Ethereum (ETH) surged to its highest value in practically three years on Thursday, December 6, reaching $4,089.

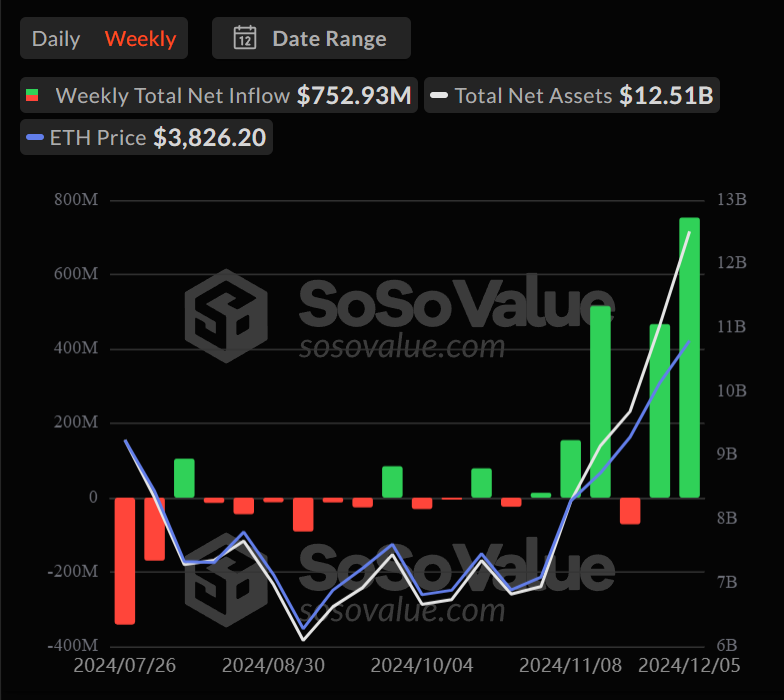

The rise follows important institutional curiosity, with US Ethereum ETFs seeing their largest single-day web influx of $428.4 million on December 5.

A Revival of Institutional Investments in Ethereum ETFs

Main the inflows was BlackRock’s ETHA fund, adopted by Constancy’s FETH. These contributions additionally pushed Ethereum ETFs to document their largest weekly web influx since launching in July.

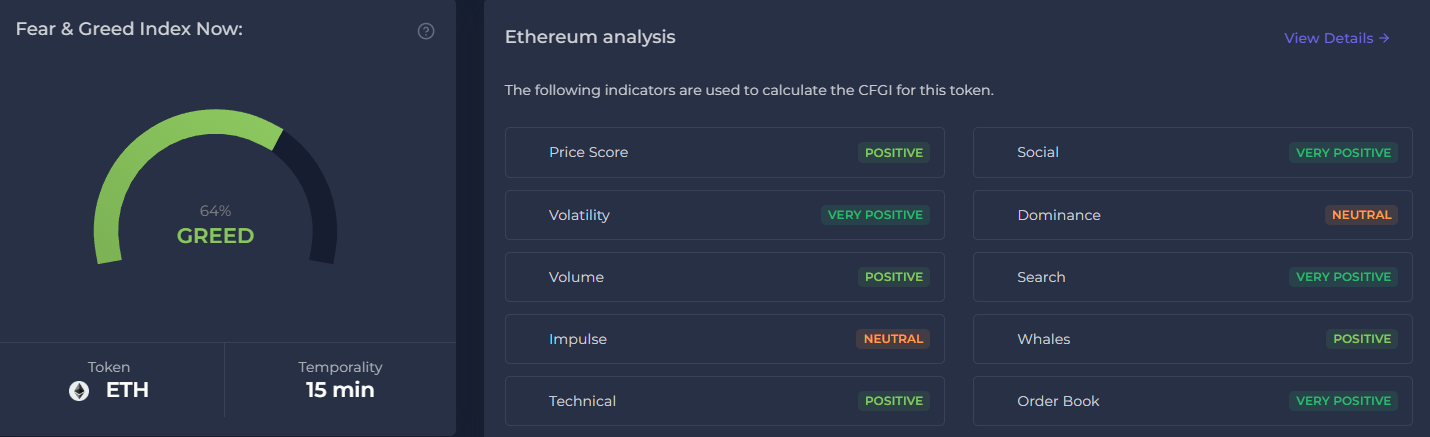

The whole weekly influx stands at $752.9 million within the first week of December. That is already a document weekly acquire for the funds, even with out the ultimate figures for Friday. This wave of institutional funding spurred Ethereum’s value development and shifted the worry and greed index to “greed,” at present at 65.

ETH Concern and Greed Index. Supply: CFGI

Ethereum ETFs have had a slower begin within the US in comparison with Bitcoin ETFs. The primary month of launch noticed just one week of optimistic influx. Presently, the entire property throughout 9 ETFs stand at $12.5 billion. This accounts for roughly 2.7% of Ethereum’s complete provide.

Nevertheless, November marked a turning level, with month-to-month inflows exceeding $1 billion, signaling rising institutional curiosity regardless of earlier outflows.

Ethereum ETF Internet Weekly Data from July to December 2024. Supply: SoSoValue

A notable improvement got here from the State of Michigan Retirement System (SMRS), which grew to become the primary US state pension fund to put money into an Ethereum ETF. SMRS now holds 460,000 Grayscale Ethereum shares and 110,000 ARK Bitcoin ETF shares as a part of its diversified crypto portfolio.

In the meantime, different altcoins are additionally getting into the ETF race. Corporations like VanEck, 21Shares, and Grayscale have filed for Solana ETFs. Additionally, WisdomTree and Bitwise are amongst 4 corporations in search of approval for XRP ETFs.

As US rules seem to undertake a extra crypto-friendly stance, the ETF marketplace for digital property is more likely to increase.