Ethereum (ETH) has formally misplaced the $2,000 mark, buying and selling beneath this key stage for the primary time since 2023 and reaching its lowest level since October 2023. The worth plummeted as little as $1,750, marking a dramatic drop from its December 2024 excessive of $4,100. This staggering 57% decline has created a tough atmosphere for bulls, as Ethereum struggles to search out stability amid rising promoting strain.

The broader crypto market downturn, pushed by macroeconomic uncertainty and risk-off sentiment, has left ETH in a susceptible place, with merchants not sure whether or not a backside has fashioned or if additional draw back is forward. The sharp decline in Ethereum’s worth has intensified bearish sentiment, making it one of many worst-performing main altcoins over the previous few months.

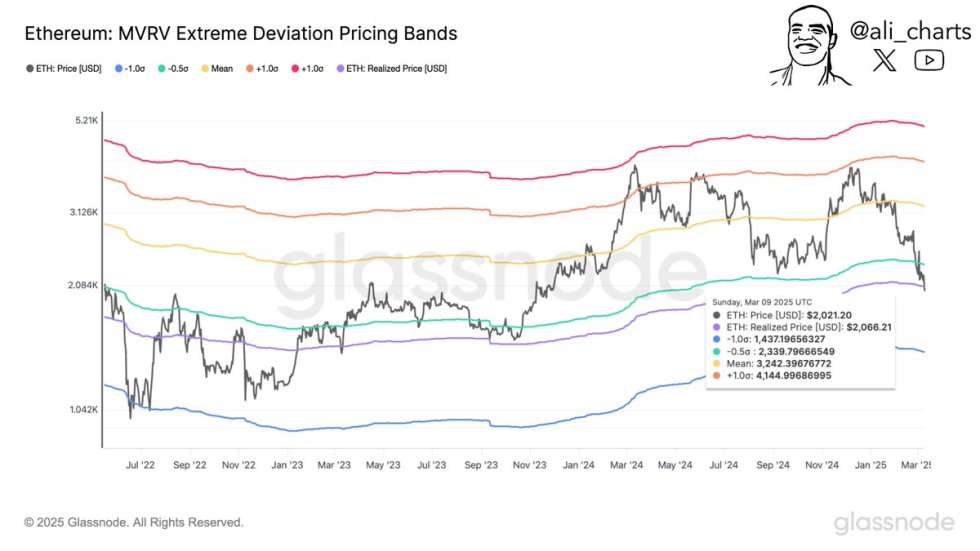

In keeping with Glassnode knowledge, Ethereum is testing key ranges beneath $2,000 and above $1,800 primarily based on the MVRV Pricing Bands. Traditionally, this vary has acted as a significant assist zone, and its potential to carry can be important in figuring out Ethereum’s short-term worth route. If ETH fails to stabilize, the market may very well be in for an additional wave of promoting, probably pushing costs even decrease.

Ethereum Checks Crucial Assist As Market Struggles

The complete crypto market has suffered a significant breakdown, mirroring the decline in U.S. inventory markets as commerce warfare fears and uncertainty surrounding U.S. President Trump’s insurance policies weigh closely on investor sentiment. Macroeconomic instability and volatility have been the first market drivers for the reason that U.S. elections in November 2024, and present circumstances counsel that this development is much from over.

Rising international commerce warfare considerations and erratic decision-making by the U.S. administration have additional fueled concern and uncertainty, sending the U.S. inventory market to its lowest ranges since September 2024. This risk-off atmosphere has translated into elevated promoting strain throughout the crypto market, with Ethereum (ETH) struggling to carry important assist ranges.

High analyst Ali Martinez shared insights on X, highlighting that Ethereum is now testing key ranges primarily based on the MVRV Pricing Bands. In keeping with on-chain knowledge, ETH’s Realized Value presently sits at $2,060, a stage that has acted as essential assist in earlier cycles. If Ethereum fails to carry above this mark, the subsequent main draw back goal is round $1,440, which might symbolize a considerable drop from present ranges.

With market circumstances nonetheless fragile, the subsequent few buying and selling periods can be essential in figuring out Ethereum’s short-term trajectory. If ETH can maintain above $2,060, it could have an opportunity to stabilize and try a restoration. Nevertheless, if promoting strain intensifies, the market might see Ethereum check considerably cheaper price ranges, including to the rising uncertainty amongst buyers.

ETH Struggles Beneath $2,000

Ethereum is presently buying and selling at $1,900, following days of heavy promoting strain which have led to vital losses. ETH has failed to carry key ranges, with the worth dropping as little as $1,750 just some hours in the past, marking one among its lowest factors in months. With the market below continued bearish management, bulls are actually racing to reclaim the $2,000 mark in an effort to stabilize worth motion and shift momentum towards a possible restoration part.

For Ethereum to regain energy, it should maintain above present ranges and push previous $2,000 rapidly. A break above this key resistance zone would point out renewed shopping for curiosity, lowering promoting strain and permitting ETH to try a extra sustained restoration. Nevertheless, if ETH fails to reclaim $2,000, the market is prone to see a continuation of the downtrend, with additional declines anticipated.

With Ethereum in a fragile place, the subsequent few days can be essential in figuring out whether or not bulls can step in to reverse the development or if ETH will slide into deeper correction territory. Merchants are carefully watching worth actions, as Ethereum stays liable to additional draw back if key ranges will not be regained.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.