- The Ethereum worth is close to the essential trendline and will bounce or slice by the $1,800 excessive.

- Whales have purchased 449,000 ETH, and alternate balances are being diminished.

- The degrees of $1,670 and 2000$ appear to be essential for ascertaining whether or not the value will flip bullish or fall additional.

Ethereum (ETH) has proven notable indicators of energy regardless of ongoing bearish market stress. Not too long ago, the on-chain information present that long-term buyers maintain 449,000 ETH whereas nonetheless in losses, demonstrating their confidence within the additional progress of ETH. Trade reserves have additional decreased to 19.1 million ETH, retaining with the pattern of customers shifting their belongings off exchanges and holding them in private wallets.

Supply: CryptoQuant

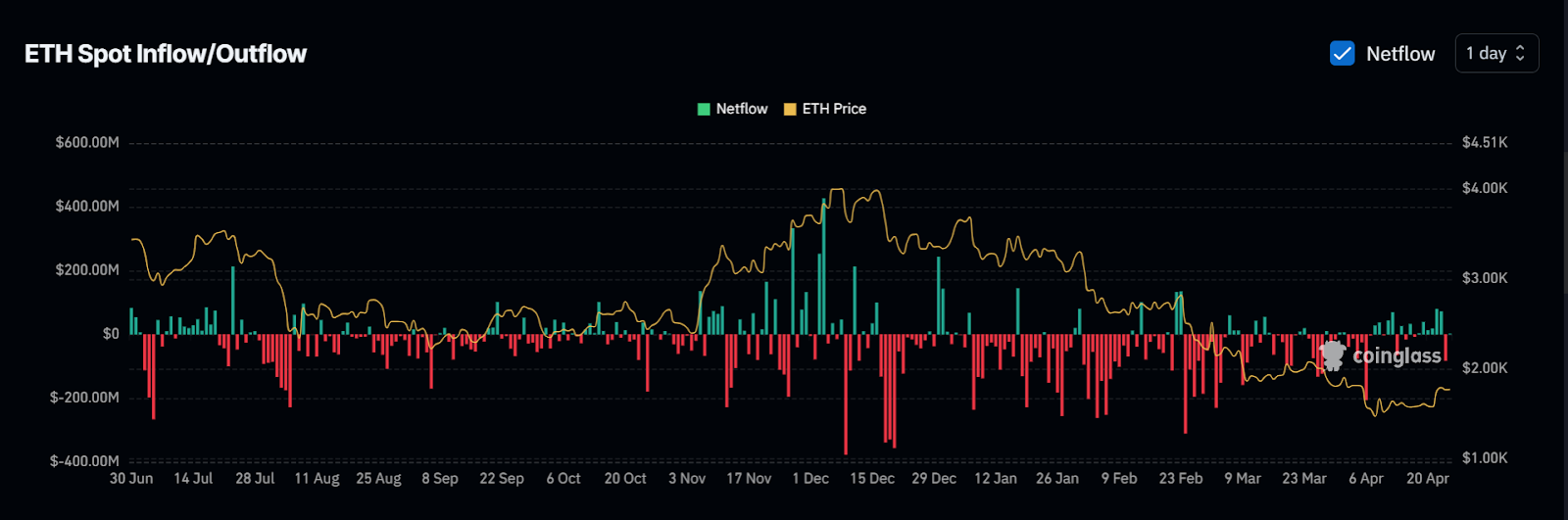

In the meantime, netflows stay largely destructive. The info obtained from Coinglass reveals that ETH has recorded extra outflows than inflows since February. Sustained outflow may imply a build-up on the buy-side and the relief of promoting stress, which may increase a rebound within the worth.

Supply: Coinglass

Nonetheless, buying and selling quantity declined by 19.18% over the past 24 hours, which reveals indicators that short-term demand is waning. On the time of writing, ETH trades at $1,775.60, up 1.12% prior to now day. It has gained 12.12% within the final week, lifting its market cap to $214.3 billion.

Key Ranges to Watch: $1,895 Resistance and $1,540 Help

Completely different technical analyses reveal a major zone of resistance close to $1,895, with a degree of $2,142 as pivotal for additional developments which will impression mass Ethereum bullishness. Bollinger Bands reveals Ethereum is within the means of crossing above the midline, but it surely has not been decided but. The RSI is nearer to 53.7,9, which requires impartial momentum whereas focusing on a hostile breakout previous 60, which can sign short-term continuation.

Supply: TradingView

In response to the dealer DonAlt, ETH must regain $2,000 as help to validate an even bigger turnaround. He identifies $1,670 as his present short-term pivot, hinting that any failure to carry above this degree will probably be bearish. If the value breaks under the impulse low at $1,540, a bearish sample would emerge to disprove the present construction.

