Ethereum is exhibiting indicators of renewed power because it continues to commerce above the $2,700 stage, reaching as excessive as $2,790 in latest hours. The worth motion has energized the market, with many analysts now calling for a significant breakout that would not solely elevate ETH additional but additionally set off the long-awaited altseason.

Whereas Bitcoin has led the rally for many of the yr, Ethereum seems to be catching up. In accordance with prime analyst Daan, the ETH spot premium stays agency, signaling sustained demand even within the absence of ETF-level inflows. “It doesn’t have as many ETF inflows as BTC does,” Daan famous.

This relative power, mixed with rising optimism round altcoins, is fueling hypothesis that Ethereum may quickly check—and probably break—important resistance ranges. With sentiment turning bullish throughout the market and ETH gaining momentum, all eyes are actually on whether or not it will probably push previous key resistance and lead the cost right into a broader altcoin breakout. The approaching days may show pivotal as Ethereum units the tone for the following section of crypto market enlargement.

Ethereum Checks Important Resistance As It Faces A Pivotal Second

Ethereum is now confronting what many analysts think about an important resistance stage of the present cycle. The zone between $2,700 and $2,800 has turn into the battleground for ETH’s subsequent main transfer. A profitable breakout may set off a run towards all-time highs, whereas rejection could result in a wholesome—however deeper—retracement.

International macro situations are including weight to this second. Rising U.S. Treasury yields and protracted inflation proceed to rattle conventional markets, growing systemic stress. But, on this unsure surroundings, Ethereum and Bitcoin have proven resilience, suggesting that traders are more and more viewing them as alternate options or hedges in opposition to conventional monetary dangers.

Daan shared insights reinforcing this bullish outlook. In accordance with his evaluation, the ETH spot premium stays agency regardless of missing the ETF-driven inflows seen with Bitcoin. ETH doesn’t require as a lot influx relative to its market cap to maintain bullish momentum.

Nonetheless, the $2,800 stage stays a major barrier. It represents a key inflection level for Ethereum’s value motion and total market sentiment. The approaching days are essential, as Ethereum’s means to both break above or get rejected at this resistance may form the altcoin market’s path for the remainder of the quarter.

ETH Value Evaluation: Testing Key Liquidity Ranges

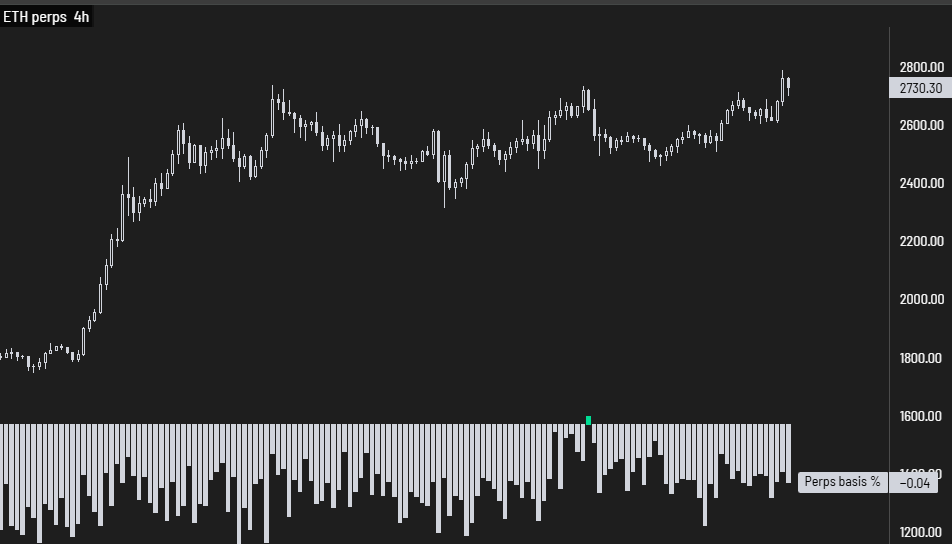

Ethereum is at present buying and selling at $2,731 on the 4-hour chart, exhibiting robust bullish momentum because it exams the important thing $2,800 resistance stage. After weeks of consolidation between $2,500 and $2,700, ETH has damaged out with conviction, using greater transferring averages and elevated quantity. The 34 EMA at $2,622 and the 50 SMA at $2,598 proceed to behave as dynamic assist, confirming the power of the uptrend.

This breakout try follows an extended interval of compression, the place ETH constructed a base of upper lows. Value has now surged to problem a significant resistance zone that has traditionally capped upward momentum. If bulls handle to flip this stage into assist, it may open the door to a pointy transfer towards $3,000 and better.

Quantity has picked up on the latest push, a optimistic signal that patrons are stepping in with extra confidence. Nonetheless, merchants ought to watch carefully for potential rejection or profit-taking at this key zone. If Ethereum fails to interrupt and maintain above $2,800, a short-term pullback towards the 34 EMA may observe.

Featured picture from Dall-E, chart from TradingView