Ethereum’s main holders are returning to the market. Amid the previous week’s market consolidation, main gamers have seized the chance to build up ETH aggressively.

On-chain knowledge reveals an uptick in whale holdings, whereas ETH-based exchange-traded funds (ETFs) recorded their first weekly web influx in eight weeks, signaling a big shift in sentiment.

ETH Whale Accumulation and ETF Inflows Trace at Imminent Value Surge

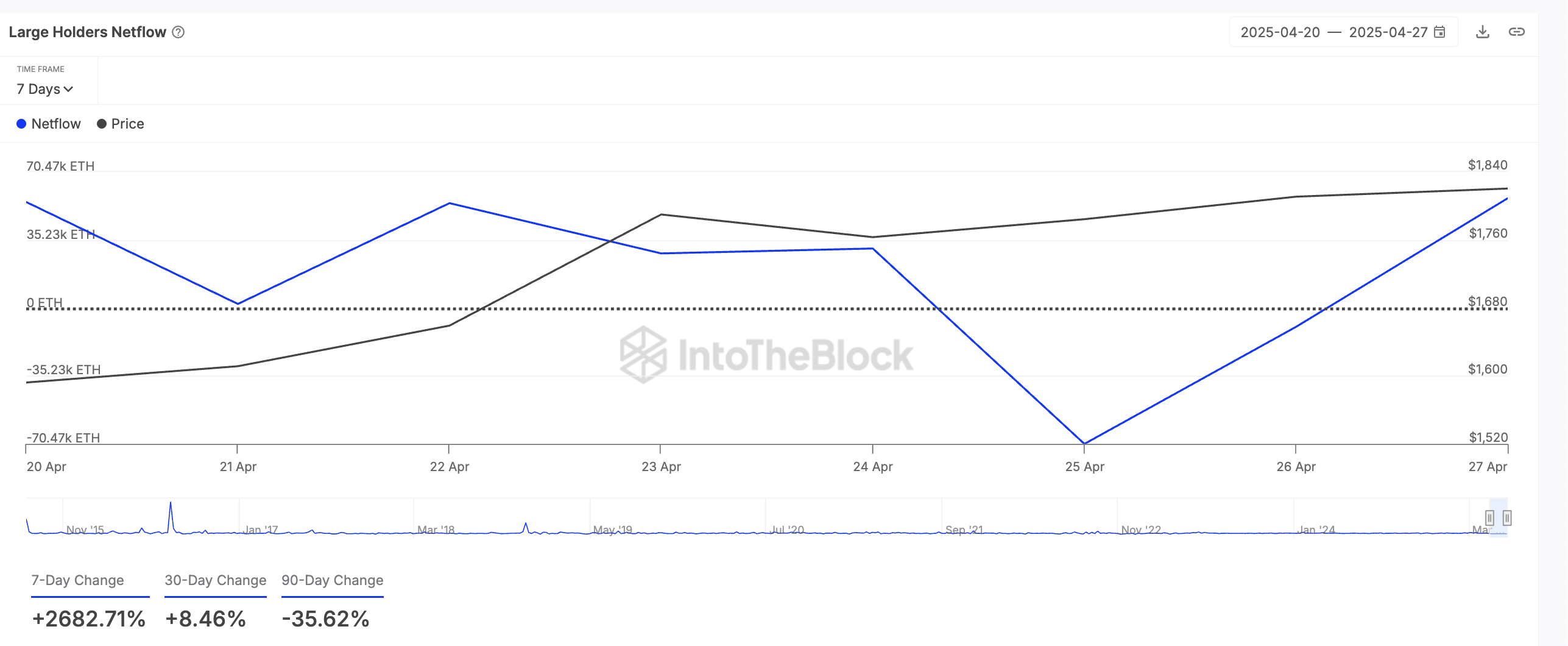

In keeping with on-chain knowledge, main altcoin ETH has famous a big spike in its giant holders’ netflow over the previous week. In keeping with the on-chain knowledge supplier, this has rocketed 2682% previously seven days.

