Ethereum has skilled a exceptional surge in value, up 60% over the previous month, reaching $2,543. This rally is essentially pushed by important accumulation by traders, totaling 1.34 million ETH value over $3.42 billion.

Regardless of the expansion, some important traders are starting to exit, aiming to safe their income earlier than potential dangers come up.

Ethereum Traders Gobble Up Provide

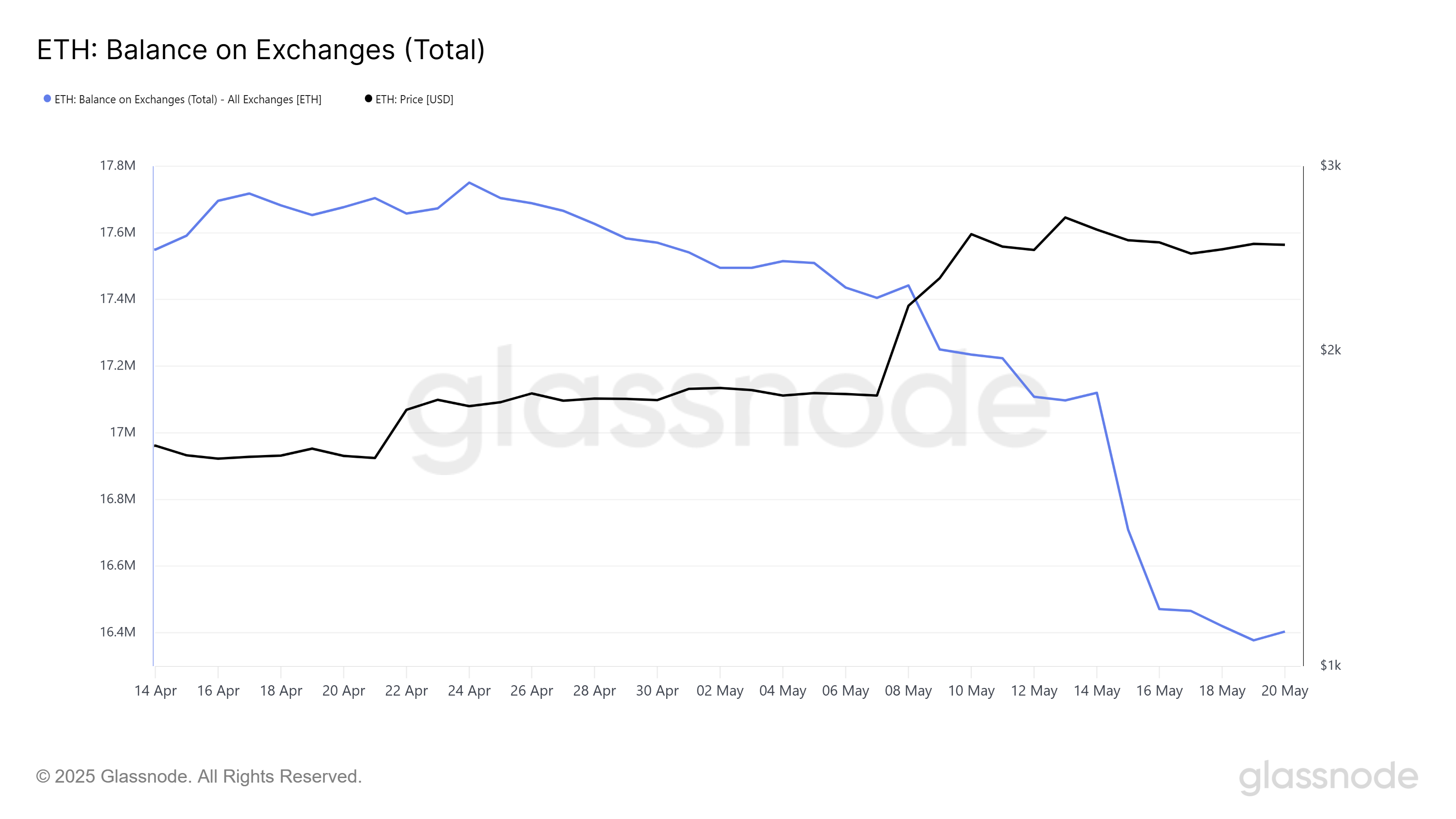

Ethereum’s steadiness on exchanges has dropped by 1.34 million ETH previously month (April 21 to Could 21), marking a big shift in market circumstances. This provide discount is valued at over $3.42 billion and is essentially as a result of Pectra improve, which has boosted investor confidence in Ethereum’s long-term progress.

