Ethereum’s value has slipped almost 5% after hitting a brand new all-time excessive of $4,946 earlier right this moment.

Abstract

- Ethereum value has cooled off after hitting an all-time excessive on Aug. 25.

- Historic knowledge means that September may very well be bearish for ETH.

- Technicals painting a contrasting outlook as ETH trades inside an ascending channel on the each day chart.

In line with knowledge from crypto.information, Ethereum (ETH) value rallied over 21% to hit a brand new all-time excessive of $4,946 on Aug. 25 earlier than settling down at $4,713 as of press time. At this value, it stays 26% above because the starting of August and 220% from its year-to-date low.

Regardless of the sturdy positive factors posted by the main altcoin by market cap in August, historic knowledge means that the upcoming month might possible be bearish for it.

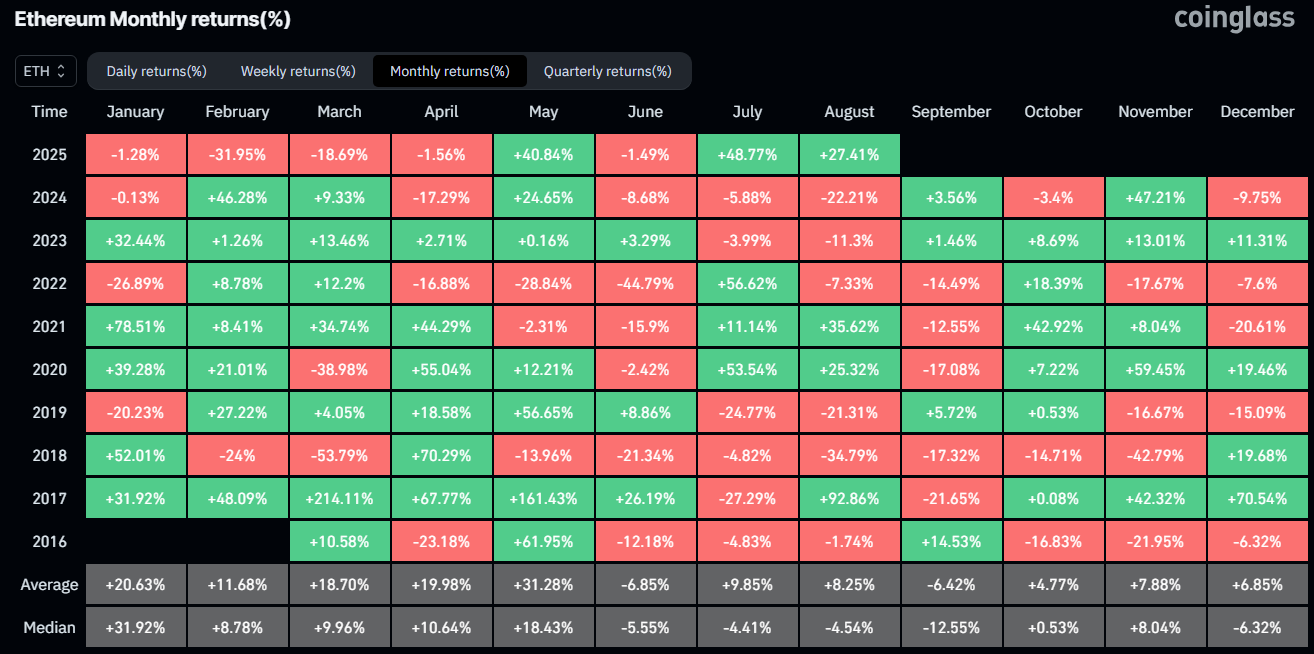

A take a look at knowledge from CoinGlass exhibits that since 2016, every time Ethereum recorded positive factors in August, it was adopted by a decline in September. Extra particularly, ETH posted positive factors of 92.86%, 25.3%, and 35.6% in August of 2017, 2020, and 2021, whereas the respective Septembers recorded declines of 21.65%, 17.08%, and 12.55%.

ETH month-to-month value positive factors | Supply: CoinGlass

Such a situation is additional supported by the truth that ETH stays near its all-time excessive ranges. Cryptocurrencies sometimes are likely to face some sell-off after hitting a brand new peak, as early buyers start to guide earnings.

You may additionally like: Vitalik Buterin makes use of FOCIL framework to reaffirm Ethereum’s impartiality

