Ethena’s artificial stablecoin, USDe, has climbed to over $13 billion in circulation lower than a day after it was listed on Binance.

DeFiLlama knowledge exhibits provide jumped practically 2% in 24 hours to about $13.2 billion, making it the fastest-growing stablecoin up to now day.

This speedy enlargement has been ongoing over the previous month, with the protocol including greater than $3 billion to its footprint after it crossed $10 billion in August. Notably, USDe is the third-largest stablecoin within the trade, controlling round 5% of the $287 billion stablecoin market.

In the meantime, the timing of this development displays a number of reinforcing elements designed to spice up the stablecoin’s development.

Over the previous months, market curiosity in stablecoins has accelerated after President Donald Trump signed the GENIUS Act, the primary federal legislation offering a framework for these belongings.

That regulatory readability, coupled with Ethena’s important yields of round 10%, has drawn capital from buyers who see DeFi returns as extra engaging than US Treasurys.

Binance’s integration provides USDe $4B alternative

This milestone comes as Binance added USDe to its platform this week.

Man Younger, Ethena Labs’ founder, stated the itemizing highlights Binance’s uncommon choice to again an exterior undertaking after intensive due diligence.

He described the mixing as a turning level, with Binance’s $130 billion in belongings and $40 billion in stablecoins providing a large distribution channel.

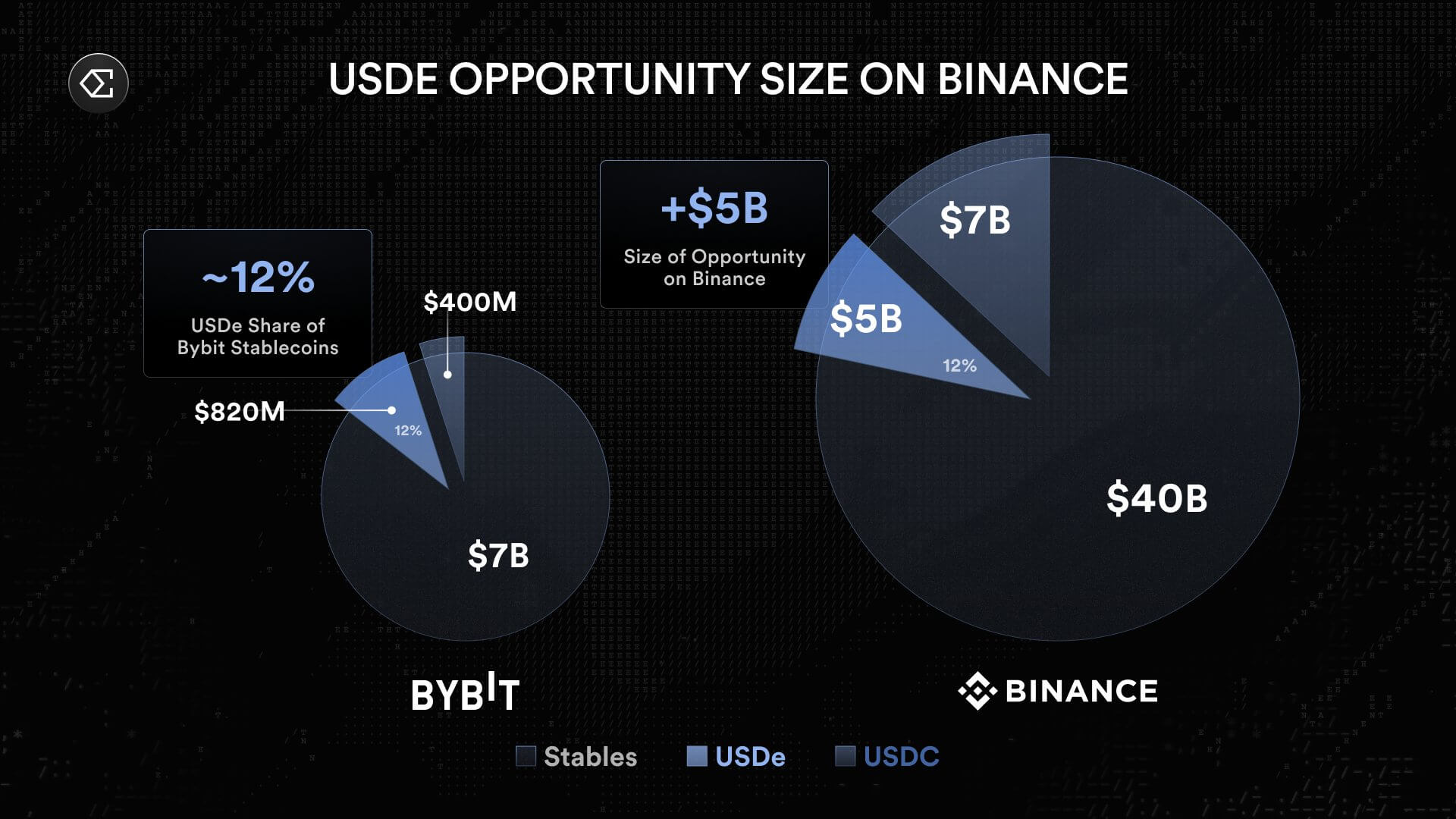

Contemplating this, Younger stated he expects USDe adoption on Binance to ultimately mirror its penetration on Bybit, the place it accounts for round 12% of whole greenback balances.

In response to him:

“USDe penetration for USD belongings on different CEXs sits at roughly ~12% which might correspond to >$4.0 billion of USDe on Binance.”

In response to the announcement, the token can be paired in opposition to Tether’s USDT and built-in into Binance Earn, permitting customers to gather weekly dollar-denominated rewards for merely holding USDe on the change.

Later this month, will probably be accepted as collateral throughout Binance’s futures and perpetual markets.