Leveraged brief positions in ethereum (ETH) have climbed to unprecedented highs, signaling a bearish tilt in market sentiment as merchants brace for intensified volatility.

Ethereum Bears Guess Massive as Futures Market Information Peak Brief

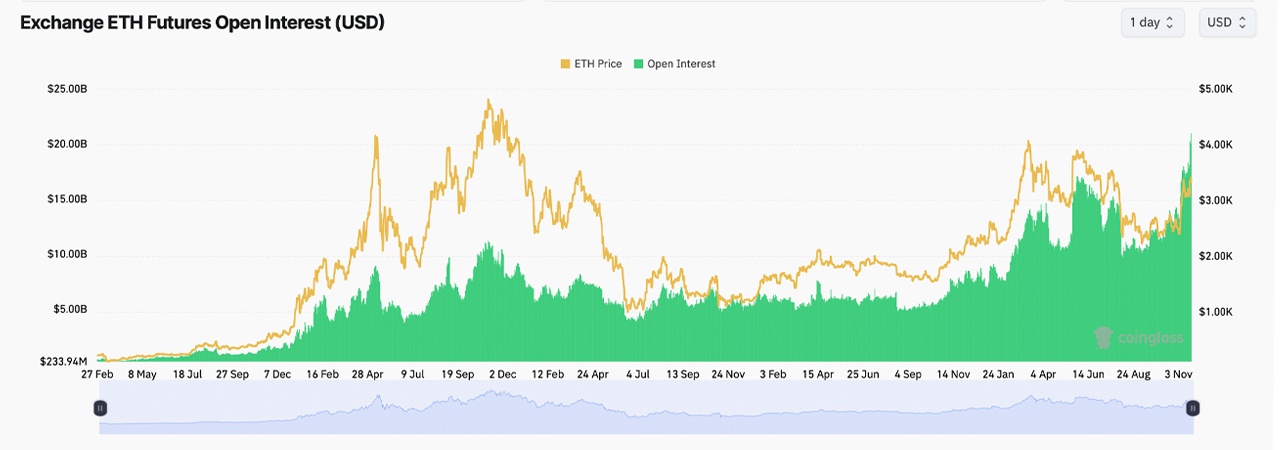

Open curiosity in ethereum futures has surpassed $20 billion, setting a brand new document and highlighting heightened speculative exercise. This upswing in brief positions signifies an growing variety of merchants are wagering on ethereum’s worth dropping. On the identical time, the estimated leverage ratio (ELR) has reached a peak, reflecting a better reliance on borrowed funds—an strategy that magnifies the potential for fast liquidations.

Sentiment amongst merchants reinforces this cautious outlook. Choices exercise exhibits a rising desire for protecting put contracts, which now account for greater than 34% of trades in comparison with 26% favoring bullish calls. Though bearish sentiment by way of different indicators has eased to 47% from 70% in October, it stays a powerful sign of lingering warning.

Further metrics level to ether’s uphill battle. Resistance close to $3,600 has confirmed robust to breach, whereas a weakening relative energy index (RSI) hints at dwindling momentum. Institutional curiosity additionally seems to be cooling, as ethereum exchange-traded funds (ETFs) just lately skilled a number of single-day internet outflows final week.

The spike in leveraged shorts provides one other layer of pressure to the market. If costs unexpectedly rise, brief sellers may face pressured liquidations, doubtlessly unleashing a series response of purchase orders that drive costs larger—a phenomenon generally known as a brief squeeze. On the flip facet, a sustained downturn may validate bearish bets, albeit at the price of heightened market pressure.

Regardless of the prevailing negativity, some analysts stay optimistic a couple of turnaround earlier than year-end, forecasting ethereum may attain between $5,000 and $10,000. Nonetheless, such projections hinge on important shifts in market circumstances.

Ethereum’s derivatives market, marked by record-breaking brief positions and leverage, is just not for the faint of coronary heart. Merchants ought to proceed with warning because the market balances on a knife’s edge between bearish dominance and the potential for sharp reversals. Whether or not this marks the beginning of a deeper decline or units the stage for restoration stays an open query.