Ethereum value right now: $2,510

- Key Ethereum on-chain knowledge has remained muted prior to now week.

- Center East geopolitical tensions have brought about market members to turn into much less lively.

- ETH prolonged its consolidation after discovering help at $2,450.

Ethereum (ETH) held regular round $2,500 within the early Asian session on Thursday following blended exercise throughout its on-chain knowledge.

Ethereum on-chain knowledge stays muted following Center East battle rigidity

Ethereum is experiencing calmness in its on-chain metrics following an prolonged interval of value consolidation that has spanned the previous six days after dropping from above $2,700.

US spot Ethereum exchange-traded funds (ETFs) have seen appreciable drops in inflows, registering simply $32 million in web inflows over the previous two days, in response to SoSoValue knowledge. That is in distinction to final week when it noticed over $170 million within the first two days of buying and selling.

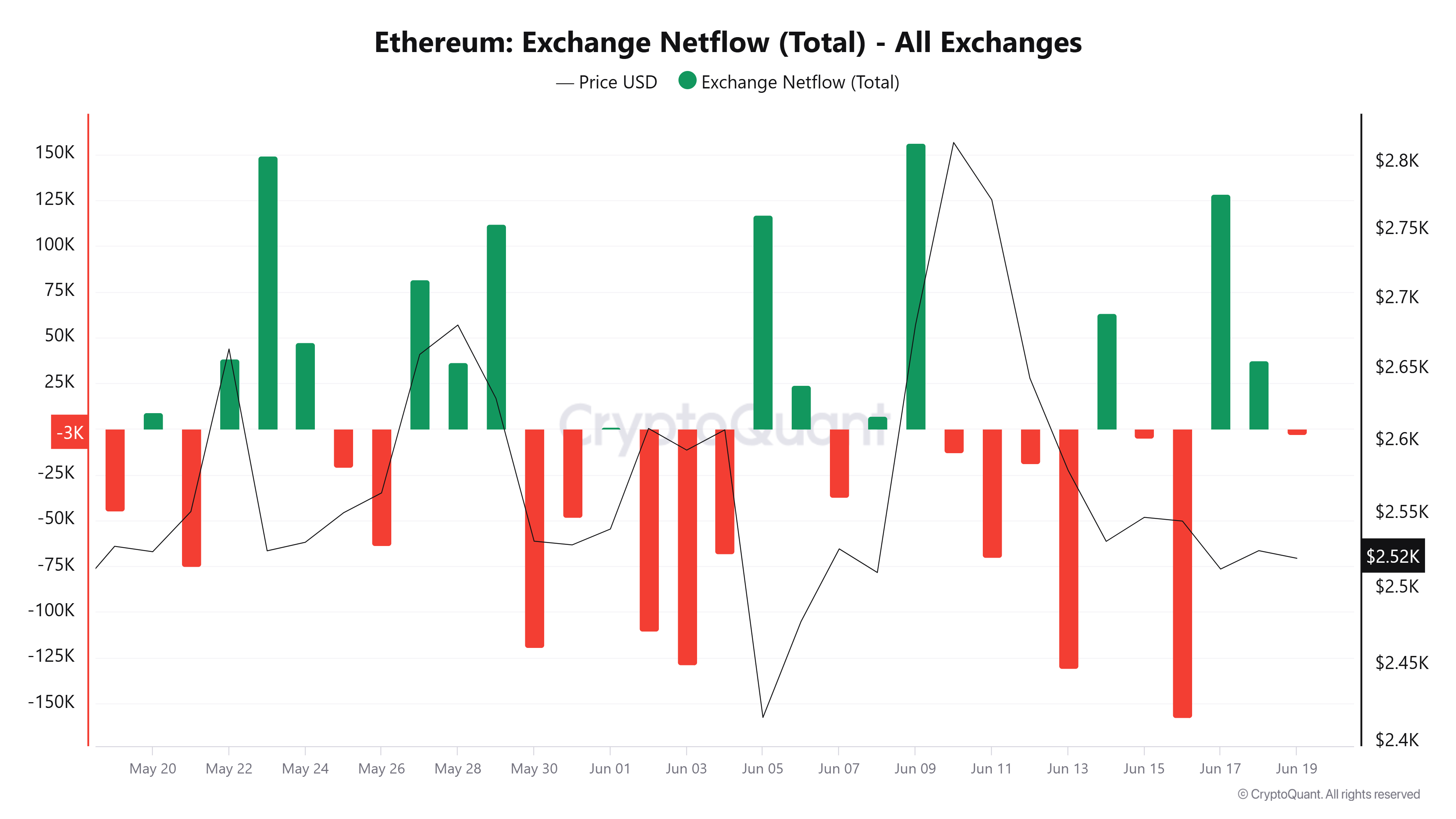

Change web flows have additionally been largely blended, with a mix of inflows and outflows over the previous week, indicating a wrestle for route amongst market members. The same image is clear in Ethereum futures, the place open curiosity has remained flat prior to now six days.

ETH Change Netflows. Supply: CryptoQuant

The calm available in the market follows the US Federal Reserve’s determination to carry charges regular at 4.25-4.50% on Wednesday amid ongoing issues about US tariffs and a resumption of Center East battle tensions.

“Markets are more and more centered on a possible realignment in Center Jap energy constructions and the implications this may occasionally have for regional geopolitics because the US, Russia and China are all concerned by proxy,” mentioned QCP analysts in a notice to buyers on Wednesday.

“Tehran is cornered, a disruption or full blockade of this essential chokepoint turns into a reputable tail danger. The strait accounts for a big share of worldwide crude oil flows, and any provide shock would have a pronounced inflationary affect,” they added.

In consequence, buyers are using risk-off methods to hedge towards draw back danger, whereas others stay muted. On Deribit, the most important choices alternate, buyers have purchased an elevated quantity of places across the $2,450 to $2,500 strike value over the previous 24 hours, making this degree a essential level of volatility within the coming days, in response to knowledge from Amberdata.

Put choices are contracts that give the client the appropriate however not the duty to promote an underlying asset at a particular value (strike value) earlier than the contract expires. It represents a draw back value prediction. When costs transfer beneath a places’ strike value, the contract turns into “within the cash” or in revenue.

“This geopolitical stress is layered atop an already fraught international macro setting, marked by stubbornly elevated inflation and a world reset in tariff regimes. The so-called Tariff Conflict could have fizzled with little fanfare, however investor consideration has swiftly migrated to the Center East,” the analyst mentioned.

Ethereum Worth Forecast: ETH extends consolidation amid weak volumes

Ethereum skilled $64.61 million in futures liquidations, with lengthy and quick liquidations totaling $35.61 million and $29 million, respectively, over the previous 24 hours, in response to Coinglass knowledge.

Ethereum continued consolidating on Wednesday, holding the $2,450 help on the 38.2% Fibonacci Retracement. If ETH may cross above the 50-day Exponential Transferring Common (EMA), it may shortly rise to check the $2,850 resistance. To beat the $2,850 key resistance, ETH wants a surge in quantity accompanied by robust bullish sentiments.

ETH/USDT 8-hour chart

On the draw back, a transfer beneath the 38.2% Fibonacci degree and the decrease boundary of a key channel may ship ETH towards the $2,260-$2,110 vary.

The Relative Power Index (RSI) and Stochastic Oscillator (Stoch) are beneath their impartial ranges and shifting sideways, indicating a dominant bearish momentum.