The main altcoin ETH has bucked the broader market downturn over the previous 24 hours, posting modest good points of round 1%. At press time, the coin trades at $1,842.

This comes as a key momentum metric — the taker buy-sell ratio—surges to its highest stage in 30 days, signaling renewed bullish strain within the asset’s futures market.

Merchants Eye ETH Upside as Purchase Stress and Construct

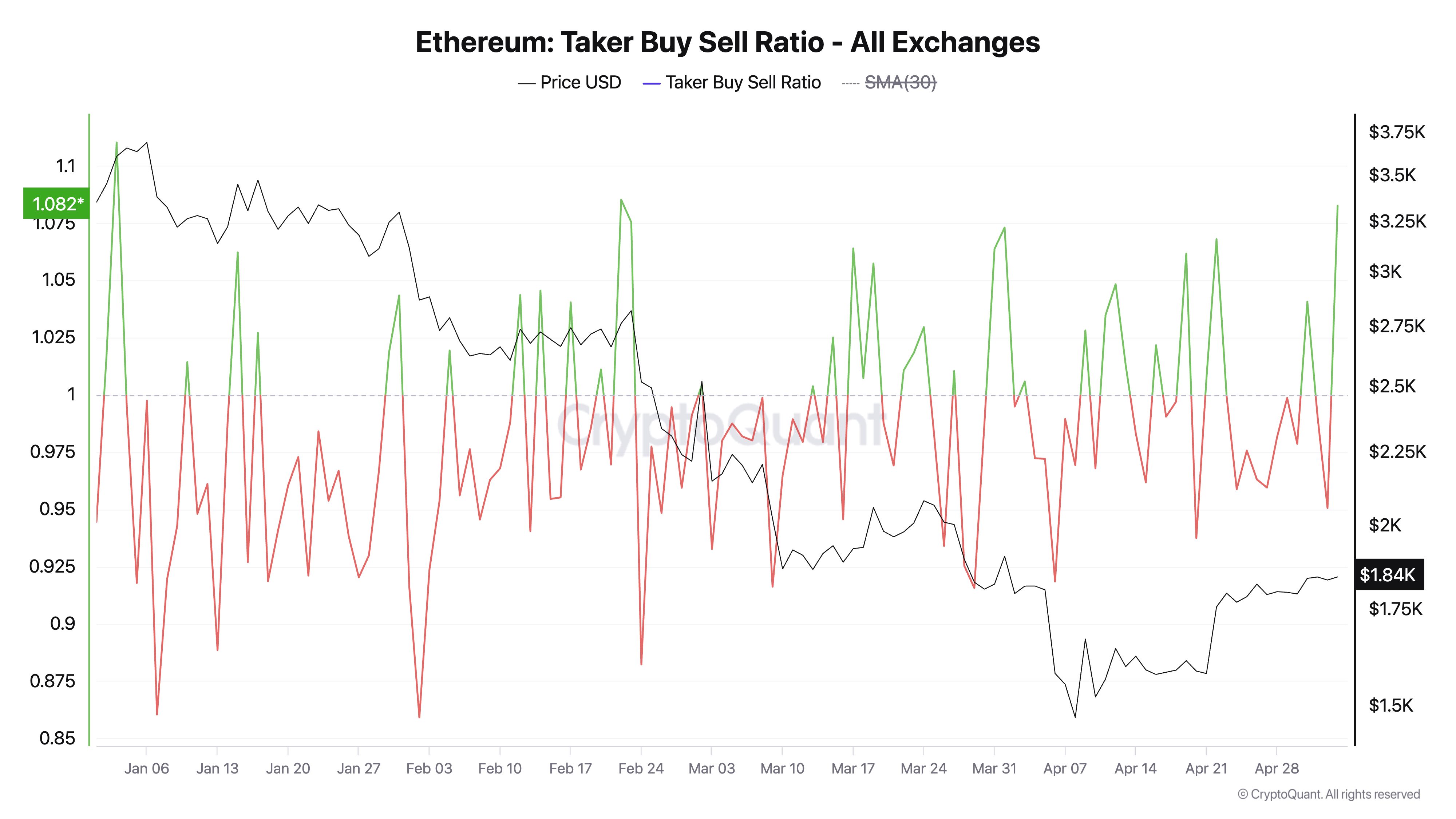

Based on CryptoQuant, ETH’s taker-buy-sell ratio is presently at 1.08, marking its highest worth since early April.

Ethereum Taker Purchase Promote Ratio. Supply: CryptoQuant

This metric measures the ratio between the purchase and promote volumes in ETH’s futures market. A price above 1 means that extra merchants are aggressively shopping for ETH contracts than promoting, whereas values under 1 point out dominant promote strain.

At 1.08, ETH’s taker buy-sell ratio clearly tilts in favor of consumers, reflecting growing confidence amongst merchants that costs might proceed rising.

