Ethereum’s rally in early August drove the most important altcoin to a cycle peak of $4,793 by August 14, marking certainly one of its strongest performances of the yr.

Nonetheless, the sharp rise additionally triggered a wave of profit-taking, which has since put important strain on the asset and induced it to lose a lot of its latest positive aspects. With selloffs intensifying within the derivatives market, ETH now faces the chance of a breakdown beneath the $4,000 value mark.

ETH Faces Heavy Promote Strain

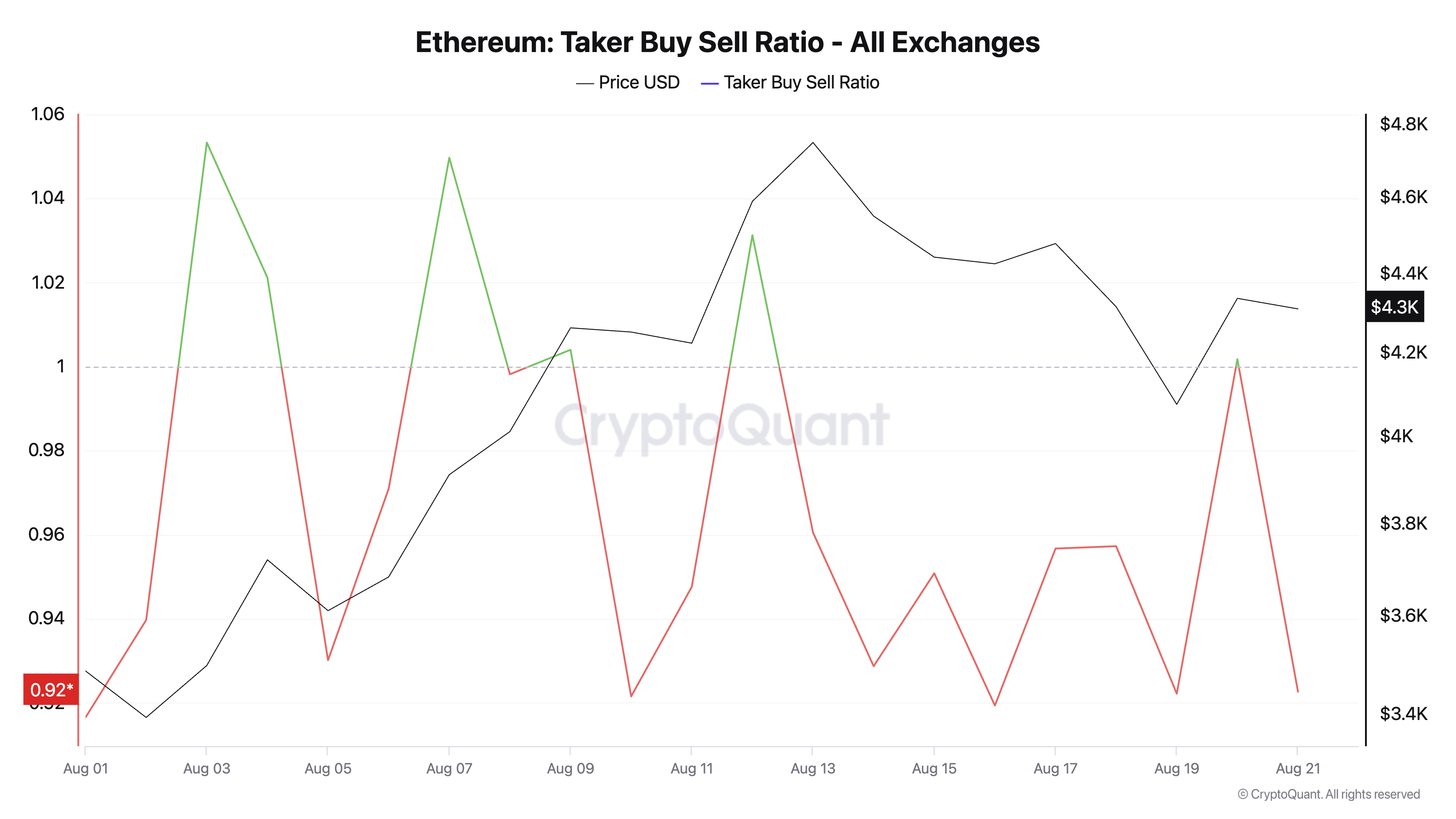

ETH’s value has been weighed down by the bearish tilt in sentiment amongst its derivatives merchants. That is mirrored by its taker-buy/promote ratio, which has largely remained underneath one for the reason that starting of August.

At press time, this stands at 0.92 per CryptoQuant, indicating that promote orders dominate purchase orders throughout the ETH futures market.

ETH Taker Purchase Promote Ratio. Supply: CryptoQuant

The taker buy-sell ratio measures the steadiness between purchase and promote orders in an asset’s futures market. A ratio above one signifies stronger shopping for strain, exhibiting merchants are actively chasing value positive aspects. However, a worth beneath one displays dominant promoting strain, usually linked to profit-taking or bearish sentiment.

Since August started, ETH’s taker purchase/promote ratio has stayed largely beneath one, confirming persistent sell-offs amongst futures merchants.

For context, the coin’s efficiency had been largely muted for a lot of the yr, so when an uptrend lastly started in July and prolonged into early August, many merchants seized the chance to lock in earnings.

