Whereas the Ethereum ecosystem continues to develop with a number of Layer 2 (L2) networks — designed to enhance scalability and cut back charges — the info reveals it might not all the time be financially viable for decentralized finance (DeFi) protocols to deploy iterations on all of those networks.

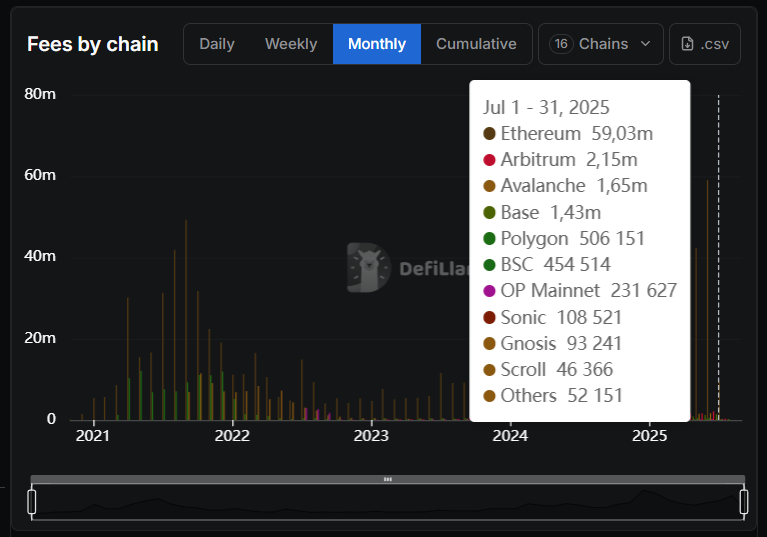

DefiLlama knowledge reveals that for protocols which have expanded essentially the most throughout the Ethereum ecosystem, over 90% of charges or income nonetheless come from the mainnet, with L2s contributing solely a small share.

Aave, the most important DeFi cash market, generated over $65 million in charges in July 2025, changing roughly $9 million into income. However the overwhelming majority of that got here from the Ethereum Layer 1, which hosts practically $29 billion in whole worth locked.

Aave Charges by Blockchain

In the meantime, the mixed TVL of a constellation of Layer 2 chains — Arbitrum, Avalanche, Base, Polygon, Optimism, Sonic, Scroll, Linea, Celo, and Soneium — pales as compared, and so does their contribution to price revenue.

As an example, Scroll generated solely $46,366 for Aave in June, that means lower than $1,500 per day, whereas Gnosis fared barely higher with $93,241.

Curve Finance’s numbers inform an identical story. For a similar interval, charges hovered round $2 million, with about $1 million changing to income. Ethereum swimming pools dominated that tally, leaving the smaller L2s with solely a fraction of the pie. Whereas a granular breakdown by chain is scarce, the obtainable knowledge paints an image of modest returns for a lot of of those newer deployments.

Saturation Level

Ignas, co-founder of DeFi inventive studio Pink Brains, mentioned in an X publish on Aug. 1 that the trade might need hit “an L2 saturation level,” noting that Aave most likely gained’t transfer ahead with a Bob BTC Layer 2 launch although it handed a temp-check vote, since present deployments haven’t actually paid off financially.

Some have already raised issues that a number of Layer 2s are barely pulling in $1,500 a day in charges, not practically sufficient to justify all of the work and assets concerned. On Curve’s discussion board, a consumer underneath the alias “phil_00Llama” proposed stopping all new Layer 2 improvement, saying it takes a whole lot of developer time and assets however solely brings in about $1,500 a day in charges, far too little to cowl the excessive maintenance prices of those fast-changing chains.

Nonetheless, the dialogue on this proposal has been quiet, with few responses. Those that did reply expressed skepticism about halting L2 improvement solely, suggesting that there should still be alternatives value pursuing on these chains.

The true prices of working protocols on L2s aren’t all the time clear, making profitability laborious to measure. For instance, Aave’s growth onto Scroll required committing $500,000 value of AAVE tokens within the security module, whereas its transfer onto Gnosis required as much as $5 million in capital devoted to supporting GHO liquidity. GHO is Aave’s native stablecoin with a market capitalization of roughly $300 million.

With charges already low — and revenues even decrease — initiatives aiming to be in every single place on Ethereum could must rethink their technique, as some deployments could require extra effort than they’re value.