After weeks of accumulation, Ethereum worth right now is urgent into a vital resistance zone close to $2,640, a degree that has constantly capped upside makes an attempt since early June. The broader construction reveals bullish intent, however a transparent breakout above this provide zone is required to substantiate a development continuation.

What’s Occurring With Ethereum’s Value?

ETHUSD worth dynamics (Supply: Tradingview)

The Ethereum worth motion is approaching the apex of a big symmetrical triangle, seen on the day by day chart. ETH is at the moment priced at $2,623.83, with intraday highs extending to $2,646.02. The construction has been coiling since April, with worth constantly posting greater lows towards horizontal resistance — forming what seems to be an ascending triangle inside a broader consolidation section.

Quantity is rising progressively, and worth continues to carry above the Bull Market Help Band (20-week SMA and EMA), at the moment between $2,194.90 and $2,407.89. This construction reinforces the mid-term bullish thesis.

ETHUSD worth dynamics (Supply: Tradingview)

Good Cash Idea evaluation reveals a number of current CHoCHs and BOS confirmations close to $2,580–$2,600, including weight to the present breakout try. ETH can also be pushing by way of a minor liquidity pocket, suggesting provide absorption underway.

Why Ethereum Value Going Up Right this moment?

The reply to why Ethereum worth going up right now lies in bullish confluence throughout each worth construction and sentiment metrics.

ETHUSD worth dynamics (Supply: Tradingview)

On the 4-hour chart, ETH stays above all key EMAs (20/50/100/200), with the EMA20 at $2,574 performing as near-term dynamic assist. Bollinger Bands are increasing, with worth testing the higher band close to $2,633 which is an indication of accelerating momentum and volatility.

ETHUSD worth dynamics (Supply: Tradingview)

The weekly Fibonacci retracement locations ETH slightly below the 0.5 degree at $2,745, with assist confirmed close to the 0.382 retracement at $2,424. ETH has now printed its second consecutive inexperienced weekly candle above $2,500 — one other bullish sign.

ETHUSD worth dynamics (Supply: Tradingview)

Momentum indicators additionally assist the breakout case. The Cash Circulation Index (MFI) on the 4-hour chart is rising at 66.69, indicating sustained capital influx. The Chande Momentum Oscillator is above 50, exhibiting upward momentum is accelerating.

ETHUSD worth dynamics (Supply: Tradingview)

On the 15-minute chart, ETH seems to be forming an ascending wedge sample, with instant resistance close to $2,640. If bulls can break above this ceiling, the following check lies close to $2,685–$2,715, a zone marked by sturdy historic promoting stress.

