Ethereum’s worth as we speak is round $4,355, which is a bit of decrease than it was after a tough August when it stored going backwards and forwards between $4,200 help and $4,800 resistance. The market is transferring up inside a channel, and merchants are divided on whether or not the following massive transfer shall be a breakout or a correction.

Current information exhibits how fragile the steadiness is. Whale flows present that there’s nonetheless a variety of promoting strain, with $12.8 million in internet outflows on August 30. Leveraged positions close to $4,200 are additionally susceptible to cascading liquidations. On the identical time, $27.6 billion in ETF inflows and extra institutional staking present that there’s structural demand.

This conflict between short-term volatility and long-term resilience will outline the September outlook. Ethereum’s subsequent transfer hinges on whether or not bulls can defend key helps or if sellers drive a deeper retracement.

Ethereum Value Holds Channel Assist as Indicators Tighten

ETH worth dynamics (Supply: TradingView)

Ethereum worth motion stays inside an ascending channel that has guided the uptrend since July. Assist is layered round $4,200, with resistance capping upside close to $4,800. The midpoint of the channel, round $4,500, has acted as a pivot zone the place momentum repeatedly shifts.

ETH worth dynamics (Supply: TradingView)

On the every day chart, the parabolic SAR sits close to $4,957, reinforcing the resistance cluster overhead. In the meantime, the 20-day EMA close to $4,420 and the 50-day EMA round $4,200 present short-term demand zones. A break beneath $4,200 would expose the $3,800–$3,600 space, the place historic liquidity zones align.

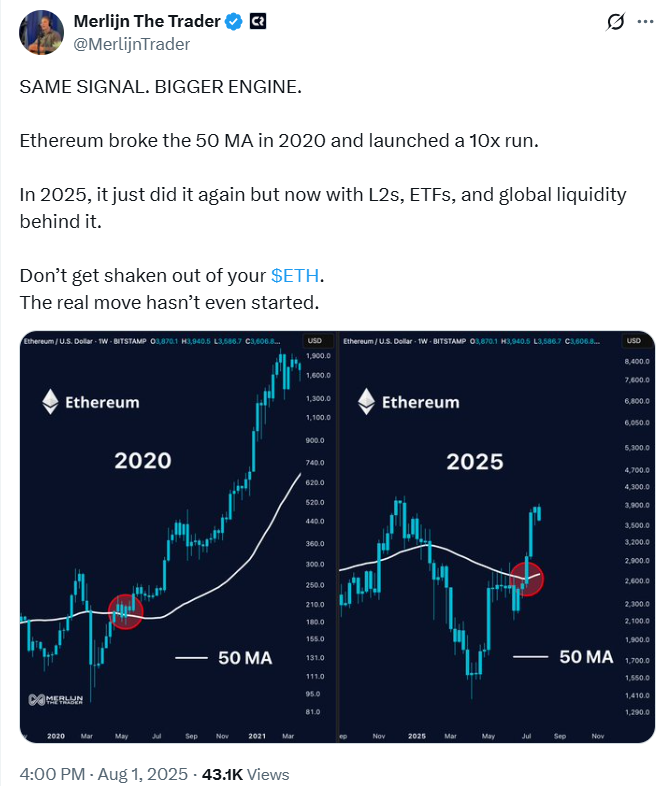

Momentum indicators counsel warning. On the 4-hour chart, Bollinger Bands have narrowed, pointing to an impending growth in volatility. RSI hovers close to impartial ranges, whereas MACD flattens after signaling exhaustion from the August rally. Analysts on X observe similarities to the breakout sample of 2021, with Merlijn the Dealer describing it as “the retest the place legends purchase, and the breakout the place fortunes are made.”

ETHEREUM IS REPEATING HISTORY

2021 confirmed us the sample.

2025 is exhibiting us the chance.The retest is the place legends purchase.

The breakout is the place fortunes are made.$ETH isn’t carried out. It’s simply getting began. pic.twitter.com/81TVrNlp70— Merlijn The Dealer (@MerlijnTrader) August 29, 2025

Whale Exercise and ETF Flows Drive Contradictory Indicators

Ethereum’s liquidity dynamics have grown more and more complicated. Whale conduct has amplified volatility, with some entities accumulating aggressively whereas others execute sharp sell-offs. In Q3, whales boosted holdings by over 9% since October 2024, but current outflows spotlight fragility. A single whale’s $37 million sale in August triggered a ten% intraday drop.

ETH Spot Influx/Outflow (Supply: Coinglass)

Spot trade information reinforces the divide. On August 30, ETH recorded $12.8 million in internet outflows, per the broader August pattern of promoting into rallies. On the identical time, institutional staking has added structural demand. Practically 30% of Ethereum’s provide is now staked, with $17.6 billion in company allocations following the CLARITY Act.

ETF inflows additionally spotlight adoption. Information exhibits $27.6 billion of internet inflows into Ethereum merchandise this 12 months, supporting a story of institutional acceptance. These inflows have offered resilience in opposition to whale-driven volatility, however dangers stay elevated given $2 billion of leveraged lengthy positions hovering close to liquidation thresholds.

Bulls Goal $4,800, Bears Warn of $4,000 Breakdown

The market is polarized between bullish and bearish narratives. Bulls argue that Ethereum’s consolidation above $4,200 confirms structural power. With TVL surpassing $200 billion and regulatory readability enhancing, they see $4,800 as the following goal. A breakout above this degree might set off momentum towards $5,200 and doubtlessly $6,000 by year-end.

Bears counter that Ethereum worth volatility stays tied to leverage and whale flows. They spotlight the $2 billion in open lengthy positions weak if ETH dips beneath $4,200. A breach of that degree might spark cascading liquidations just like the $3 billion wipeout earlier this month, dragging worth again towards $3,600. With Bollinger Bands tightening and netflows damaging, draw back dangers can’t be dismissed.

This rigidity leaves Ethereum merchants in a holding sample, with each eventualities believable relying on the following liquidity shock.

Ethereum Quick-Time period Outlook: Breakout or Breakdown Forward?

Heading into September, Ethereum worth prediction hinges on whether or not patrons can reclaim momentum above $4,450. Sustained closes above this degree would tilt bias towards a retest of $4,800, with potential extensions to $5,200.

Conversely, failure to carry $4,200 would expose deeper helps at $3,800 and $3,600. The presence of heavy leverage beneath $4,200 amplifies the chance of a pointy flush if promoting intensifies.

For now, Ethereum worth replace indicators a market at equilibrium, with structural inflows offset by fragile liquidity circumstances. Merchants will watch whale exercise and leveraged positioning intently to gauge the following decisive transfer.

Ethereum Forecast Desk

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.