The Ethereum validator exit queue could spike within the coming days, however crypto market contributors have little to fret about, says Ethereum educator Anthony Sassano.

“This ETH will presumably be restaked utilizing new validator keys, aka it’s not going to be bought,” Sassano mentioned in an X put up on Tuesday, citing Kiln Finance’s announcement following a hack of a Switzerland-based crypto wealth administration platform, SwissBorg.

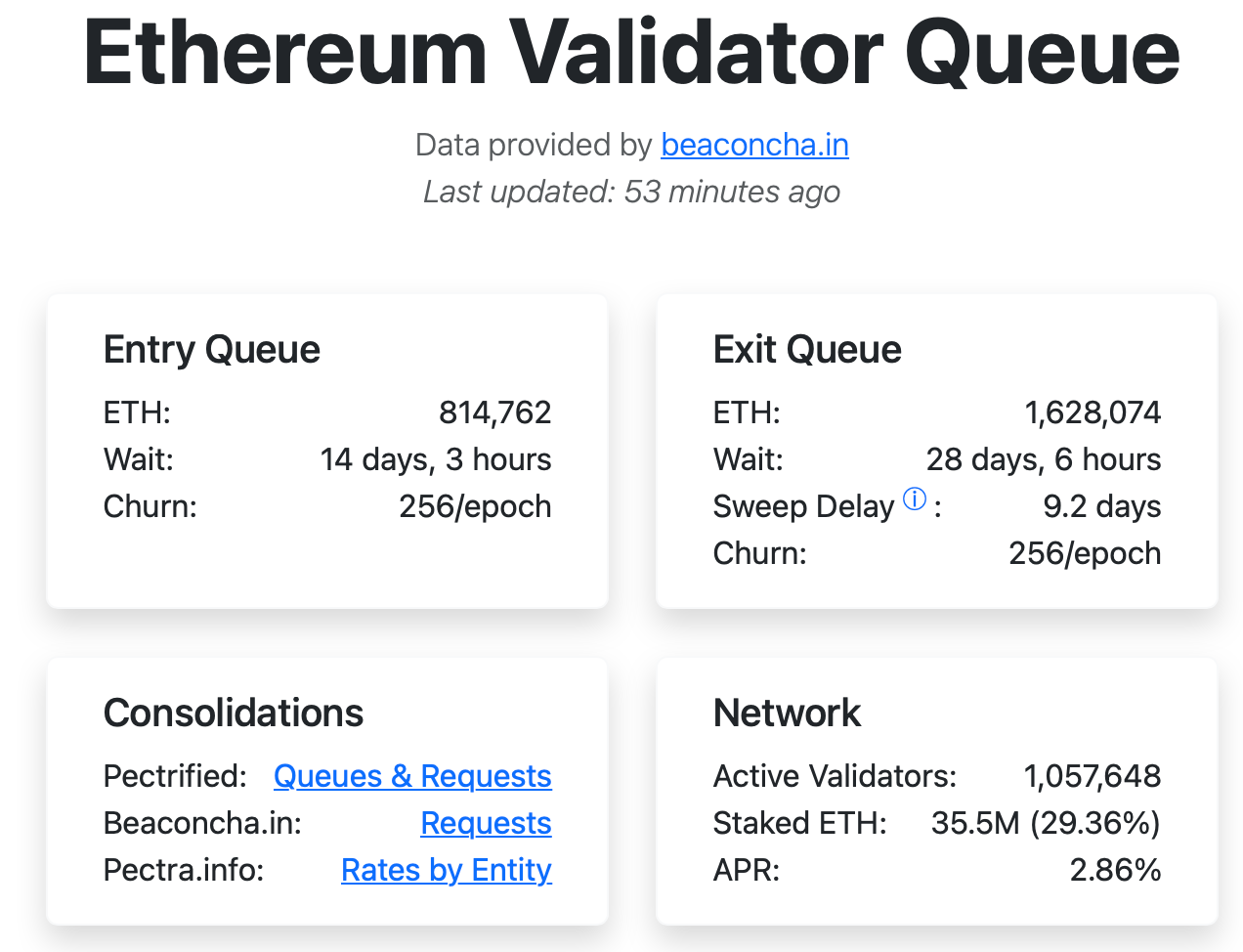

A big quantity of Ether (ETH) being unstaked is typically thought-about a bearish indicator, as merchants could concern it indicators upcoming promoting stress. The ETH exit queue is sitting at 1,628,074, in accordance with ValidatorQueue knowledge. Roughly 35.5 million ETH is staked, roughly 29.36% of the whole provide.

Kiln begins “orderly exit” of Ethereum validators

“Following our announcement yesterday concerning the Solana incident involving SwissBorg, Kiln is taking further precautionary measures to safeguard shopper property throughout all of the networks,” Kiln Finance mentioned in an X put up on Tuesday.

SwissBorg earlier revealed that hackers had exploited a vulnerability within the API of its staking accomplice Kiln, draining about 193,000 Solana (SOL) tokens from its Earn program.

“As a part of this response, Kiln right this moment started the orderly exit of all of its Ethereum validators. The exit course of is a precautionary measure designed to make sure the integrity of the staked property,” Kiln Finance defined.

The Ethereum exit queue at the moment has roughly 1.63 million ETH. Supply: ValidatorQueue

Exit course of may take as much as 42 days, Kiln says

Kiln Finance defined that the exit course of is anticipated to take between 10 and 42 days, relying on the validator.

Ether is buying and selling at $4,306 on the time of publication, in accordance with CoinMarketCap.

Associated: Ethereum exit queue hits document $5B ETH, elevating promote stress considerations

It comes after Ethereum has skilled instances of surging entry and exit queues in latest months.

On Aug. 28, Cointelegraph reported that Ethereum noticed probably the most vital validator exodus in crypto historical past, with over 1 million Ether tokens at the moment ready to be withdrawn from staking by Ethereum’s proof-of-stake (PoS) community.

In the meantime, on Sept. 3, the quantity of Ether within the queue to be staked surged to its highest stage since 2023 as institutional merchants and crypto treasury corporations intention to scoop rewards for his or her holdings.

Journal: Can Robinhood or Kraken’s tokenized shares ever be actually decentralized?