Glassnode knowledge may indicate Ethereum value dynamics are extra influenced by derivatives and different off-chain markets in comparison with Bitcoin.

CBD Information Reveals Divergence In Spot Exercise For Bitcoin & Ethereum

In a brand new put up on X, on-chain analytics agency Glassnode has talked about how the Price Foundation Distribution (CBD) has diverged between Bitcoin and Ethereum lately.

The CBD refers to an indicator that tells us in regards to the quantity of a given asset that addresses or buyers on the community final bought at every of the worth ranges visited by the cryptocurrency in its historical past.

This metric is helpful as a result of buyers put particular emphasis on their break-even stage and have a tendency to make some sort of transfer when a retest of it happens. The extra quantity of the asset that the holders bought at a specific stage, the stronger is their response to a retest.

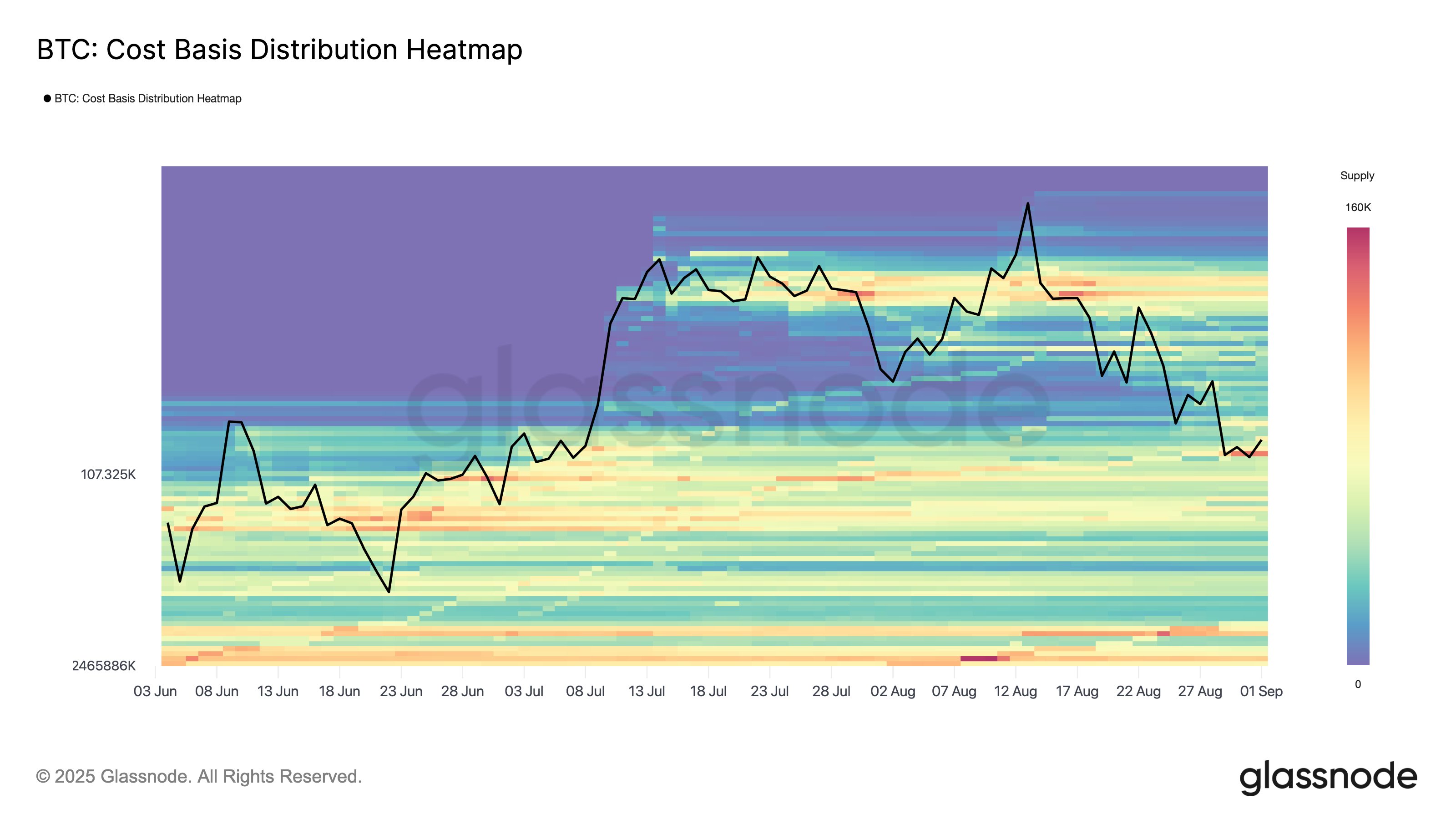

Now, first, here’s a chart that reveals the development within the CBD for Bitcoin over the previous couple of months:

Appears like BTC is presently retesting a significant demand zone | Supply: Glassnode on X

As displayed within the above graph, the Bitcoin CBD acquired a big “air hole” when Bitcoin noticed its explosive rally again in July. This occurred as a result of BTC moved via value ranges too quick for getting and promoting to happen at them, so only a few cash have been in a position to obtain a value foundation at them.

As BTC consolidated after the rally cooling off, ranges began being stuffed up with provide. The identical has adopted through the newest part of decline and now, the earlier air hole has disappeared. This reveals that demand for spot buying and selling has maintained for the cryptocurrency.

