One of many largest publicly-traded Ethereum (ETH) treasury corporations, SharpLink Gaming, at this time introduced that it had raised $76.5 million in a direct inventory providing at a worth above market charge. A portion of the proceeds is probably going for use to purchase extra ETH.

SharpLink Raises $76.5 Million To Purchase Extra Ethereum

Based on an announcement made earlier at this time, SharpLink Gaming has entered right into a securities buy settlement with an unknown institutional investor for the acquisition and sale of 4.5 million shares of its frequent inventory.

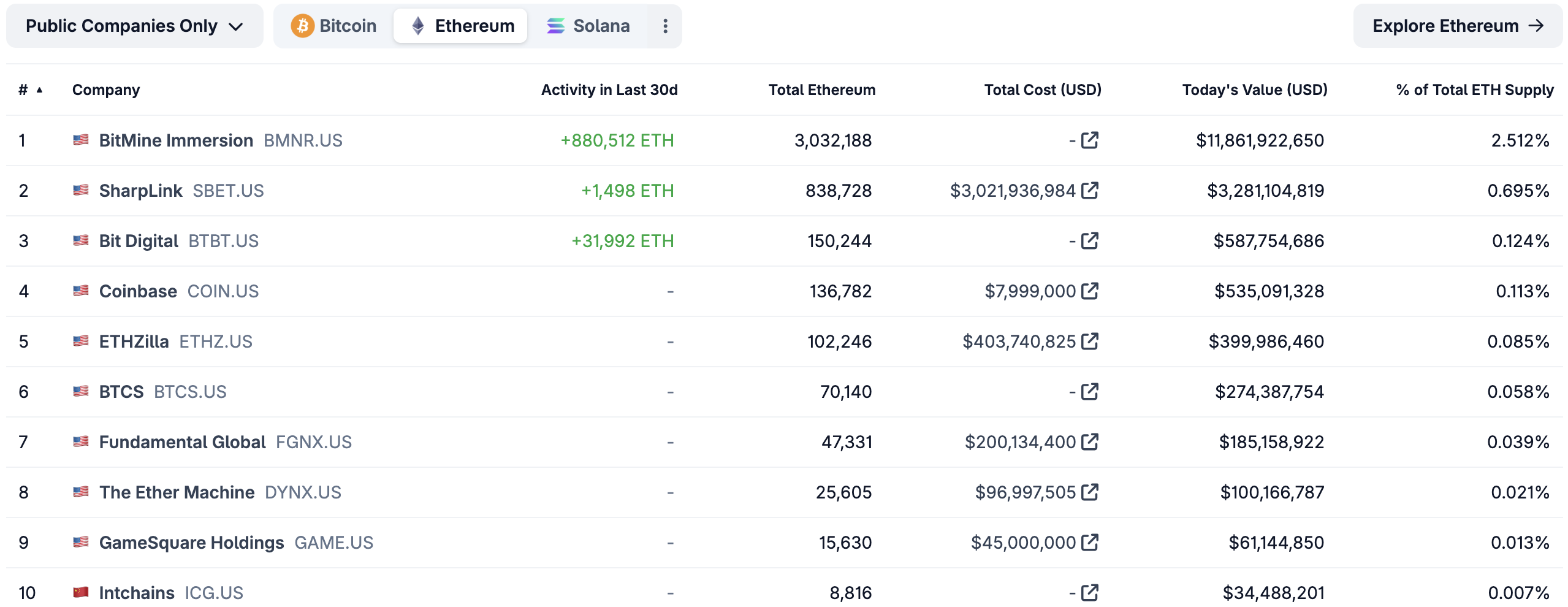

Notably, the Minneapolis-based agency said that it had offered shares for $17 per share, a 12% premium above its market charge of $15.5 recorded within the closing hours of buying and selling on October 15. Additionally it is at a premium to the Web Asset Worth (NAV) of the agency’s present holdings of 840,124 ETH.

The providing is predicted to shut on October 17, topic to satisfaction of customary closing circumstances. Commenting on the event, Joseph Chalom, co-CEO of SharpLink mentioned:

This can be a novel fairness sale transaction that’s each accretive to stockholders and strategically structured, reflecting sturdy institutional confidence in SharpLink and our long-term imaginative and prescient. By elevating fairness at a significant premium to each market worth and NAV, we’re capable of proceed accumulating ETH and growing ETH-per-share for our buyers.

He added that Ethereum adoption continues to develop amongst each retail and institutional buyers, throughout totally different verticals comparable to stablecoins, decentralized finance (DeFi), and tokenized property.

