Ethereum is navigating renewed volatility after weeks of relentless beneficial properties and bullish momentum. The world’s second-largest cryptocurrency surged to its highest ranges in years, however bulls are actually locked in a battle to defend the $4,200 mark. This worth level has emerged as an important short-term assist, with institutional patrons persevering with to build up ETH regardless of current turbulence in broader markets.

What stands out on this section is Ethereum’s trade influx exercise in comparison with Bitcoin. Over the previous month, the 2 belongings have displayed sharply totally different patterns. Whereas Bitcoin’s inflows have remained comparatively reasonable, signaling stability and restricted promoting stress, Ethereum has seen a major uptick in cash transferring onto exchanges.

This divergence suggests a extra dynamic market construction for Ethereum. Rising inflows might point out profit-taking by long-term holders, or repositioning by massive buyers making ready for volatility or upcoming catalysts within the ETH ecosystem. Nonetheless, institutional curiosity, alongside strengthening fundamentals akin to declining provide on exchanges, continues to assist Ethereum’s long-term outlook. Merchants now watch intently to see if ETH can maintain $4,200 and stabilize for an additional leg increased.

Bitcoin vs. Ethereum: Divergence in Trade Inflows

In keeping with on-chain knowledge from CryptoQuant, Bitcoin (BTC) and Ethereum (ETH) are displaying a transparent divergence in trade inflows, signaling very totally different dynamics at play available in the market. Bitcoin inflows have remained reasonable, fluctuating between 12,000 and 70,000 BTC per day.

Whereas there have been temporary spikes in mid-July and round August 1st, these actions haven’t endured lengthy sufficient to counsel a broader development. This steadiness implies that BTC holders should not speeding to exchanges, which reduces rapid promoting stress. It additionally reinforces the concept that sentiment round Bitcoin stays comparatively secure regardless of current volatility in worth motion.

Ethereum, nevertheless, is telling a unique story. Over the previous a number of weeks, ETH inflows have surged considerably, with every day trade inflows repeatedly climbing above 2 million ETH in mid-August and peaking close to 2.6 million ETH. This marks a pointy improve in comparison with late July, when inflows usually sat under 1.5 million ETH.

Such elevated exercise suggests large-scale repositioning amongst main holders or elevated profit-taking following ETH’s sturdy rally. The info highlights that Ethereum is getting into a extra lively buying and selling section, doubtlessly introducing short-term promoting stress that might affect worth path.

The divergence is placing: Bitcoin inflows counsel relative calm, whereas Ethereum inflows sign heightened market exercise. This imbalance means merchants ought to watch ETH intently, as sustained trade inflows might both spark a corrective pullback or function a stepping stone for a renewed rally, relying on how the market digests the extra liquidity.

Technical Particulars: Key Worth Ranges

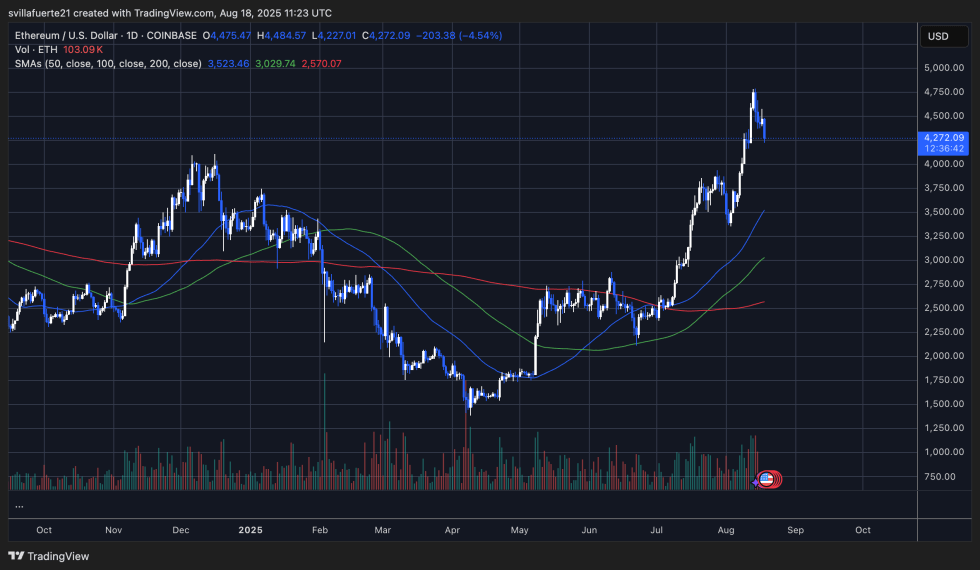

Ethereum’s current worth motion reveals a notable retracement following weeks of sturdy bullish momentum. After peaking close to $4,790, ETH has pulled again to round $4,272, reflecting an 11% decline. This transfer has introduced the value again towards a crucial assist zone at $4,200, the place bulls are at present trying to defend in opposition to additional draw back stress.

The chart highlights that Ethereum stays nicely above its key transferring averages (50, 100, and 200-day), that are all trending upward and reinforcing a broader bullish construction. Regardless of the sharp retracement, the longer-term development nonetheless favors patrons, as ETH has maintained increased highs and better lows since its reversal earlier this yr.

A breakdown under $4,200 zone might open the door to $3,800–$3,900, whereas a profitable protection might set the stage for an additional try on the $4,800–$5,000 area. Total, Ethereum’s chart continues to point out bullish power, although volatility stays excessive.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.