Ethereum (ETH) has staged a powerful comeback in opposition to Bitcoin (BTC) at present. The important thing ETH/BTC chart, as highlighted in CoinEdition’s evaluation, has damaged a long-term downtrend after an enormous 48% rally.

Notably, Ethereum had damaged its all-time excessive, surging to almost $5,000 on Sunday. ETH climbed to $4,950, surpassing its earlier report of $4,867 set on November 8, 2021. This marks an vital milestone for ETH because it enters a worth discovery part, the place the asset reaches new highs with none resistance.

Ethereum’s comeback rally carefully follows Bitcoin’s fall in dominance to 57.91%, down from round 63% only a month in the past. Whereas Ethereum hit a brand new peak Sunday night, Bitcoin remained largely steady round $115,500—an 8% drop from its all-time excessive of $124,500.

$ETH/BTC has rallied 48.52% off the lows, breaking its macro downtrend and coming into an accumulation part. With $BTC dominance sliding to 57.91%, the setup mirrors previous cycles that triggered altcoin rallies.

The breakout confirms our earlier projection, #Ethereum power… https://t.co/FGqQBvQBfk pic.twitter.com/CYZJM39ovb

— Coin Version: Your Crypto Information Edge ️ (@CoinEdition) August 25, 2025

Analyst Miles Deutscher summarized the shift in market management succinctly, stating that “BTC is exhausted, and ETH isn’t.”

In different phrases, whereas Bitcoin’s rally has stalled close to latest highs, Ethereum is simply starting its momentum surge into uncharted territory.

Associated: Ethereum Leads a Market-Large Rally After Powell’s “Dovish” Jackson Gap Speech

Ethereum Is Not But Executed

This setup mirrors situations in previous market cycles the place Ethereum’s power marked the start of altcoin season.

Analysts level out this breakout confirms earlier projections that Ethereum may take the lead in driving the following wave of capital flows throughout the crypto market. Nevertheless, an enormous sell-off adopted shortly after Ethereum’s surge. The worth of ETH crashed again to $4,607 simply hours after surpassing $4,950, amid profit-taking stress.

Whereas this pullback has triggered some considerations, analysts like Ali Martinez imagine Ethereum is way from completed.

Huge Lengthy Positions on ETH as It Targets $15,000

This bullish sentiment is additional bolstered by new knowledge from Lookonchain, which exhibits that whales are more and more taking lengthy positions on Ethereum.

In a tweet, Lookonchain revealed that whale “0x31F9” deposited $15.47 million in USDC to the Hyperliquid platform to lengthy Bitcoin and purchase Ethereum. A follow-up put up revealed one other whale, “0x4174,” deposited $5.45 million to the identical platform to lengthy Ethereum with 20x leverage.

Extensively adopted dealer Machi Huge Brother can be reportedly lengthy on Ethereum with 25x leverage.

Machi Huge Brother(@machibigbrother) is presently lengthy $BTC(40x) and $ETH(25x) with max leverage.

Present positions:

15,300 $ETH($72M)

155 $BTC($17.5M)https://t.co/T0DJNDGd53 pic.twitter.com/6mebLf8szZ— Lookonchain (@lookonchain) August 25, 2025

Notably, many imagine Ethereum is on monitor to interrupt the $10,000 degree this yr. Business leaders like Tom Lee have set even larger targets, forecasting ETH to hit $15,000 by the tip of December.

Components Including to ETH Bullish Outlook

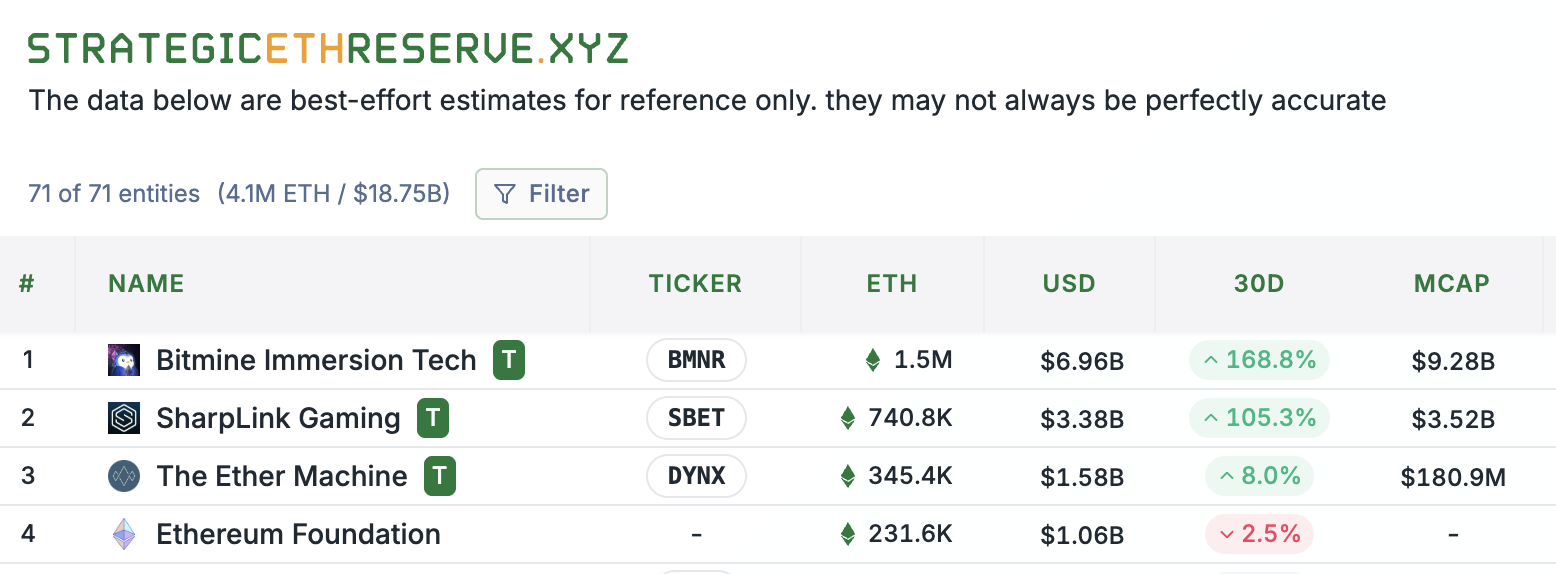

The bullish outlook for Ethereum is additional fueled by institutional curiosity. Corporations at the moment are shopping for ETH en masse to determine treasuries, much like the sooner pattern with Bitcoin.

Supply: StrategicETHReserve

Companies main this initiative embrace Bitmine Immersion Tech with $7 billion in ETH funding. Sharplink Gaming additionally has $3.43 billion in ETH, whereas The Ether Machine has $1.6 billion in ETH.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.