Ethereum (ETH) has rallied previous the $3,600 resistance for the primary time in about 5 months, however technical indicators recommend a cautious strategy for the second-ranked digital asset by market cap.

The most recent Ethereum upside momentum was partly pushed by elevated capital flowing into the asset’s exchange-traded fund (ETF), alongside a surge in open curiosity and futures premium.

Now, the Ethereum rally is going through its first main take a look at because the ETH/BTC pair approaches a crucial resistance zone dubbed the ‘hassle space’ round 0.04615 BTC, which might act as a robust ceiling, probably resulting in a worth rejection, in accordance with an outlook shared by outstanding pseudonymous crypto buying and selling knowledgeable CrediBULL in an X publish on November 28.

Ethereum will possible kind a decrease excessive if this rejection is confirmed, which might drive ETH into its weekly demand zone.

The knowledgeable famous that the value motion is intently tied to Bitcoin’s (BTC) efficiency, suggesting {that a} broader market pullback might amplify Ethereum’s downward transfer, pushing it towards the important thing $2,700–$2,800 purchase zone.

This degree, marked by sturdy demand, is seen as a main re-entry alternative for merchants seeking to capitalize on a possible restoration.

“Spot holders can maintain until new highs and ignore this decrease TF PA imo, however for merchants the 2700-2800 zone is the place I’m fascinated about doing enterprise at this stage, if we get it,” the analyst famous.

Ethereum’s bullish outlook

Regardless of this warning, one other projection by cryptocurrency buying and selling analyst Ali Martinez provided a dissenting opinion, stating that the latest Ethereum breakout positions the decentralized finance asset for a goal of $10,000.

In an X publish on November 28, Martinez set ETH’s short-term goal at $6,000, with the $10,000 projection as a long-term worth forecast.

His projection is predicated on Ethereum’s technical construction, which reveals the asset continues to commerce inside a robust ascending channel.

The outlook aligns with the $8,000 set by one other buying and selling knowledgeable, Alan Santana, who set the same goal.

Ethereum’s rally was backed by $40.6 million in internet inflows into its ETF on November 26, marking three consecutive days of optimistic exercise across the asset.

This influx contrasts with Bitcoin ETFs, which have faltered lately, a shift attributed to attainable modifications in investor sentiment amid anticipation of the beginning of the altcoin season.

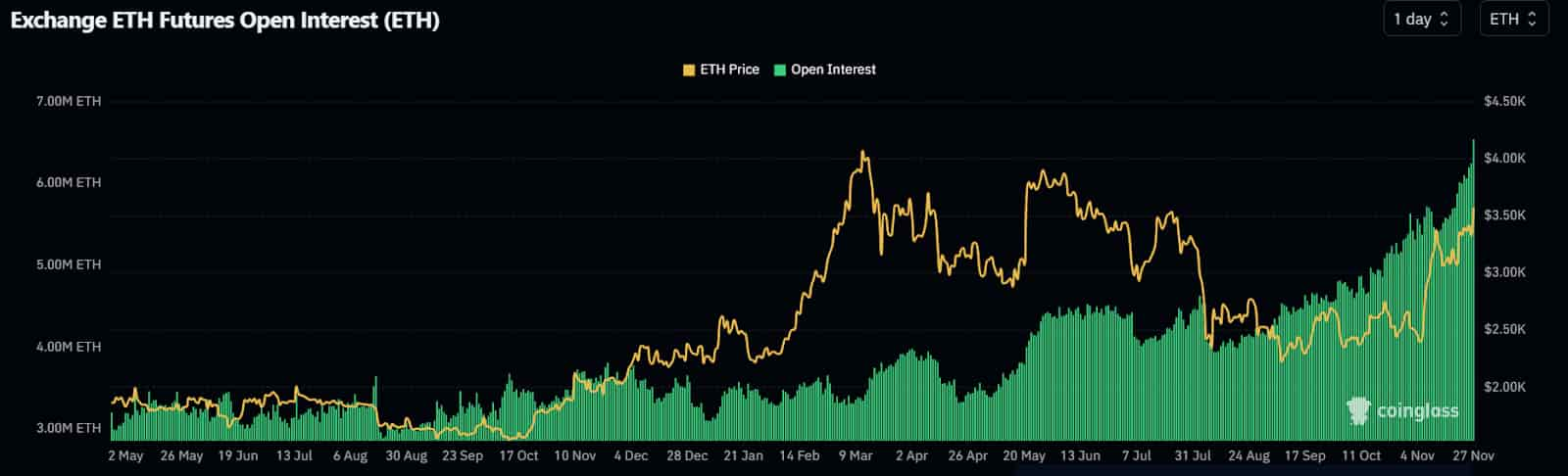

Additional supporting the bullish narrative across the cryptocurrency, Ethereum open curiosity (OI) hit a file 6.55 million ETH, valued at $23.34 billion, on November 27, as extra buyers confirmed confidence within the asset.

Ethereum worth evaluation

Ethereum was buying and selling at $3,608 by press time, reflecting a worth development of just about 6% within the final 24 hours. The weekly chart highlights the magnitude of ETH’s latest breakout, with the asset gaining over 15% through the timeframe.

As issues stand, Ethereum is usually bullish. If this momentum is sustained, the asset will possible contact the $4,000 resistance zone. This goal stays attainable, contemplating ETH is buying and selling above the 50-day and 200-day easy transferring averages, confirming a robust upward development.

Nonetheless, Ethereum is in overbought territory with a 14-day relative power index (RSI) of 70, signaling a attainable worth consolidation or pullback could possibly be on the playing cards. Buyers ought to stay cautious of a possible dip under $3,000.

Featured picture by way of Shutterstock