Ethereum’s climb towards the long-awaited $5,000 mark could face additional stalls as on-chain alerts counsel headwinds.

Information reveals that long-term holders (LTHs) of ETH are actively distributing their cash, creating potential promote strain that would weigh in the marketplace. On the identical time, persistent bearish sentiment amongst futures merchants provides one other layer of warning, placing its near-term upside in danger.

Revenue-Taking by Lengthy-Time period Holders Places ETH’s Breakout on Maintain

ETH’s month-long value consolidation has created a possibility for long-term holders (LTHs) to lock in earnings following the altcoin’s late-August rally to an all-time excessive.

This development is clear within the coin’s Liveliness metric, which, in accordance with Glassnode, has climbed to a year-to-date peak of 0.704.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

ETH Liveliness. Supply: Glassnode

An asset’s Liveliness tracks the motion of its beforehand dormant tokens by measuring the ratio of an asset’s coin days destroyed to the full coin days gathered. When it falls, LTHs are shifting their belongings off exchanges, an indication that accumulation is underway.

However, when an asset’s liveliness climbs, extra dormant cash are bought, signaling elevated profit-taking by LTHs.

Subsequently, the uptick in ETH’s Liveliness means that its LTHs are actively realizing beneficial properties as a substitute of holding out for additional upside. This promoting strain may restrict ETH’s capability to stage a decisive breakout towards the $5,000 degree within the close to time period.

Futures Merchants Keep Heavy Promote-Aspect Stress

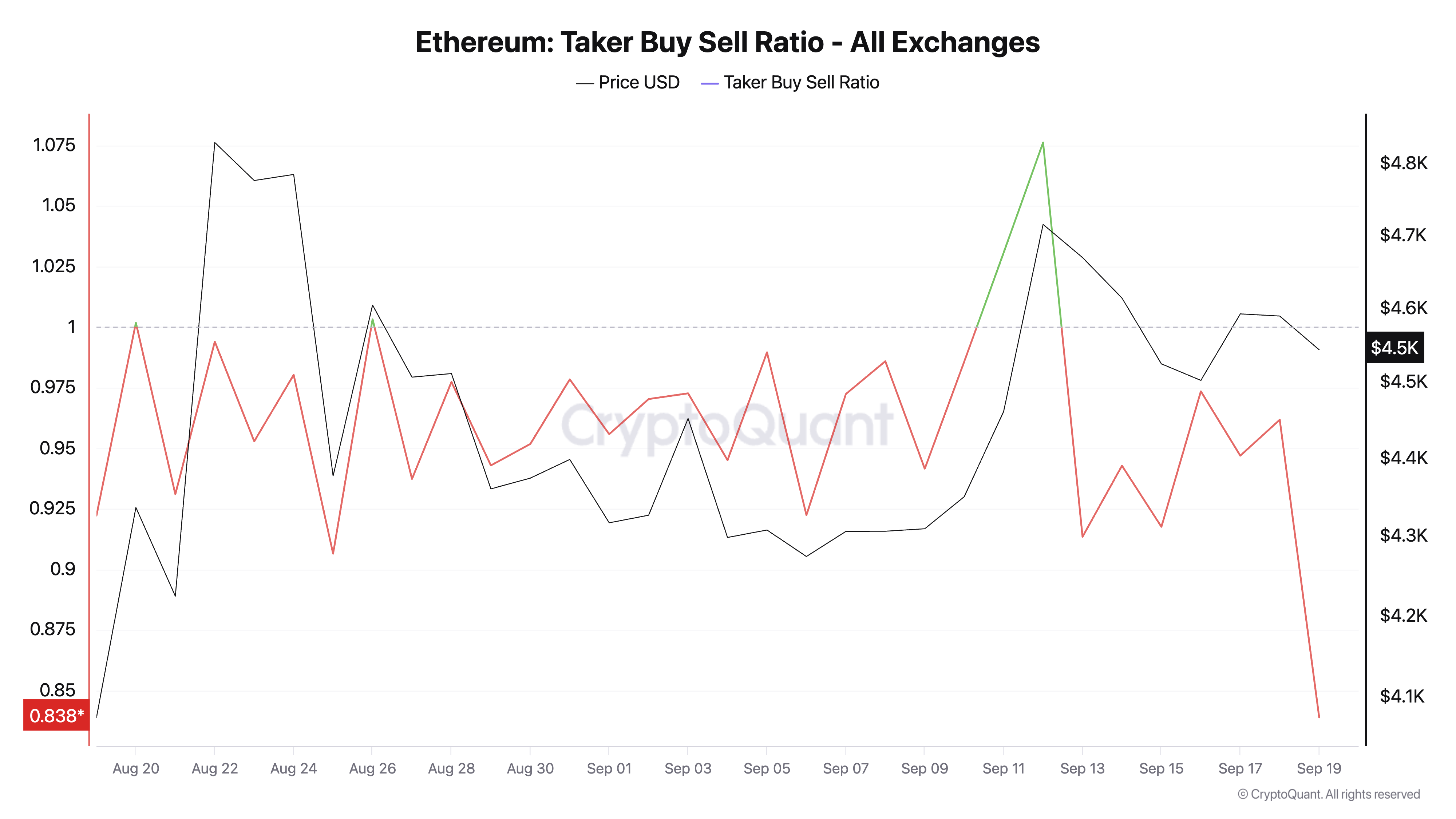

The persistent bearish sentiment within the derivatives market provides to this strain. Readings from CryptoQuant present that ETH’s taker buy-sell ratio has remained principally within the purple for a lot of the previous month, highlighting persistent exits amongst futures merchants.

Ethereum Taker Purchase Promote Ratio. Supply: CryptoQuant

An asset’s taker buy-sell ratio measures the stability between purchase and promote volumes within the futures market. A worth better than one signifies stronger purchase quantity, whereas a price beneath one alerts heavier sell-side exercise.

As seen with ETH, there was a persistent return of values underneath one for over a month. This factors to sustained bearish positioning amongst merchants, which may additional delay ETH’s rally to $5000.

$5,000 Breakout Hinges on Demand Revival

As of this writing, the main altcoin trades at $4,542, holding above the assist flooring at $4,211. If bearish sentiment strengthens and selloffs proceed, the coin may retest this assist line.

It may give solution to a deeper decline to $3,626 if it fails to carry.

Ethereum Value Evaluation. Supply: TradingView

Nonetheless, a resurgence in demand for ETH may invalidate this bearish outlook. In that occasion, the coin’s value may try to breach the resistance at $4,957. If profitable, it may propel it to new value peaks above $5,000.

The put up Ethereum’s $5,000 Dream Delayed by Lengthy-Time period Holder Exit and Bearish Futures Bets appeared first on BeInCrypto.