- Ethereum worth rebounds after retesting its each day help at $3,730, holding intact the possibilities to achieve $4,000.

- On-chain information reveals that ETH whale wallets proceed to build up ETH tokens, whereas alternate reserves hit a 9-year low.

- Ether Machine introduced on Ethereum’s tenth birthday that its subsidiary has bought almost 15,000 ETH.

Ethereum (ETH) marked its tenth anniversary this week with rising indicators of bullish momentum, buying and selling above $3,800 on the time of writing after bouncing off a key help degree the day prior to this.

On-chain information reveals a gentle accumulation of ETH tokens by whale wallets throughout July, whereas alternate reserves have dropped to a 9-year low. This provide crunch, mixed with the rising institutional and company curiosity, might set the stage for a breakout towards $4,000.

The Ether Machine provides 15,000 ETH

The Ether Machine, the ether technology firm, introduced on Wednesday that on Ethereum’s 10-year anniversary, its subsidiary, The Ether Reserve LLC, bought almost 15,000 ETH at a mean worth of $3,809.9, totaling $56 million.

This buy is part of The Ether Machine’s long-term accumulation technique, bringing the whole to 334,757 ETH. The agency mentioned it nonetheless has as much as $407 million accessible for extra ETH purchases.

“We could not think about a greater technique to commemorate Ethereum’s tenth birthday than by deepening our dedication to ether,” mentioned Andrew Keys, Chairman and Co-Founding father of The Ether Machine, in a press launch.

“We’re simply getting began. Our mandate is to build up, compound, and help ETH for the long run – not simply as a monetary asset, however because the spine of a brand new web financial system,” he added.