Derivatives and Quantity Verify Uptrend Intent

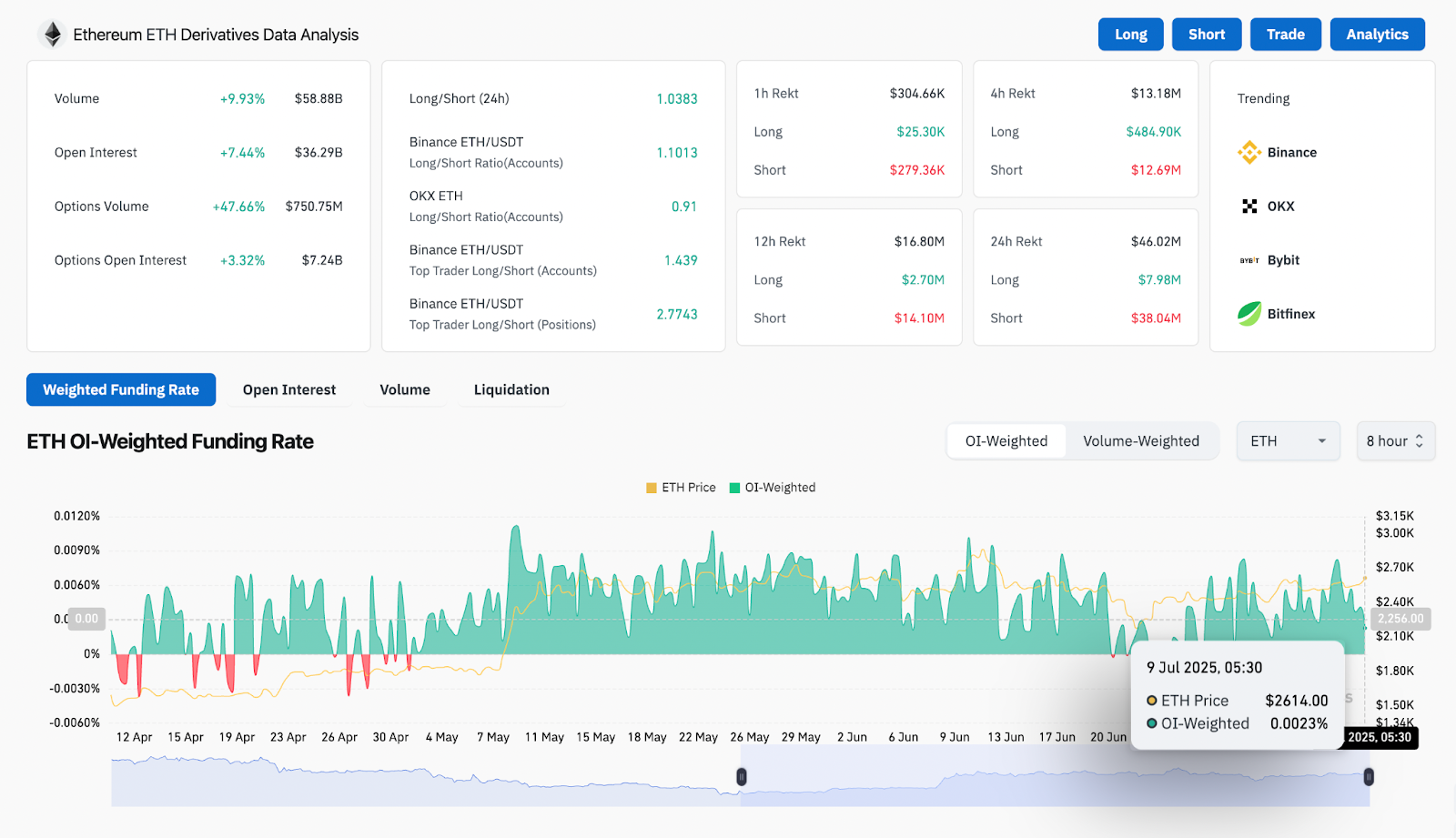

ETH Spinoff evaluation (Supply: Coinglass)

Derivatives knowledge additional highlights rising optimism. Ethereum open curiosity is up 7.44% to $36.29B, with choices quantity surging 47.66% to $750.75M. Each day quantity has elevated almost 10% to $58.88B. Binance prime dealer lengthy/brief ratios are above 2.77, exhibiting lengthy dominance.

The ETH OI-weighted funding price stays optimistic (0.0023%) as of July 9, confirming that longs are paying a premium to take care of place — a typical sign of bullish sentiment.

ETHUSD worth dynamics (Supply: Tradingview)

Moreover, ETH is buying and selling close to the median of its ascending pitchfork channel on the 4-hour chart. A clear break above the R3 pivot ($2,643.41) would align with the channel’s higher trendline, opening a path towards the following resistance band close to $2,715–$2,745.

Ethereum Value Prediction: Brief-Time period Outlook (24h)

Within the subsequent 24 hours, Ethereum worth shall be closely influenced by whether or not bulls can shut decisively above $2,640. If confirmed with quantity, the following resistance lies at $2,715 (R4) adopted by $2,745 (Fib 0.5). A breakout above that would goal for $2,852–$2,900.

On the draw back, if ETH fails to carry above $2,600, a retest of $2,574 (EMA20) and $2,510 (EMA100) is probably going. Beneath this zone, additional assist lies close to $2,424 (Fib 0.382) and $2,384 (former breakout base).

With momentum, funding, and market construction aligned, the near-term outlook stays bullish, however a rejection at $2,640 would delay the breakout and set off short-term consolidation.

Ethereum Value Forecast Desk: July 10, 2025

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.