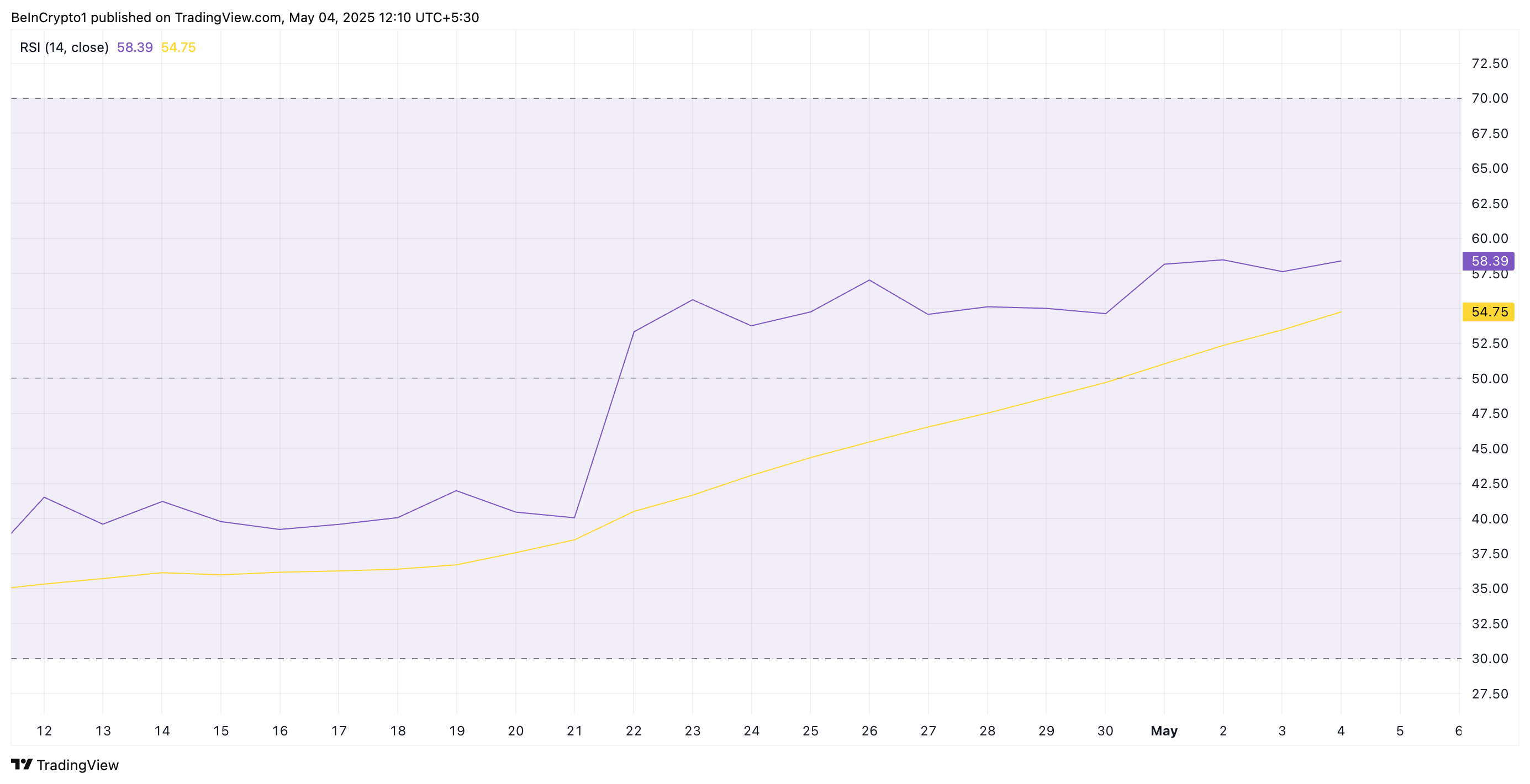

Furthermore, the altcoin’s Relative Power Index (RSI) continues to pattern upward, supporting this bullish narrative. At press time, it’s at 58.39 and climbing.

Ethereum RSI. Supply: TradingView

The RSI indicator measures an asset’s overbought and oversold market situations. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline. Conversely, values underneath 30 sign that the asset is oversold and will witness a rebound.

ETH’s RSI studying confirms the strengthening bullish bias towards the altcoin, reinforcing the view that it may very well be primed for additional upside.

ETH Builds Power Above Quick-Time period Assist

At its present worth, ETH rests above its 20-day exponential transferring common (EMA), which varieties dynamic help under its worth at $1,770.

The 20-day EMA measures an asset’s common worth over the previous 20 buying and selling days, giving weight to latest costs. When an asset trades above this key transferring common, it indicators short-term bullish momentum. This means that latest costs are trending larger than the typical over the previous 20 days. Merchants typically view this as an indication of underlying energy or an early uptrend.

Due to this fact, ETH may keep its rally towards $2,027 if shopping for strain good points momentum.

Ethereum Worth Evaluation. Supply: TradingView

However, if shopping for exercise wanes, the coin may lose latest good points, break under the 20-day EMA, and fall towards $1,385.