On Monday, ethereum could have survived a brutal sell-off, however indicators of a correct comeback are nonetheless hanging within the stability. With a present value of $4,172, a market cap of $503 billion, and a 24-hour buying and selling quantity of $48.60 billion, all eyes are on whether or not the current value flooring between $4,029 and $4,497 was the crypto equal of a panic assault—or only the start of a trendy rebound.

Ethereum

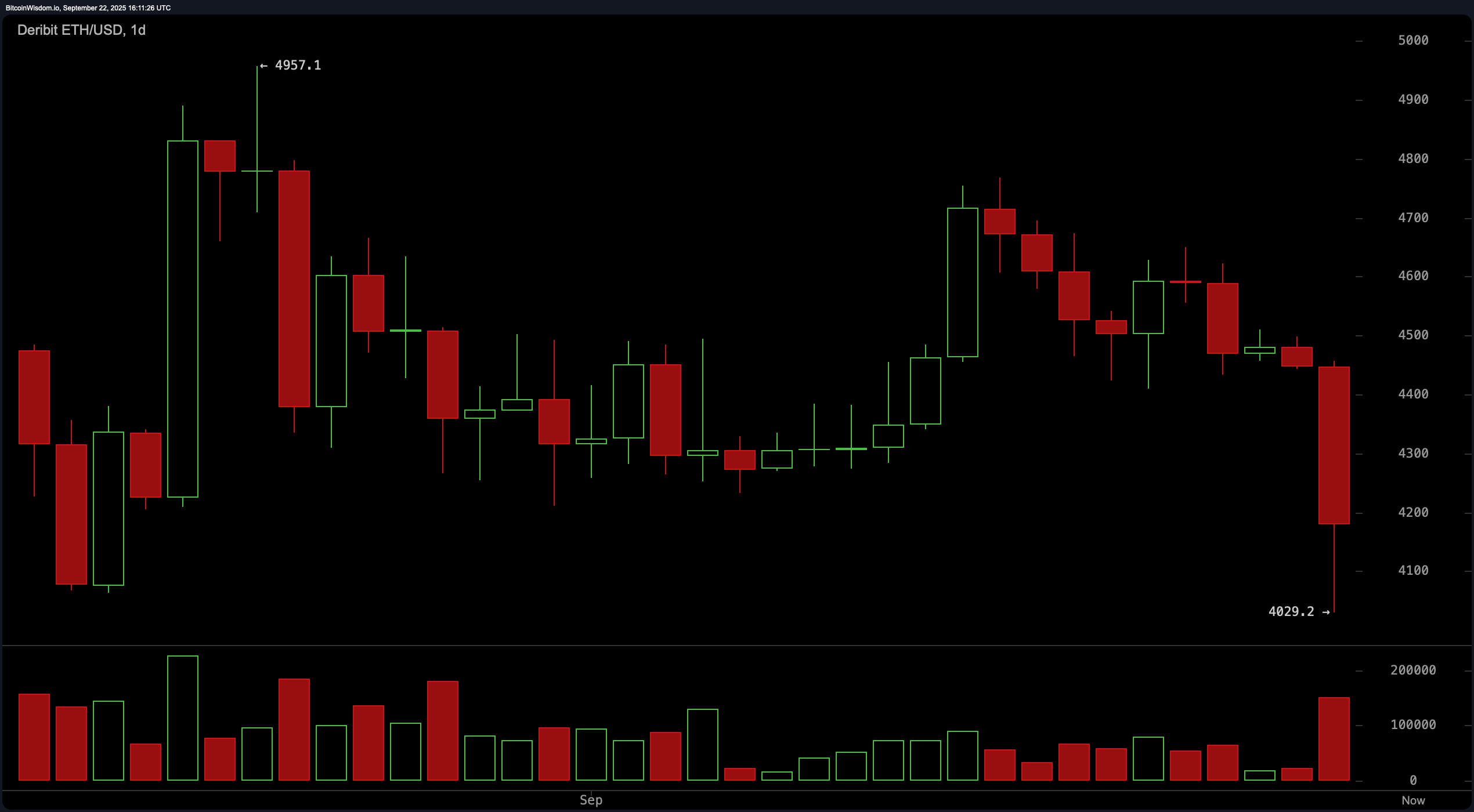

Let’s not sugarcoat it: the every day chart simply served up a traditional capitulation candle, full with a nosedive from roughly $4,600 to $4,029. Merchants noticed the life flash earlier than their portfolio as excessive quantity confirmed a real wave of panic promoting.

