On-chain information reveals Ethereum whales have lately ramped up their accumulation, an indication that may very well be bullish for the asset’s value.

Ethereum Whales Have Been Shopping for Huge

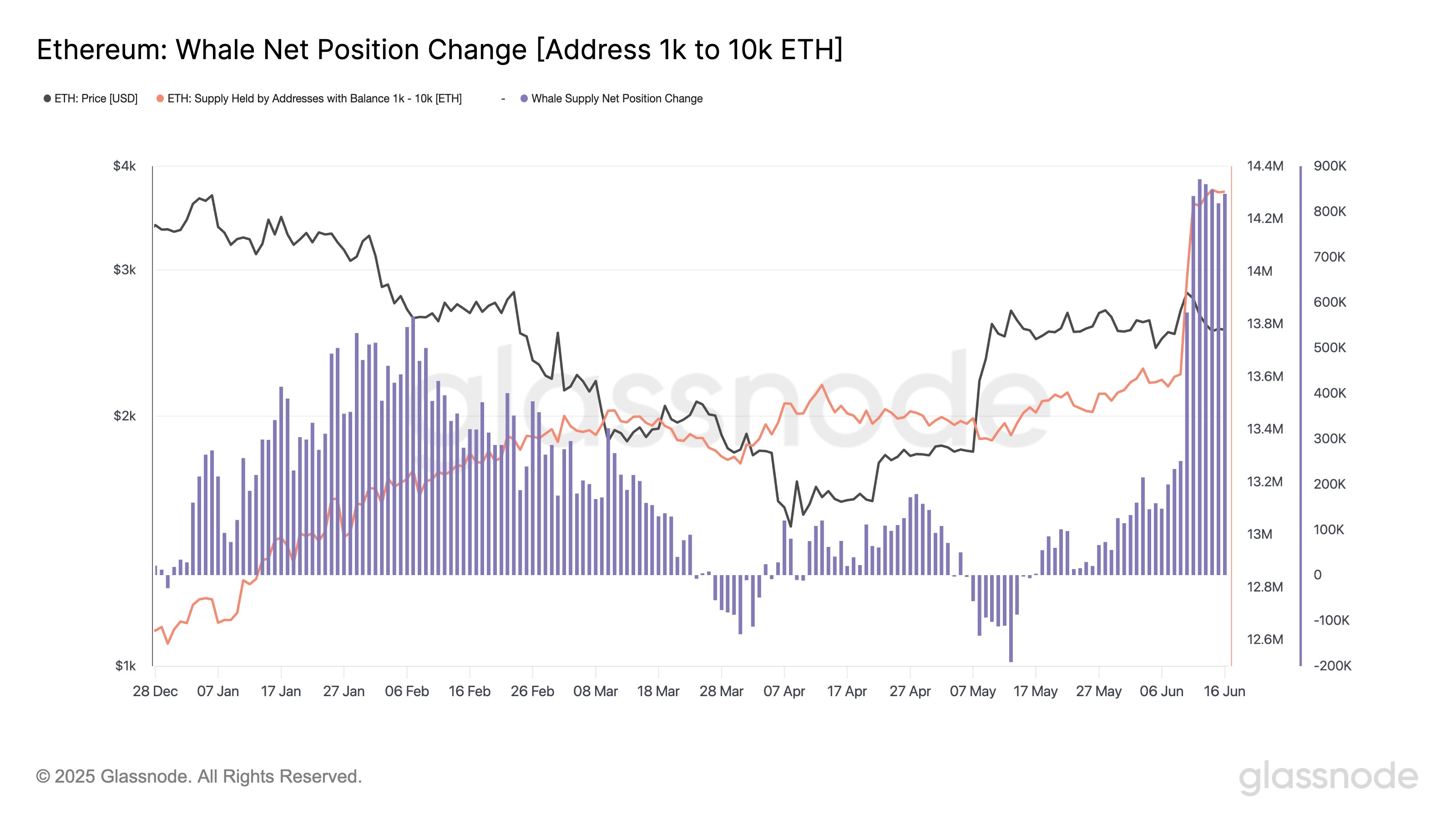

In line with information from the on-chain analytics agency Glassnode, the Ethereum whales have been taking part in a really vital quantity of accumulation throughout the previous week.

‘Whales‘ check with the the ETH buyers holding between 1,000 and 10,000 tokens of the cryptocurrency. On the present trade this vary converts to about $2.5 million on the decrease finish and $25 million on the higher one.

Whereas this vary doesn’t cowl absolutely the prime finish of the market, it nonetheless consists of humongous buyers who could also be thought-about a key a part of the ecosystem. As such, contemplating this position, the actions associated to those holders may very well be price monitoring.

One solution to watch the habits of the whales is thru the overall quantity of the Ethereum provide held by them. Under is the chart shared by Glassnode that reveals the development on this metric over the previous few months.

The worth of the metric seems to have seen a steep climb in latest days | Supply: Glassnode on X

As is seen within the graph, the availability of the Ethereum whales has lately shot up, an indication that big-money buyers have been accumulating the cryptocurrency. “For practically every week, each day whale accumulation has exceeded 800K ETH, pushing holdings in 1k–10k wallets to >14.3M ETH,” notes the analytics agency.

From the chart, it’s obvious {that a} notably giant spike occurred on June twelfth. On this date, the ETH whales added greater than 871,000 ETH to their holdings, the best each day influx for the cohort year-to-date.

The most recent accumulation spree isn’t simply notable when it comes to the yr, however reasonably additionally spectacular in a historic context. “This scale of shopping for hasn’t been seen since 2017,” says Glassnode. Naturally, the extraordinary shopping for push from these buyers may very well be a possible indication that they’re assured about the way forward for the coin.

Whereas this sturdy accumulation exercise has been noticed on-chain, one other aspect of the sector has additionally seen demand: the spot exchange-traded funds (ETFs). The spot ETFs are funding autos that present a manner for buyers to get publicity to Ethereum with out straight proudly owning the asset.

The spot ETFs commerce on conventional exchanges, so holders not accustomed to cryptocurrency wallets and exchanges can discover it simpler to take a position into the coin by way of them.

There was some excessive demand for the US ETH spot ETFs these days, because the netflow chart shared by Glassnode in an X publish showcases.

The development within the netflow of the US ETH spot ETFs since their inception | Supply: Glassnode on X

“Final week noticed 195.32K ETH movement into US Spot ETH ETFs – the third-largest weekly web influx on file,” explains the analytics agency.

ETH Value

Ethereum set its eyes on $2,700 on Monday, however it appears the worth has taken a bearish flip since then because it’s now buying and selling round $2,470.

Appears like the worth of the coin has plunged during the last 24 hours | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.