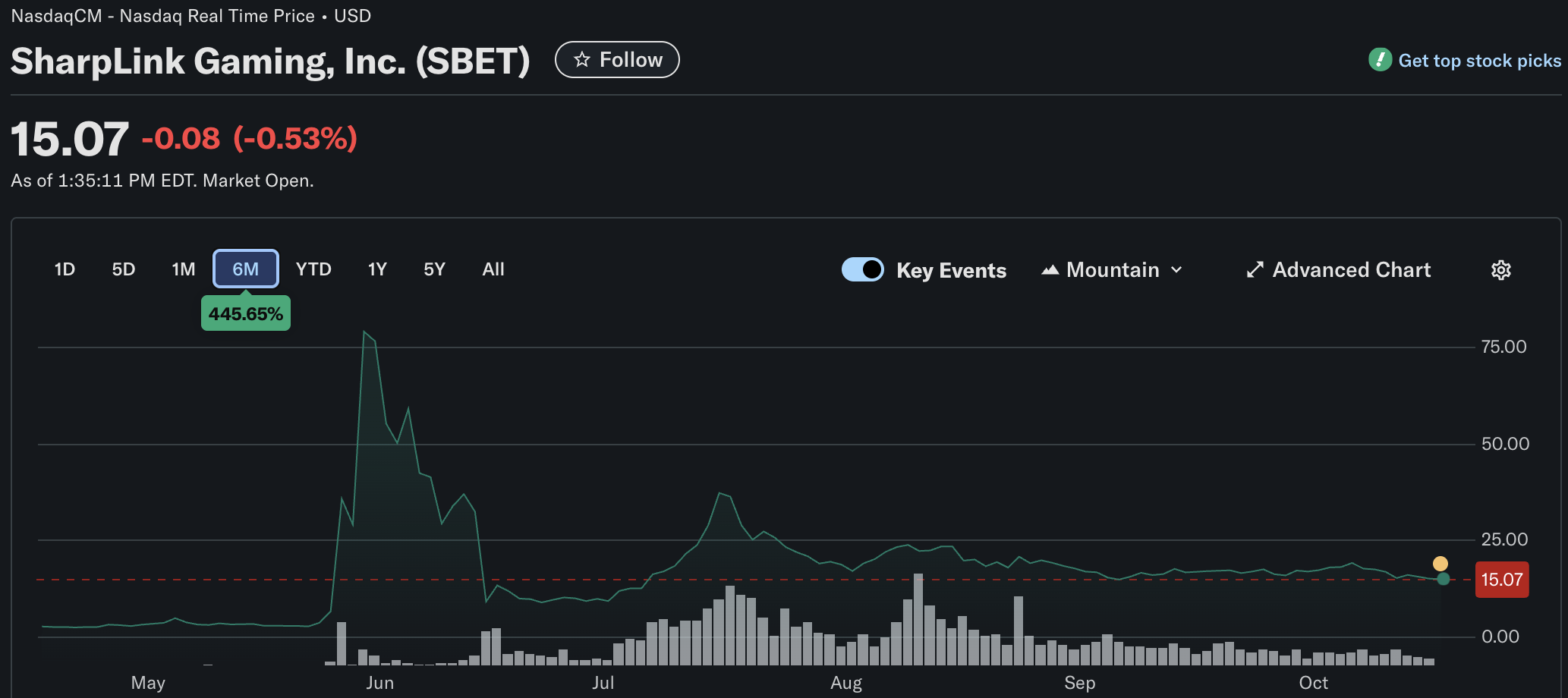

Following at this time’s announcement, SharpLink shares are barely down, buying and selling at $15.07 on the time of writing. Nevertheless, the shares are up a formidable 445% over the previous six months, largely pushed by a rise within the worth of ETH.

As talked about earlier, SharpLink is at the moment ranked second amongst publicly-traded corporations by way of the quantity of ETH held of their treasuries. BitMine Applied sciences continues to guide the pack, with greater than three million ETH on its stability sheet, based on information from Coingecko.

Is Crypto Treasury Nonetheless The Play?

The observe of firms growing crypto treasury methods has turn out to be more and more widespread over the previous few years. It picked up tempo following the victory of pro-crypto Donald Trump within the November 2024 US presidential election.

This development isn’t just restricted to main digital property like Bitcoin (BTC), or Ethereum, however firms are additionally exploring crypto treasury methods targeted on different altcoins comparable to Solana (SOL), Avalanche (AVAX), and Dogecoin (DOGE).

That mentioned, some warning indicators have the buyers doubting the advantages of a crypto-focused treasury technique on an organization’s funds. As an example, not too long ago, Metaplanet’s valuation fell under the worth of the overall BTC it holds on its stability sheet.

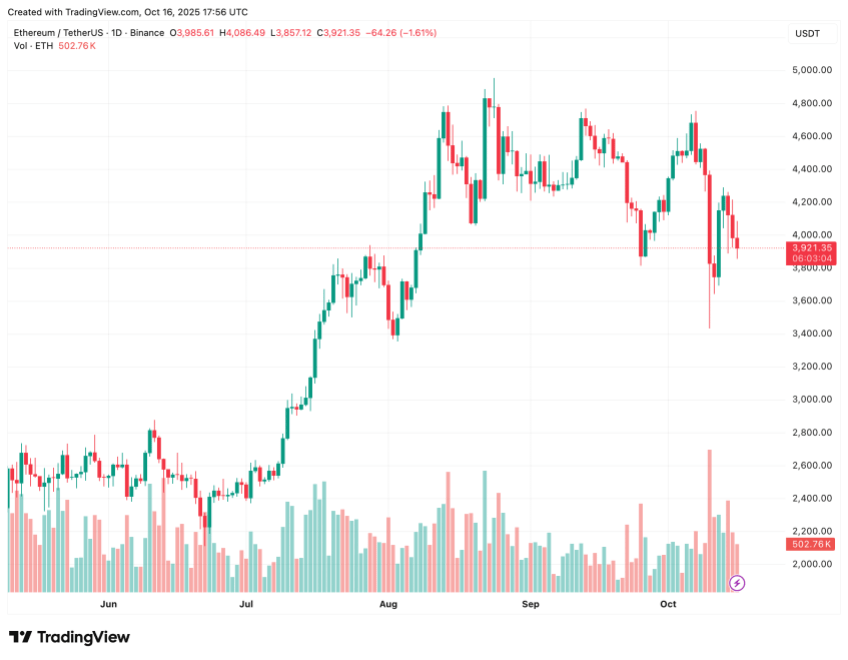

Equally, Michael Saylor’s Technique’s shares – the biggest publicly-listed agency on the planet by quantity of BTC held – have additionally proven poor efficiency over the previous few months. At press time, ETH trades at $3,921, down 1.7% previously 24 hours.

Featured picture from Unsplash.com, charts from Yahoo! Finance, Coingecko, and TradingView.com

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.