The funding agency BlackRock bought $54 million value of Ethereum (ETH), in accordance with Crypto Rover. The transaction serves as a serious institutional approval from the world’s greatest asset supervisor, producing short-term market shifts and strengthening ETH’s enchantment to institutional traders.

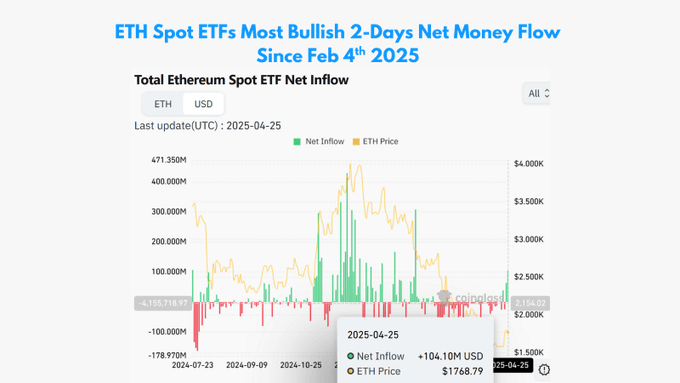

A surge in spot Ethereum ETF inflows coincides with the altering United States regulatory reforms. Analysts view this shift as an optimistic signal, as spot Ethereum ETF inflows proceed to rise and buying and selling volumes surge to match a optimistic week of ETF inflows not seen since February. Market members monitor Ethereum’s capacity to keep up its important $1,800 help space and set up a large-scale market restoration.

Ethereum Buying and selling Exercise and Market Metrics Strengthen

Ethereum (ETH) trades at $1,807.19 at press time, exhibiting a day by day market progress of 1.38%. This asset’s market capitalization reaches $218.16 billion, whereas its 24-hour buying and selling quantity quantities to $17.08 billion and marks a considerable 29.95% progress. This surge in exercise steadily signifies a spike in volatility forward, a warning for bulls and bears.

Associated: Ethereum Whale Borrows 4,000 ETH on Aave to Provoke New Quick Place

Ethereum’s short-term outlook depends upon its capacity to carry above $1,800. If this help holds, an additional take a look at towards $1,830—and presumably $1,850—would turn into extra probably. However, if there’s a decisive break beneath $1,790, ETH might be uncovered to additional draw back threat towards $1,760 and even $1,720.

BlackRock’s Strategic Timing Amid Political Shifts

The acquisition by BlackRock signifies rising curiosity from institutional traders in buying Ethereum-based funding merchandise. Knowledge from SoSoValue exhibits US spot Ethereum ETFs recorded internet inflows of $157.1 million within the earlier week and $104.1 million on Friday, marking the primary optimistic flows since February.

Supply: Coinglass

The ETHA product from BlackRock recorded $54.43 million inflows whereas surpassing the efficiency of FETH from Constancy and ETHE from Grayscale. As well as, President Trump’s softened rhetoric concerning China tariffs and the appointment of Paul Atkins, a crypto-friendly determine, as SEC Chair have considerably improved sentiment amongst institutional traders.

Associated: Ethereum Whales Stack 449K ETH in a Day, however $1,895 Resistance Holds Agency

The brand new Chairman of the SEC, Atkins, takes a supportive method towards digital belongings, planning to develop “affordable and focused” regulatory tips. The political shift towards crypto-friendly rules creates excessive expectations for the SEC’s approval of spot ETFs and their staking options.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.