Ethereum (ETH) is up greater than 58% within the final 30 days, with almost 40% of that surge taking place in simply the previous 10 days. Regardless of this sharp rally, a number of key indicators are beginning to flash warning.

BBTrend has turned adverse, whale accumulation is declining, and short-term EMA momentum is stalling. These indicators counsel Ethereum could also be approaching a vital level the place renewed shopping for strain is required to maintain its uptrend—or threat a possible reversal.

Ethereum BBTrend Turns Damaging After Month-Lengthy Surge

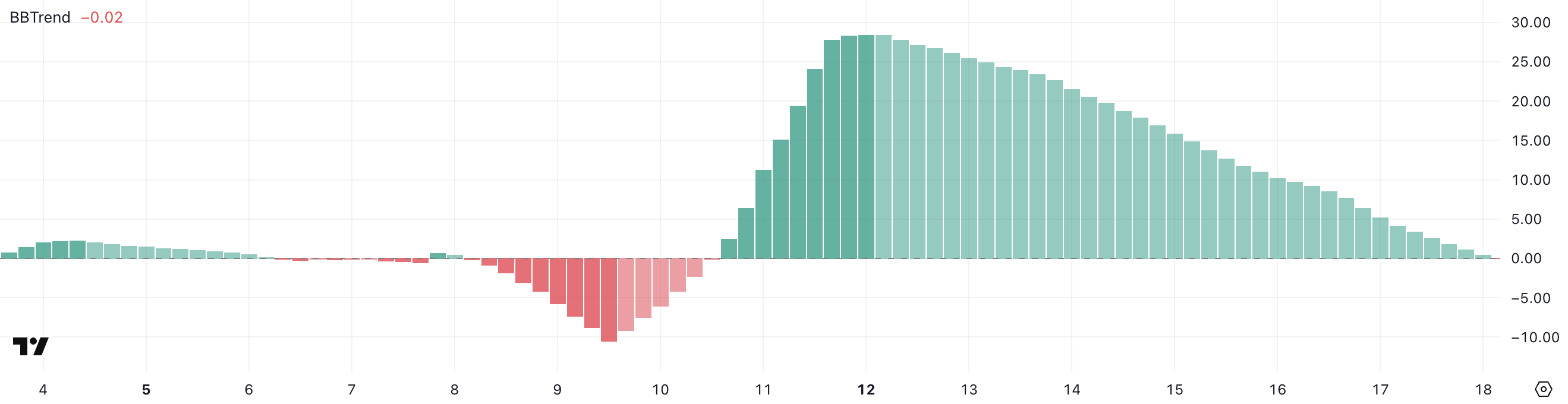

Ethereum’s BBTrend has simply dipped into adverse territory, now sitting at -0.02 after sustaining a constructive development for about seven consecutive days.

This shift follows a powerful peak of 28.39 on Could 12, signaling the top of the bullish part.

The transfer under zero comes after Ethereum surged 58.5% over the previous month, elevating questions on whether or not the asset is coming into a consolidation interval or dealing with early indicators of a pullback.

ETH BBTrend. Supply: TradingView.

The BBTrend, or Bollinger Band Pattern, measures value momentum relative to volatility by assessing how far value strikes deviate from their common inside the Bollinger Bands.

When BBTrend values are constructive, it usually signifies bullish momentum, whereas adverse values counsel the market could also be shedding power or coming into a bearish part.

With ETH’s BBTrend now barely under zero, it might sign waning shopping for strain after the current rally. If this development continues downward, Ethereum’s value may stall or retrace as merchants shift to a extra cautious stance.