This mounting sell-side strain confirms the weakening bullish sentiment and will worsen ETH’s value fall if it continues.

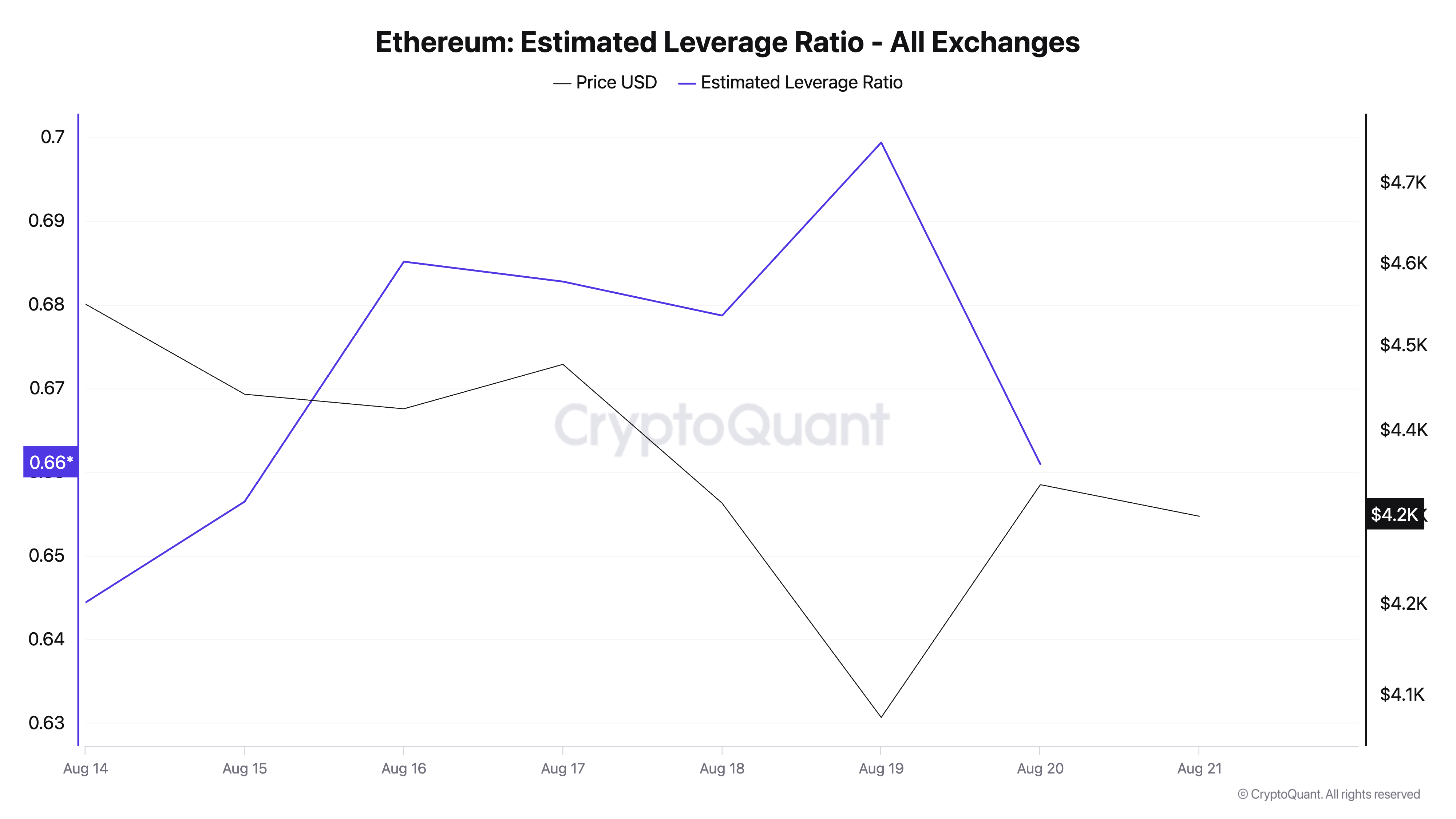

Merchants Ditch Excessive-Danger Bets Amid Value Strain

The latest decline in ETH’s Estimated Leverage Ratio (ELR) additionally confirms the low confidence amongst coin holders. Based on CryptoQuant, ETH’s ELR presently sits at 0.66 — its lowest worth previously 5 days.

ETH Estimated Leverage. Supply: CryptoQuant

An asset’s ELR measures the common leverage its merchants use to execute trades on a cryptocurrency change. It’s calculated by dividing the asset’s open curiosity by the change’s reserve for that foreign money.

When an asset’s ELR falls, it signifies a decreased threat urge for food amongst merchants. This pattern indicators that ETH traders have grown more and more cautious this week and at the moment are avoiding high-leverage positions that would worsen potential losses.

Which Comes First: $3,491 or $4,793?

As of this writing, ETH trades at $4,295. If sell-side strain strengthens, the altcoin may retest the help flooring at $4,063. Ought to this key value mark give method, ETH may plunge to $3,491.

ETH Value Evaluation. Supply: TradingView

Conversely, ETH may see a rebound and rally to $4,793 if new demand enters the market.

The submit Ethereum’s Early August Surge Meets Actuality Examine as Bears Eye Dip Beneath $4,000 appeared first on BeInCrypto.