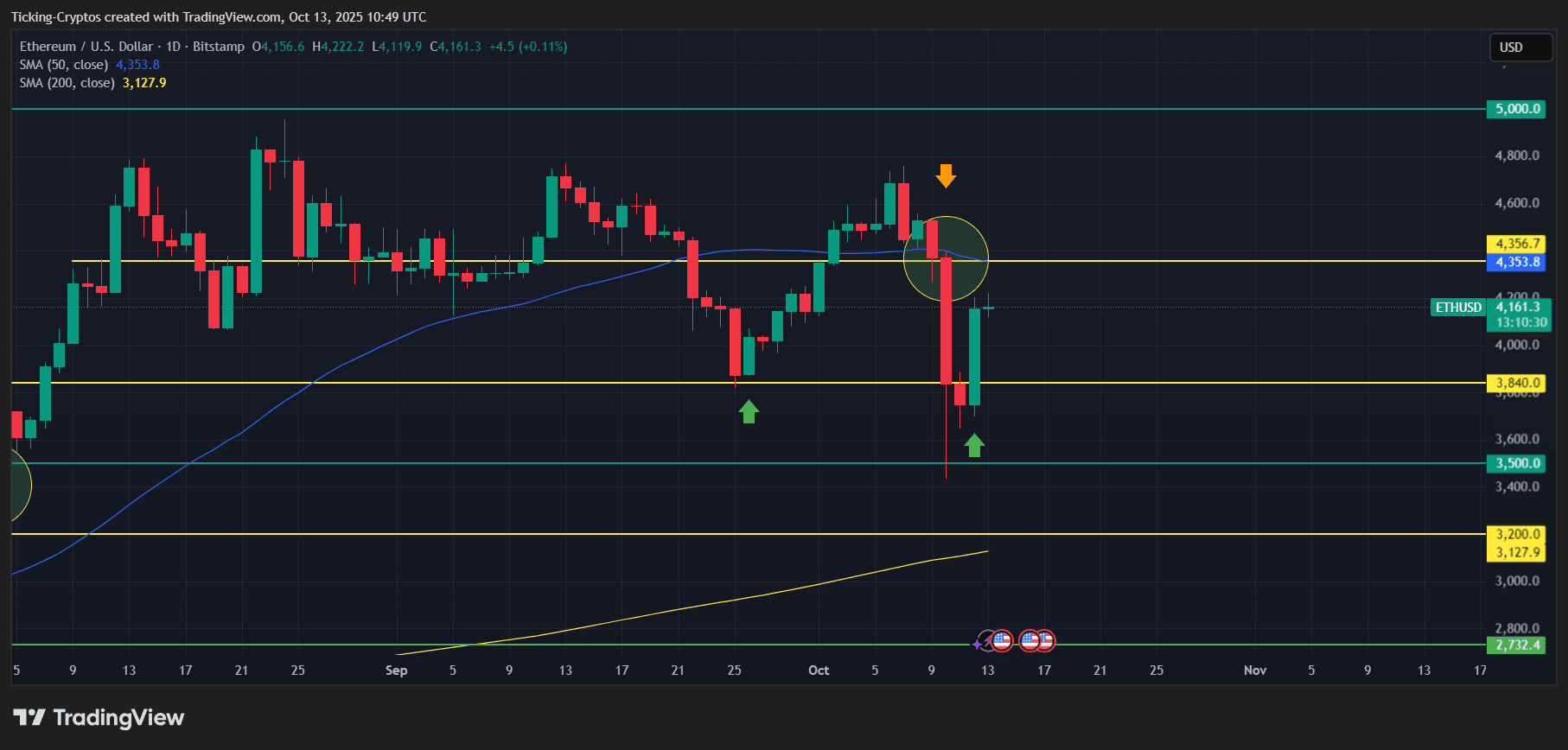

$Ethereum each day chart reveals a traditional shakeout-and-reclaim:

- The selloff knifed by means of mid-range help, tagging the $3,840–$3,500 demand zone (a number of inexperienced arrows), then reversed exhausting.

- Worth has reclaimed the $4,000 deal with and is urgent into the $4,350 space, which aligns with the 50-day SMA (~$4,354) and prior horizontal resistance (~$4,356–$4,357).

- Candles present lengthy decrease wicks on the lows, hinting at aggressive dip shopping for. Momentum now hinges on whether or not bulls can convert $4,350 into help.

ETH/USD 1-day chart – TradingView

Key ranges from the chart

- Resistance: $4,350–4,360 (50D SMA & prior horizontal), $4,500, $4,800, $5,000 (psychological).

- Help: $4,000 (spherical), $3,840 (vary ground), $3,500, $3,200–$3,130 (200D SMA), $2,730 (main higher-time-frame degree).

Ethereum Worth UP: Why Consumers Returned

- Geopolitics easing: Markets are leaning into headlines suggesting progress towards an Israel–Hamas warfare endgame and de-escalation extra broadly—lowering tail-risk premia throughout threat property.

- U.S.–China tone shift: Indicators from Beijing towards placing a tariff compromise with Washington cooled trade-war anxiousness, lifting international threat sentiment.

With the macro worry premium fading, systematic and discretionary flows rotated again into crypto, favoring high-beta leaders like ETH after an oversold flush.

(As at all times, headlines can change shortly; ranges above stay the actionables no matter information.)

Ethereum Worth Prediction (Close to Time period)

Bullish State of affairs (Base Case whereas > $3,840)

- Break & maintain above $4,350–$4,360 → momentum set off.

Targets:

- $4,500 (spherical + provide pocket)

- $4,800 (pre-$5k provide)

- $5,000 (psychological magnet / extension)

Invalidation for this path: a each day shut again under $4,000 will increase chop threat; under $3,840 flips bias neutral-to-bearish.

Bearish/Protection State of affairs (If Macro Sours or $4,350 Rejects)

- First draw back catchers: $4,000, then $3,840.

- Lack of $3,840 opens a $3,500 check.

- If promoting accelerates, $3,200–$3,130 (200D SMA) is the pivotal development guardrail.

Worst case (capitulation): a spike towards $2,730 earlier than patrons probably defend higher-time-frame construction.

Ethereum Buying and selling Technique Notes

- Momentum merchants: search for a clear each day shut above $4,350 and intraday retest/maintain to focus on $4,500 → $4,800.

- Swing members: accumulate on defended dips into $4,000–$3,840 with clear invalidation; add provided that the extent holds.

- Threat administration: respect the 200D SMA (~$3,130) as development litmus—persistent closes under it will shift the medium-term view.