Help was yanked out like a rug beneath the $4,400 degree, but the tiny wick on the candle’s backside reveals somebody, someplace, noticed worth within the chaos. If ethereum needs redemption, it’ll must placed on a convincing present within the subsequent couple of candles. Good cash will anticipate value motion to rise above $4,300 earlier than taking the bait, with exit goals dancing across the $4,500 to $4,600 mark.

ETH/USD through Deribit on Sept. 22, 2025. 1-day chart.

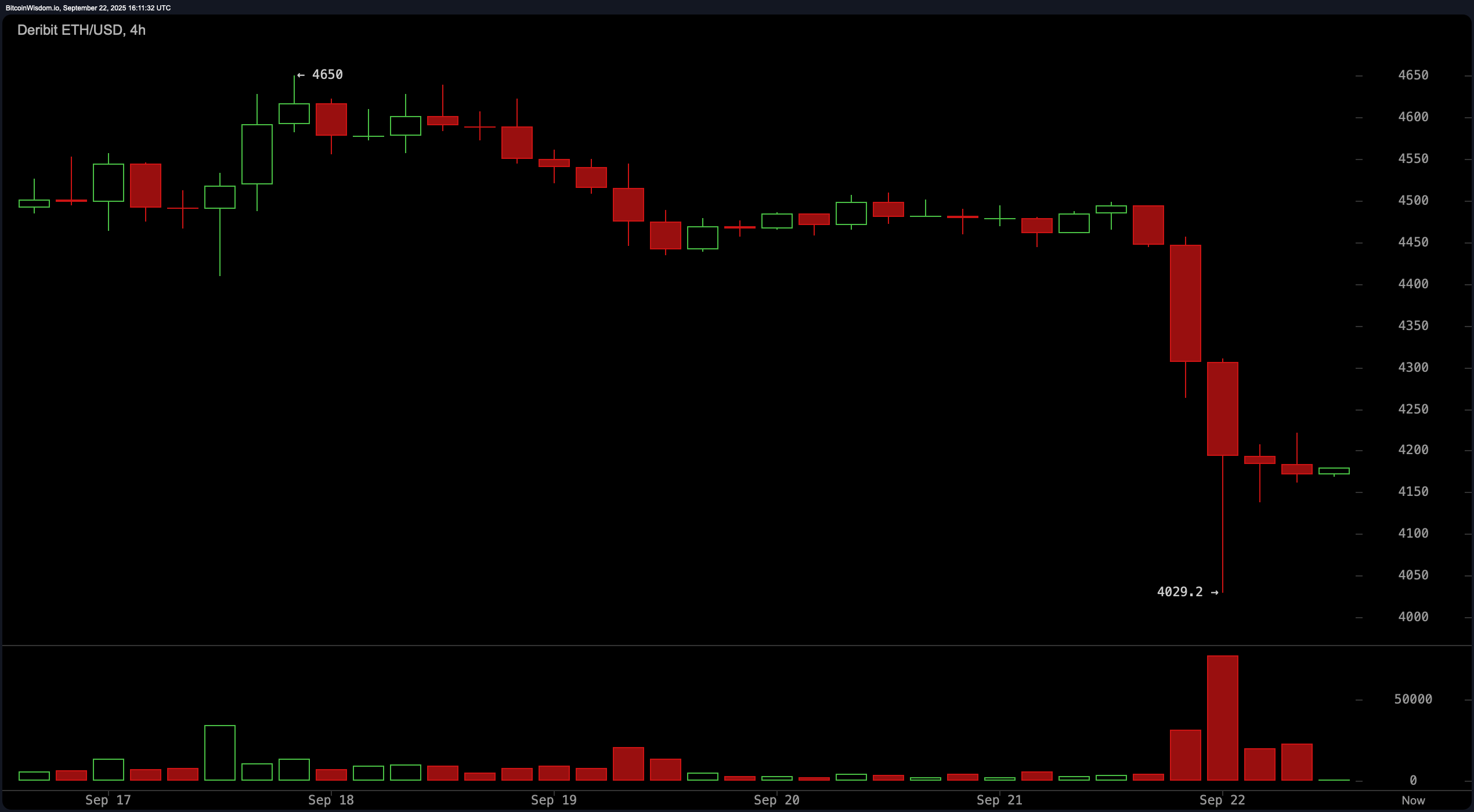

Zooming into the four-hour chart, the social gathering isn’t any livelier. ethereum suffered a breakdown from the $4,650 degree with purple candles lining up like dangerous selections at a Vegas roulette desk. Momentum has cooled, however not in a great way—it’s extra like your telephone dying mid-trade. Quantity spiked through the drop, traditional climax promoting habits. Bulls trying to hop again in ought to eye a break above $4,250 with quantity affirmation, and maintain a cautious eye on resistance ranges close to $4,500. Something beneath $4,050? Cue the trapdoor.

ETH/USD through Deribit on Sept. 22, 2025. 4-hour chart.

Now let’s speak hourly chart, the heartbeat monitor of the market. ethereum’s short-term pattern paints a story of heartbreak and hesitation. After peaking at round $4,498.70, it took a pointy nosedive and began loitering across the $4,150–$4,200 zone. A juicy quantity spike round $4,029 hints that the worst could be behind us—emphasis on may. If value can reclaim $4,250 with some quantity muscle, bulls might need a play. However don’t get cocky: $4,400 stands as a stonewall of resistance, and dips beneath $4,100 may flip optimism into remorse actual fast.

ETH/USD through Deribit on Sept. 22, 2025. 1-hour chart.