Supply: X

Widespread dealer Crypto Caesar additionally famous that the asset is in an space the place it could be set to undergo a bullish breakout by a long-term descending pattern line. The tweet reads, “$ETH is on the verge of breaking out. We actually simply want that increased excessive…”

Supply: X

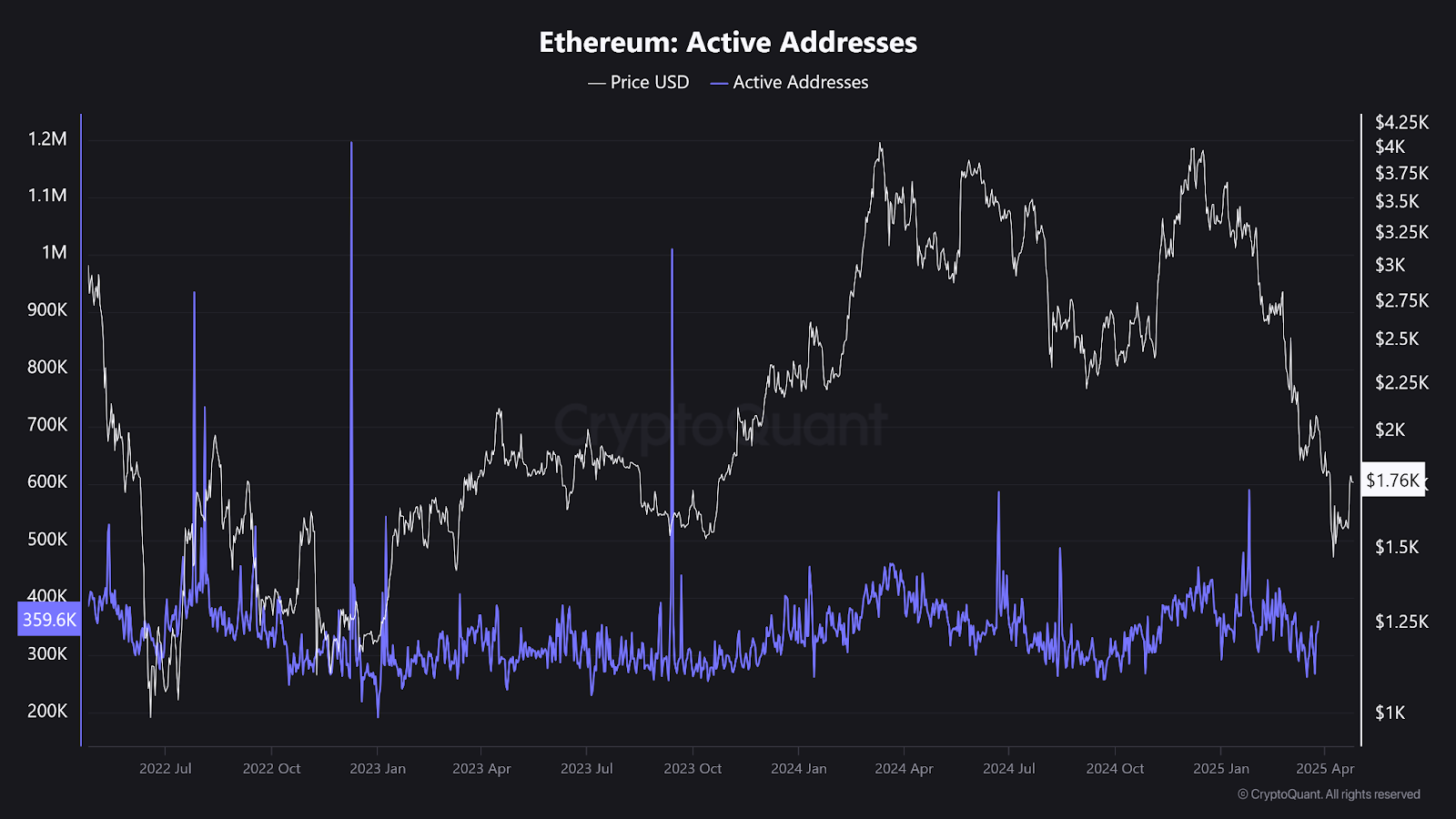

On-Chain Exercise Alerts Blended Sentiment

Ethereum’s lively addresses and transaction rely information inform a nuanced story. The lively addresses have hovered round 359,600, with a denotable sample of improve but. This may imply that the engagement of customers has been kind of stagnant whereas the value has been trending upwards.

Supply: CryptoQuant

The overall transaction rely hovers at almost 1.3 million per day, therefore signifying that total Ethereum utilization regularly stays excessive even inside a bearish area. Whereas it isn’t at bull market ranges, it’s sustained nicely above the bear market degree low level.

The downtrend of alternate reserves additional strengthens the sign, suggesting that extra Ether is being withdrawn from alternate wallets, which broadly signifies accumulation. These reserves have halved from 2022, when it reached 30 million, to just about 19 million, a lower of 37% in two years. These counsel that there’s a basic reluctance amongst buyers to promote their securities within the markets.