Whereas Ethereum (ETH) validators are unstaking their treasuries en masse, different teams are dashing into the ETH validation ecosystem. This imbalance would possibly sign about blended sentiment within the massive ETH wallets’ phase.

$7 billion caught in Ethereum (ETH) validator queue

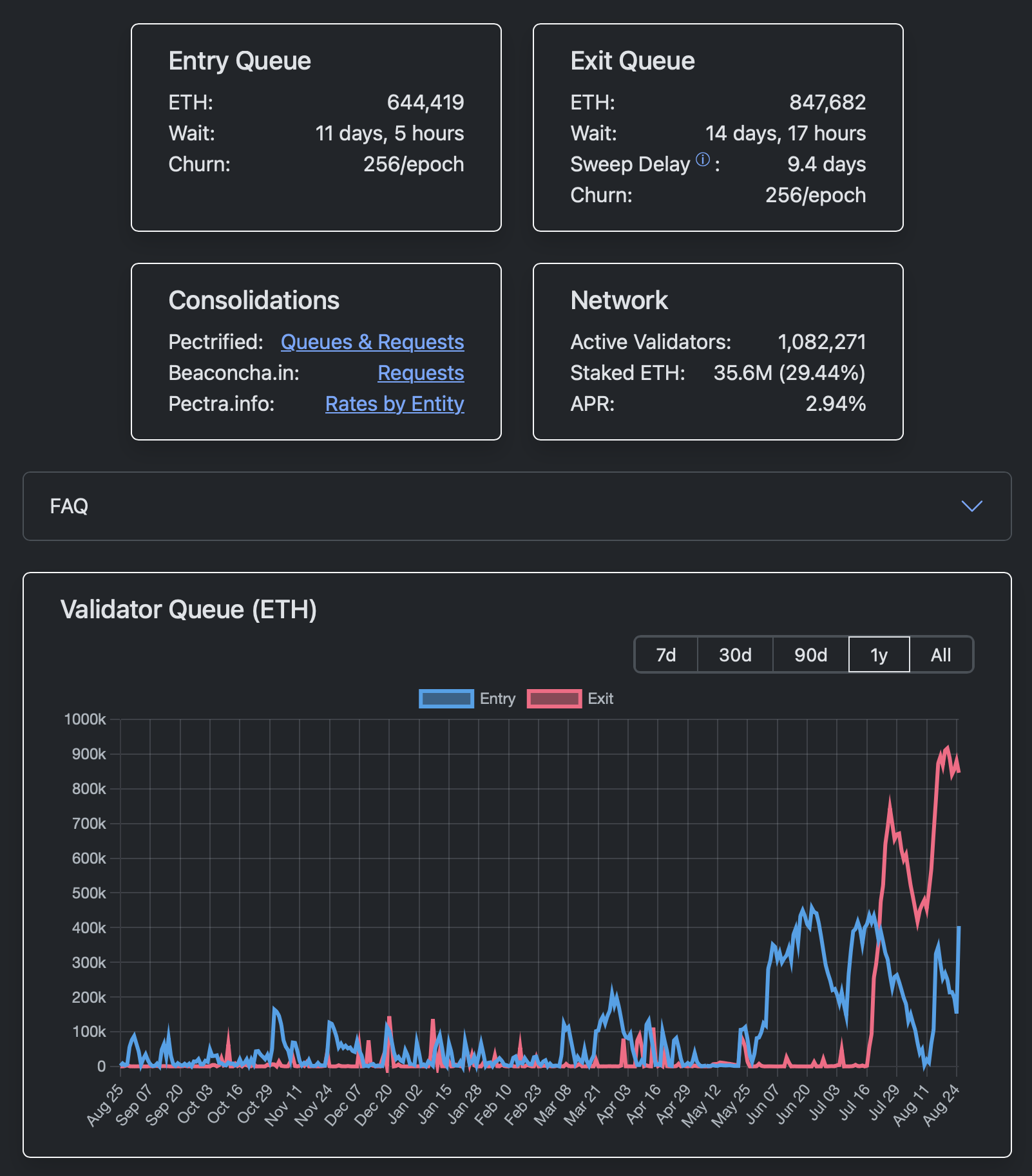

The Ethereum (ETH) validation entry queue — the listing of potential validators enthusiastic about staking their holdings as a way to get hold of periodic rewards — began quickly surging. In simply two days, it added over 400,000 ETH and hit a multi-month excessive over 644,000 Ethers.

Because of this, it takes over 11 days now to withdraw ETH allocations from staking. The final time such a rise in staking interval was noticed was over two months in the past.

On the identical time, the Ethereum (ETH) unstaking queue began to settle down following its peak on Aug. 20, 2025. After hitting an unbelievable 970,000 ETH, it has now dropped beneath 850,000 ETH.

In complete, about $7 billion in liquidity is ready to both be part of ETH staking mechanism or depart it. It indicators the blended expectations of enormous ETH market contributors.

Ethereum (ETH) group optimistic after debated ATH

The curiosity in withdrawing is most certainly related to the chance to repair income on the present worth stage. The curiosity in locking ETH on validators is, in contrast, a sign of rising optimism about its worth efficiency.

Because the ecosystem is saturated, Ethereum (ETH) staking annualized rewards dropped beneath 3% in comparison with the usually noticed 4%.

As coated by U.Right this moment beforehand, on some cryptocurrency exchanges, the Ethereum (ETH) worth reached its new all-time excessive final Friday.

On the identical time, CoinGecko and CoinMarketCap don’t affirm the earlier ATH from 2021 being smashed for the Ether worth.