The drop in trade provide displays a rising perception that Ethereum may proceed its upward trajectory. This rush to amass Ethereum has created a FOMO (concern of lacking out) impact, contributing to the value rise.

Ethereum Steadiness On Exchanges. Supply: Glassnode

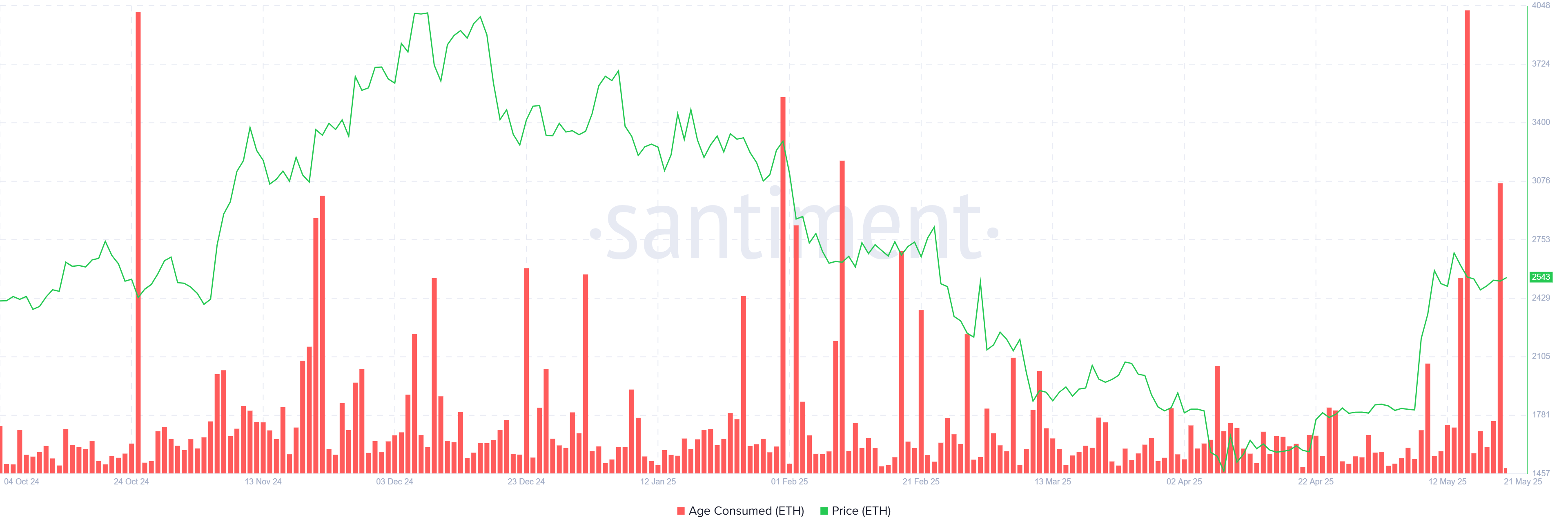

Nonetheless, the macro momentum surrounding Ethereum is combined, with long-term holders (LTHs) exhibiting conduct that means warning. The Age Consumed metric has spiked twice this week, indicating that important parts of ETH are being bought by LTHs to lock in income.

That is the most important wave of promoting previously seven months, which means that these holders imagine Ethereum could have reached its market prime. The sell-off by LTHs is drawing consideration to potential dangers that might have an effect on Ethereum’s future efficiency. If this pattern of profit-taking continues, it may hinder the cryptocurrency’s progress prospects.