Whereas Bitcoin has seen this development, the CBD has behaved in a different way for the second largest asset within the sector, Ethereum.

How the CBD has modified for ETH over the previous few months | Supply: Glassnode on X

From the chart, it’s obvious that Ethereum’s rallies have additionally created air gaps, however not like Bitcoin, its phases of slowdown haven’t resulted in any ranges filling as much as a notable diploma. “This implies ETH value dynamics could also be extra influenced by off-chain markets akin to derivatives,” notes Glassnode.

Traditionally, value motion constructed on merchandise like derivatives has usually confirmed to be extra risky. On condition that Ethereum is presently not observing any excessive ranges of spot shopping for, it solely stays to be seen what the destiny of its bull run could be.

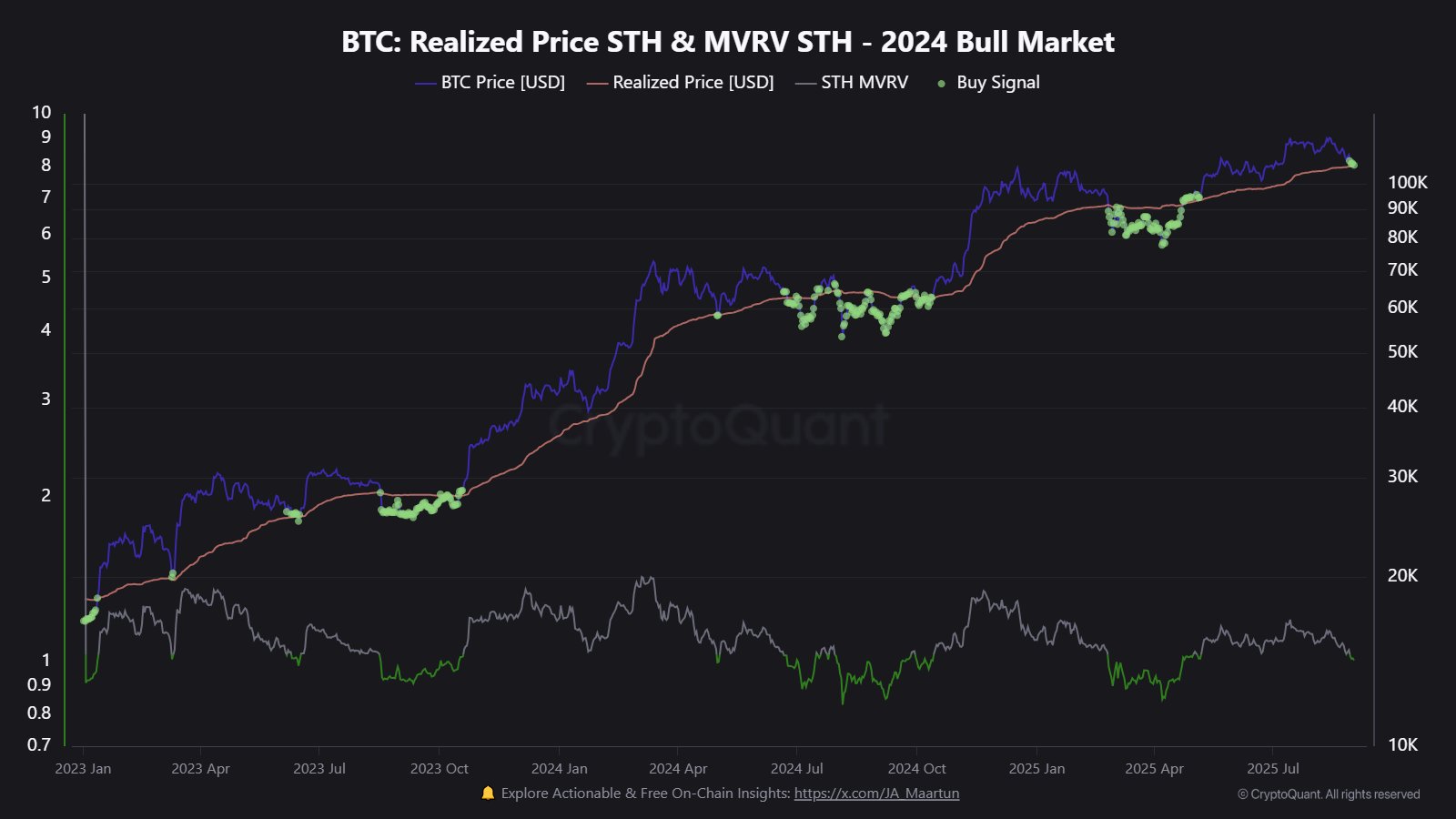

In another information, Bitcoin has been buying and selling close to an vital on-chain price foundation stage after the current value decline, as CryptoQuant writer Maartunn has identified in an X put up.

The development within the Realized Value of the BTC short-term holders | Supply: @JA_Maartun on X

The extent in query is the common price foundation of the short-term holders, buyers who bought their Bitcoin inside the previous 155 days. Up to now, shedding the extent usually resulted in short-term shifts to bearish phases.

ETH Value

Ethereum has been on the best way down lately with its value falling to $4,270 after a 6% weekly pullback.

The value of the coin seems to have gone down lately | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, Glassnode.com, chart from TradingView.com

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.