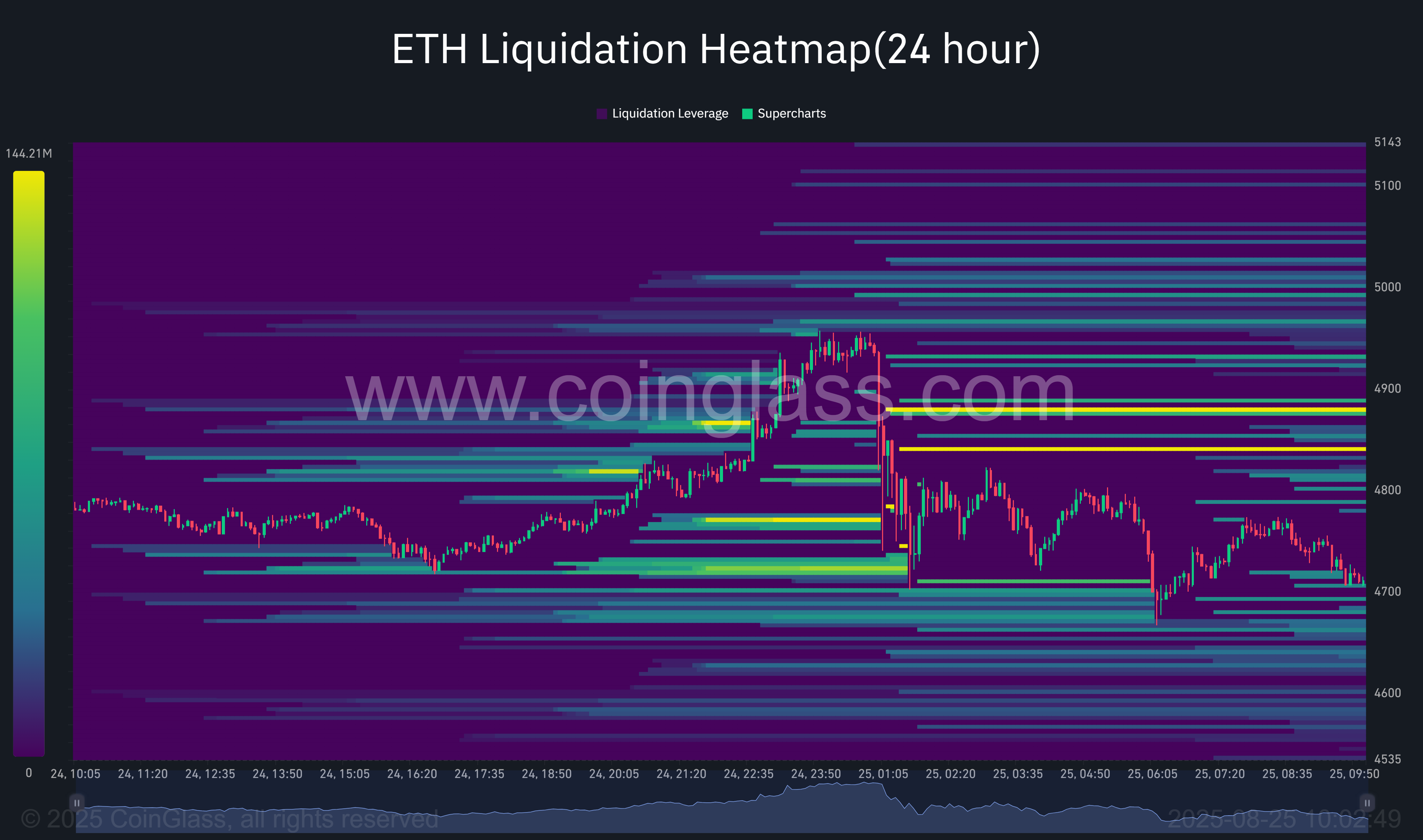

In the meantime, knowledge from CoinGlass exhibits that Ethereum’s sharp drop from its new excessive was triggered by a wave of lengthy liquidations, as overleveraged positions had been flushed close to the highest. Prior to now 24 hours, whole liquidations for ETH stood at $216 million, with almost $130 million coming from lengthy positions.

ETH liquidation knowledge | Supply: CoinGlass

As of press time, dense liquidation zones stay clustered above $4,900. Any renewed try to interrupt increased might spark one other liquidation cascade. If this happens, ETH could slip additional towards the $4,600–$4,680 vary.

Nonetheless, in contrast to in earlier cycles, Ethereum might enter the approaching September underneath a distinct macro setting, one marked by the presence of spot Ether ETFs and company treasuries holding ETH, each of which had been absent throughout previous August rallies.

The nine-spot Ether funds have attracted $2.79 billion in inflows in August, following $5.43 billion within the earlier month, reflecting sturdy demand for Ether amongst institutional buyers. This stands in distinction to their Bitcoin counterparts, which have seen outflows totaling $1.19 billion this month.

Including to the shift in market dynamics, Ether has emerged as some of the carefully watched crypto belongings this month, bolstered by regulatory momentum, and a wave of company accumulation.

On the each day chart, Ethereum has been buying and selling inside an ascending parallel channel since late June, characterised by increased highs and better lows inside two upward-sloping trendlines. This construction sometimes alerts a continuation of the prevailing bullish development, offered value stays confined inside the channel.

Ethereum value kinds an ascending parallel channel on the each day chart — Aug. 25 | Supply: crypto.information

As of press time, Ethereum was consolidating close to the midline of the channel, suggesting a interval of equilibrium between shopping for and promoting stress. Notably, the token continues to commerce above the 20-day exponential transferring common, an indication that short-term momentum stays in favor of the bulls.

Moreover, the Supertrend indicator has flipped inexperienced and positioned itself beneath the value, providing one other bullish affirmation.

In the meantime, the Relative Power Index has dropped to a studying of 60, indicating that bullish momentum persists, however with out getting into overbought territory. This means that Ethereum nonetheless has room to advance earlier than dealing with purchaser exhaustion.

Ethereum MACD chart — Aug. 25 | Supply: crypto.information

If bullish momentum continues, the subsequent main upside goal lies at $5,200, which represents a ten% acquire from the present degree and marks the higher boundary of the channel. A breakout above this degree might speed up additional positive factors, significantly if accompanied by sturdy quantity.

On the draw back, rapid assist is discovered at $4,349, a degree that aligns with the 78.6% Fibonacci retracement of the newest upward swing.

A break beneath this degree would invalidate the present sample and will set off a deeper correction towards the decrease boundary of the channel.

Learn extra: Ethereum approaches ‘Hazard Zone,’ but on-chain metrics shine

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.