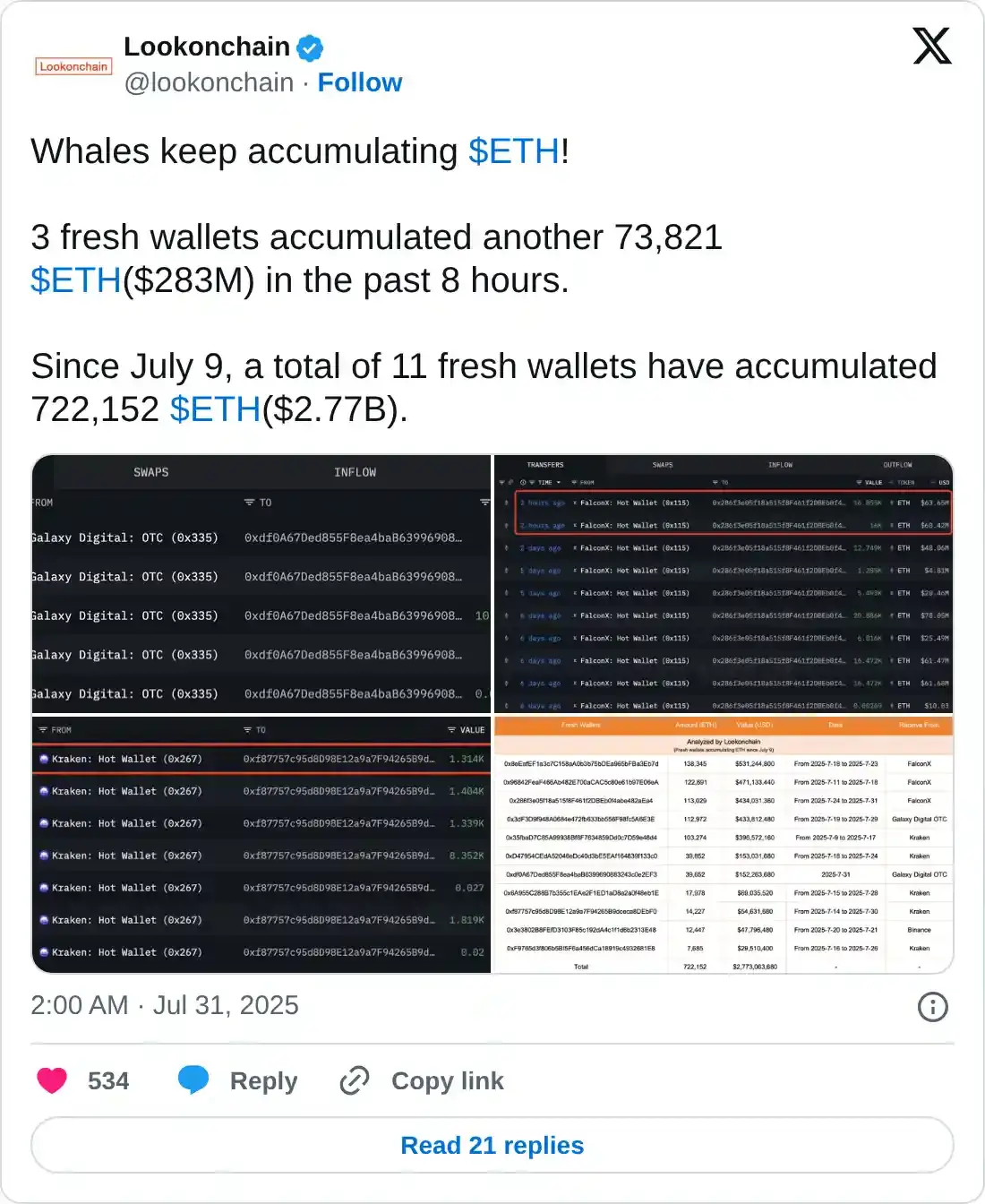

Whales are accumulating ETH tokens

Lookonchain information reveals that whale wallets are accumulating ETH tokens. The information reveals that three contemporary wallets have added one other 73,821 ETH value $283 million up to now 8 hours. Since July 9, a complete of 11 new wallets have gathered 722,152 ETH value $2.77 billion.

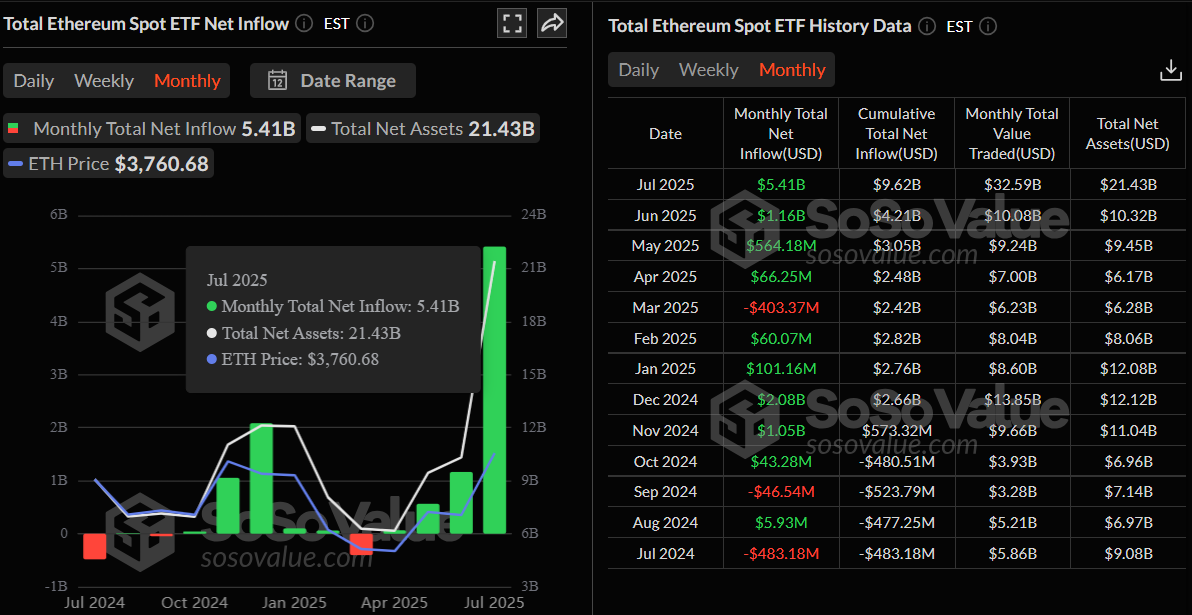

Institutional demand can also be rising, albeit by lower than earlier in July. In keeping with the SoSoValue information, US spot Ethereum Change Traded Funds (ETFs) recorded a light influx of $5.79 million on Wednesday, persevering with its streak of optimistic flows since July 3. To this point in July, the month-to-month flows have reached $5.14 billion, the best degree since their launch.

Whole Ethereum spot ETF internet influx each day chart. Supply: SoSoValue

Whole Ethereum spot ETF internet influx month-to-month chart. Supply: SoSoValue

Ethereum alternate reserve drops to a 9-year low

CryptoQuant information point out that the ETH reserves in exchanges have dropped to 18.7 million as of Thursday, extending the decline seen since early July 2024. Reserves have reached its lowest degree since 2016, indicating decrease promoting stress from traders and a diminished provide accessible for buying and selling.

A drop in reserve additionally alerts an growing shortage of cash, an prevalence sometimes related to bullish market actions.