Ethereum Whale Rely Falls Beneath Key Stage for First Time Since April 9

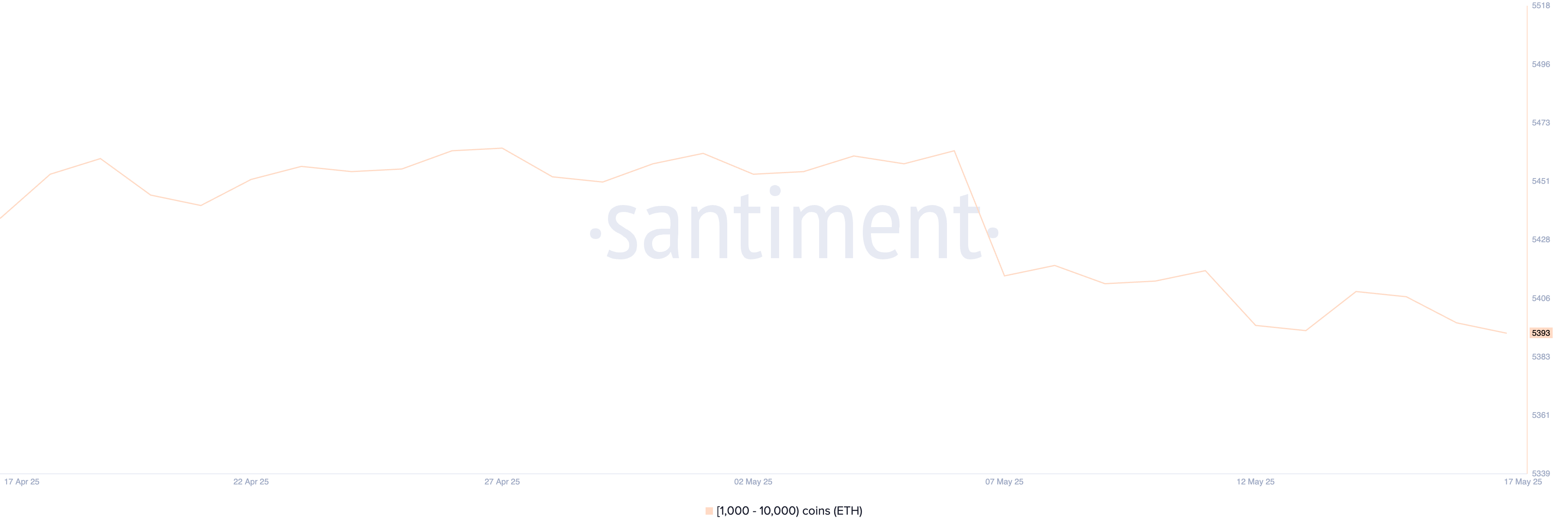

Ethereum whale exercise is displaying indicators of decline after weeks of stability. Addresses holding between 1,000 and 10,000 ETH—categorized as Ethereum whales—had remained above 5,440 since mid-April, reaching 5,463 on Could 8.

Nonetheless, over the previous 10 days, this quantity has been step by step falling, regardless of minor fluctuations.

As of now, it sits at 5,393, marking the primary time it has dipped under 5,400 since April 9—an necessary psychological and historic help stage for giant holders.

Ethereum Whales. Supply: Santiment.

Monitoring Ethereum whales is essential as a result of these addresses typically act as market movers as a result of dimension of their holdings. When whale numbers rise, it sometimes indicators accumulation, reflecting confidence and long-term positioning.

Conversely, a decline might counsel distribution, profit-taking, or warning amongst main gamers.

The current drop may suggest decreased conviction from massive traders following ETH’s robust rally, doubtlessly resulting in elevated volatility or a cooling-off interval in value momentum.

That comes at a time when some analysts are mentioning that ETH may overtake BTC and others are questioning whether or not ETH continues to be a very good funding in 2025.

ETH Struggles Close to $2,700—Can Bulls Reclaim $3,000?

Ethereum’s EMA (Exponential Shifting Common) traces stay bullish, with short-term EMAs positioned above long-term ones.

Nonetheless, momentum seems to be slowing, because the short-term traces have flattened and the hole between them is narrowing. This sample typically indicators a possible shift in development, particularly if consumers fail to regain management.

Whereas the general construction continues to be constructive, the lack of upward momentum introduces short-term uncertainty.

ETH Worth Evaluation. Supply: TradingView.

ETH value has struggled to interrupt key resistance ranges at $2,741 and $2,646 over the previous few days.

With out renewed shopping for strain, the asset might fail to reclaim the psychological $3,000 mark—a stage it hasn’t touched since February 1.

If promoting strain will increase, Ethereum may revisit help at $2,408. A breakdown there may set off additional losses, with $2,272 and $2,112 performing as the subsequent important help zones.