Ethereum Age Consumed. Supply: Santiment

ETH Worth Rallies

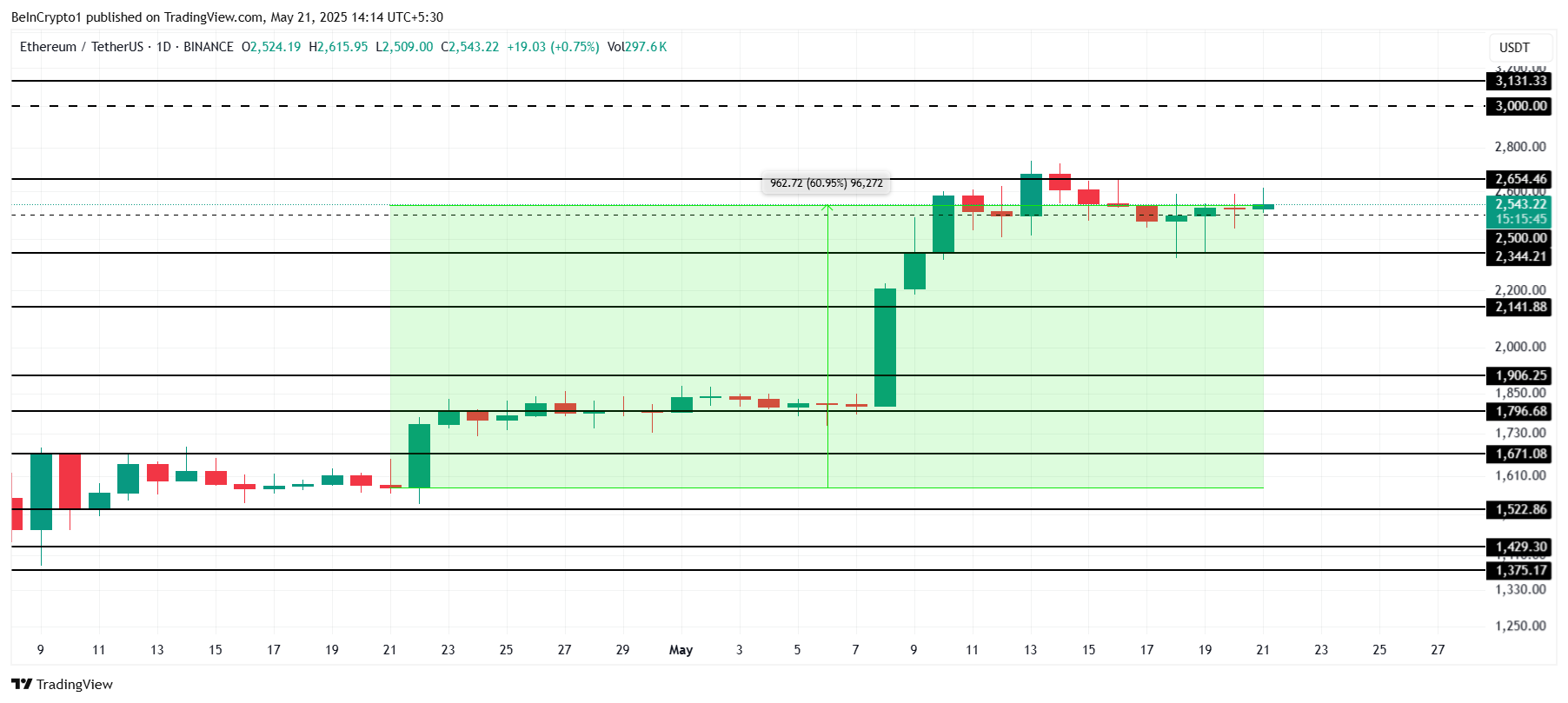

Ethereum value is at present buying and selling at $2,543, marking a 60% rally over the previous month. Nonetheless, the value faces resistance on the $2,654 mark. Breaching this resistance is essential for Ethereum to proceed its rise.

The worth will possible surge past this stage if Bitcoin types a brand new all-time excessive (ATH), as Ethereum has a robust correlation with Bitcoin. This transfer may push Ethereum nearer to $3,000, additional solidifying its bullish outlook. If the broader market stays constructive, Ethereum’s value may see continued upward momentum.

Ethereum Worth Evaluation. Supply: TradingView

Nonetheless, the market comes with its dangers. If the promoting strain from LTHs intensifies and the buildup part halts, Ethereum’s value could wrestle to take care of its upward trajectory. Shedding assist at $2,344 would possible result in a decline in direction of $2,141, invalidating the present bullish thesis and making a bearish outlook for the cryptocurrency.