ETH Massive Holders’ Netflow. Supply: IntoTheBlock

Massive holders of an asset confer with whale addresses holding greater than 0.1% of its circulating provide. The massive holders’ netflow metric tracks the distinction between the cash these traders purchase and the quantity they promote over a particular interval.

When an asset’s giant holders’ netflow surges, its whale traders are ramping up their coin accumulation. This accumulation development suggests a perception in ETH’s future upside, as main holders are likely to act once they see worth at present value ranges.

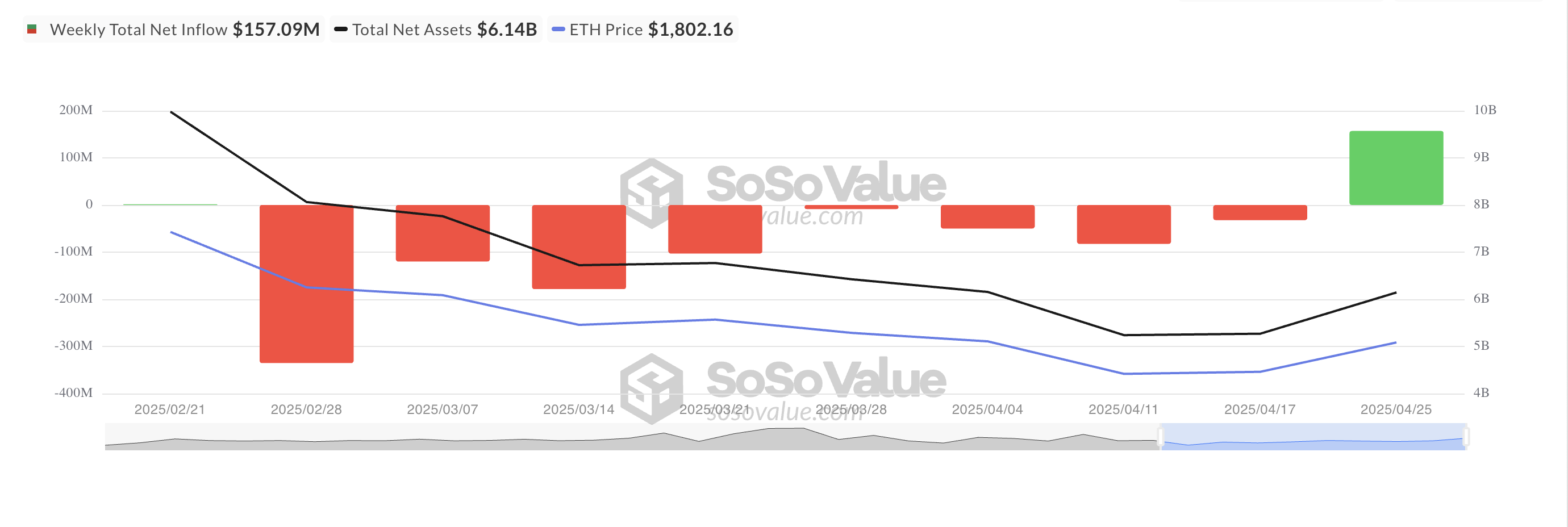

Including to the bullish narrative, ETH-backed ETFs recorded their first weekly web influx in eight weeks. In keeping with SosoValue, web inflows into ETH-backed ETFs reached $157.09 million between April 21 and April 25, reversing an eight-week streak of outflows totaling over $700 million.

Whole Ethereum Spot ETF Internet Influx. Supply: SosoValue

With main gamers re-entering the market, ETH may very well be poised for additional upside within the close to time period.

Ethereum Sees Bullish Momentum

On the technical aspect, ETH’s constructive Stability of Energy (BoP) highlights the resurgence in demand for the main altcoin. That is presently at 0.31.

This indicator measures the shopping for and promoting stress of an asset. When its worth is constructive, stress outweighs promoting stress. This means power within the ETH’s value motion and indicators additional potential upward momentum. If this occurs, ETH may rally again above $2,000 to trade fingers at $2,027.

ETH Value Evaluation. Supply: TradingView

Nevertheless, if market sentiment worsens, ETH may shed current features and plummet to $1,385.