Let’s decode the key language of technical indicators—as a result of these oscillators and shifting averages? They’re whispering candy nothings, and none of them are bullish. The relative energy index (RSI) at 39.7, Stochastic at 31.3, the commodity channel index (CCI) at −126.2, common directional index (ADX) at 15.0, and Superior oscillator at 10.1 are all crying impartial, like they’re ready for another person to make the primary transfer. However momentum at −537.4 and the shifting common convergence divergence (MACD) degree at 23.8 have already RSVP’d “bearish.” Mainly, the temper is “meh,” with a splash of “yikes.”

And eventually, the shifting averages are performing like they’ve seen sufficient. All of the quick to mid-range indicators—exponential shifting common (EMA) and easy shifting common (SMA) from 10 to 50 durations—are flashing adverse alerts. Solely the long-haul indicators, just like the 100- and 200-period EMAs and SMAs, are holding up the bullish banner. Translation: short-term momentum remains to be caught in reverse, however the long-term pattern isn’t dropping out simply but.

In abstract? ethereum is licking its wounds, and whereas there are glimmers of potential for a rebound, the charts demand persistence. Until the worth begins stacking increased highs and better lows, particularly on decrease timeframes, the bears nonetheless have the louder voice.

Bull Verdict:

If ethereum holds above $4,150 and confirms a breakout above $4,250 with quantity, a short-term rally towards $4,500 isn’t off the desk. The long-term shifting averages nonetheless assist an uptrend, suggesting the bulls may regain management—if momentum shifts quickly.

Bear Verdict:

Regardless of indicators of capitulation, ethereum’s technical indicators and shifting averages stay largely bearish within the quick time period. With no confirmed reversal and a break above key resistance ranges, this might simply be a dead-cat bounce earlier than one other leg down.