Ethereum Change Reserve– All Exchanges chart. Supply: CryptoQuant

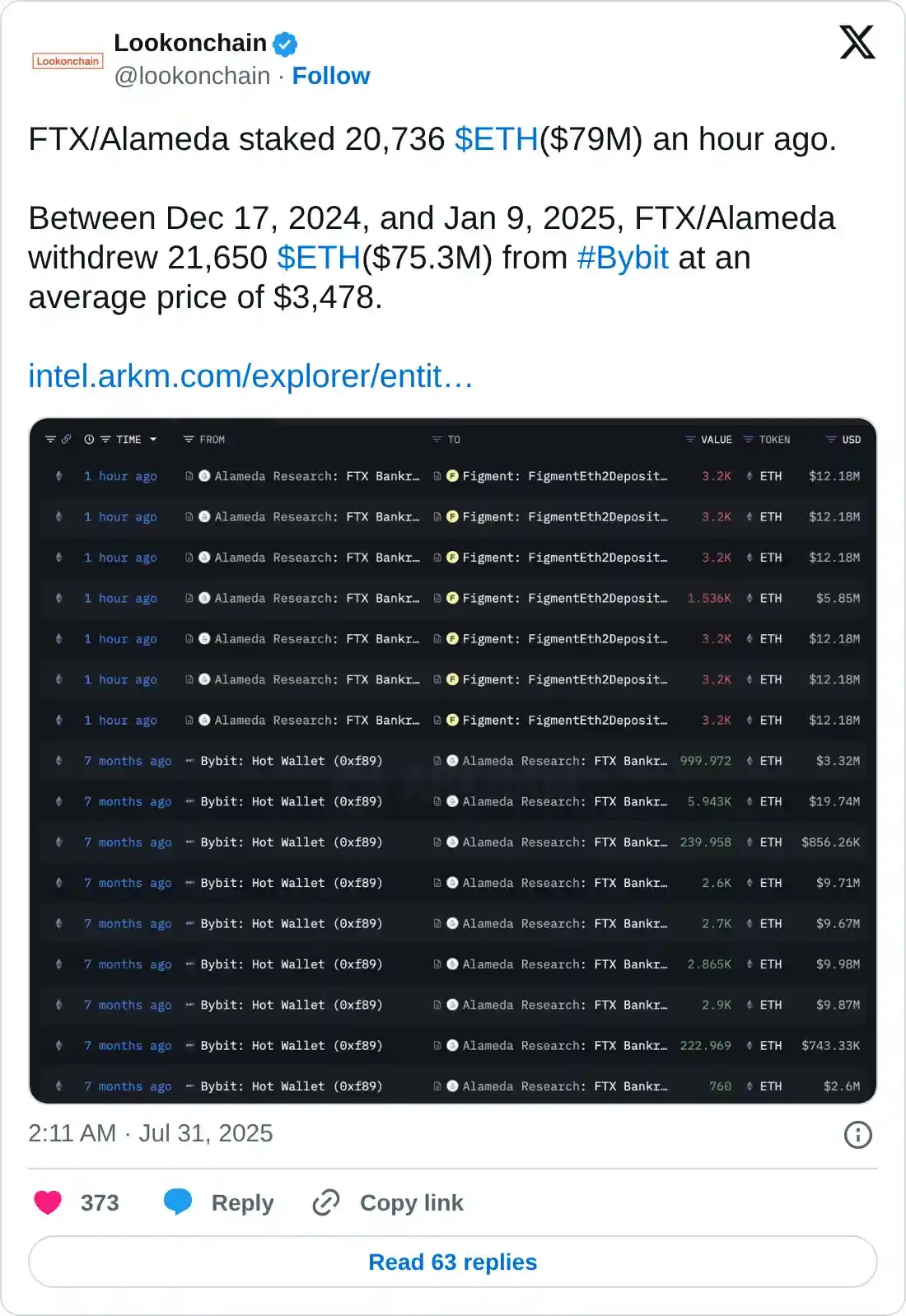

Other than the falling alternate reserve, Lookonchain information reveals that FTX/Alameda has staked 20,736 ETH value $79 million on Thursday. From mid-December to early January, FTX/Alameda withdrew 21,650 ETH from the Bybit alternate, thereby lowering promoting stress and growing the shortage of cash.

Ethereum Value Forecast: ETH bulls aiming for ranges above $4,000

Ethereum worth confronted rejection slightly below its $4,000 psychological degree on Monday and declined barely to search out help across the each day degree at $3,730 the following day. On Wednesday, ETH rebounded after retesting this help degree. On the time of writing on Thursday, it continues to recuperate, buying and selling above $3,800.

If the each day help at $3,730 holds, ETH might proceed its upward momentum concentrating on its key psychological degree of $4,000. A detailed above this degree might prolong extra positive aspects towards the December 9, 2021, excessive of $4,488.

The Relative Power Index (RSI) indicator on the each day chart reads 77, above its overbought degree of 70. Merchants ought to maintain a watch because the Transferring Common Convergence Divergence (MACD) confirmed a bearish crossover on Wednesday, suggesting early indicators of bearish momentum and a possible downward pattern forward.

ETH/USDT each day chart

If ETH faces a correction and closes under the each day help at $3,730, it might prolong the decline to the following help at $3,500.