Ethereum is rising from the ashes, with the ETH token worth reclaiming $4,000 and the chain’s total-value locked cruising to a brand new all-time excessive.

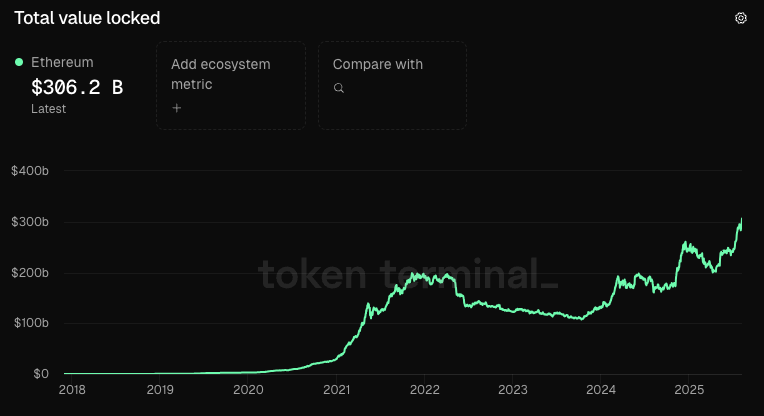

The chain’s ecosystem TVL simply made a model new excessive of $306 billion, surpassing its earlier excessive of $253 billion in December 2024, and $195 billion in 202, in keeping with TokenTerminal.

Ethereum Ecosystem TVL – TokenTerminal

Whereas ETH continues to be 15% off its all-time excessive of $4,700, the ecosystem’s stablecoin scene has exploded during the last two years and has carried the chain’s TVL to new highs. In December 2021 Circle and Tether accounted for 39%, or $75 billion of Ethereum’s TVL, however now in 2025 that aggregated complete has elevated by 63% to $121 billion.

The expansion of DeFi-native stablecoins resembling Ethena’s USDe and Sky’s USDS have contributed to the enlargement as properly, creating an extra $15 billion in financial worth for Ethereum.

Return to Glory

The Ethereum Basis’s (EF) structural modifications and Ethereum’s Pectra improve could have laid the groundwork for the token’s outperformance in Q2.

In June, the EF unveiled a brand new treasury coverage centered on a return to its cypherpunk roots after dealing with backlash from the Ethereum neighborhood all through 2024 and within the first half of 2025. The brand new roadmap focuses on transparency in basis financials, lively engagement with DeFi, supporting Ethereum builders and bettering the dynamic between the Layer 1 and Layer 2 ecosystems.

Whereas the EF centered on regaining belief from its crypto-native userbase, the Securities and Alternate Fee (SEC) and Blackrock have been going to work to make ETH extra interesting to institutional patrons.

The curiosity started in Could when BlackRock filed for in-kind redemptions allowed inside its iShares ETH ETF, and proposed that staking be permitted.

In the meantime, the SEC has been loosening the stranglehold it had set on DeFi throughout the earlier administration. On Tuesday a department of the Fee department clarified that liquid staking actions will not be thought-about securities, and final week SEC Chair Paul Atkins unveiled “Mission Crypto”, which was a sweeping endorsement of all issues DeFi, from staking to tokenized inventory buying and selling.

The ETH/BTC ratio can also be rebounding after getting crushed over most of this cycle. The ratio bottomed out at 0.018 in April, a 78% fall from its 2022 highs of 0.085. ETH/BTC is again as much as 0.034 right now, an 89% rally from its Q2 backside.

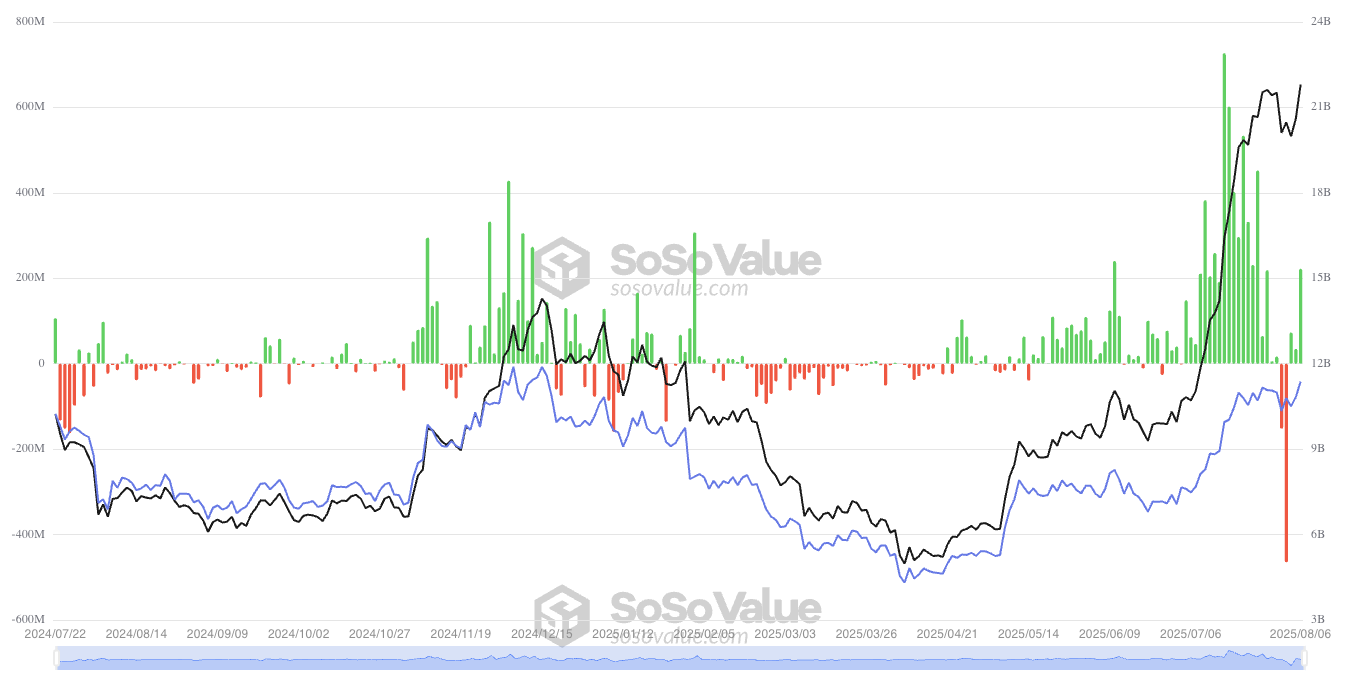

ETF patrons could also be driving the reversion, with ETH ETFs hitting new highs of $21 billion in belongings underneath administration, a 300% improve from the April backside of $5.25 billion, in keeping with SoSoValue.

ETH ETF Flows – SoSoValue