Main altcoin Ethereum has surged by over 40% prior to now week, fueled by renewed optimism throughout the cryptocurrency market. At press time, the coin rests solidly above the psychological $2,500 worth mark.

Nonetheless, this rally could also be dropping steam, particularly as US-based buyers look like cashing out. How will this influence ETH’s worth efficiency within the close to time period?

ETH’s Worth Rally Faces Danger as US Traders Exit

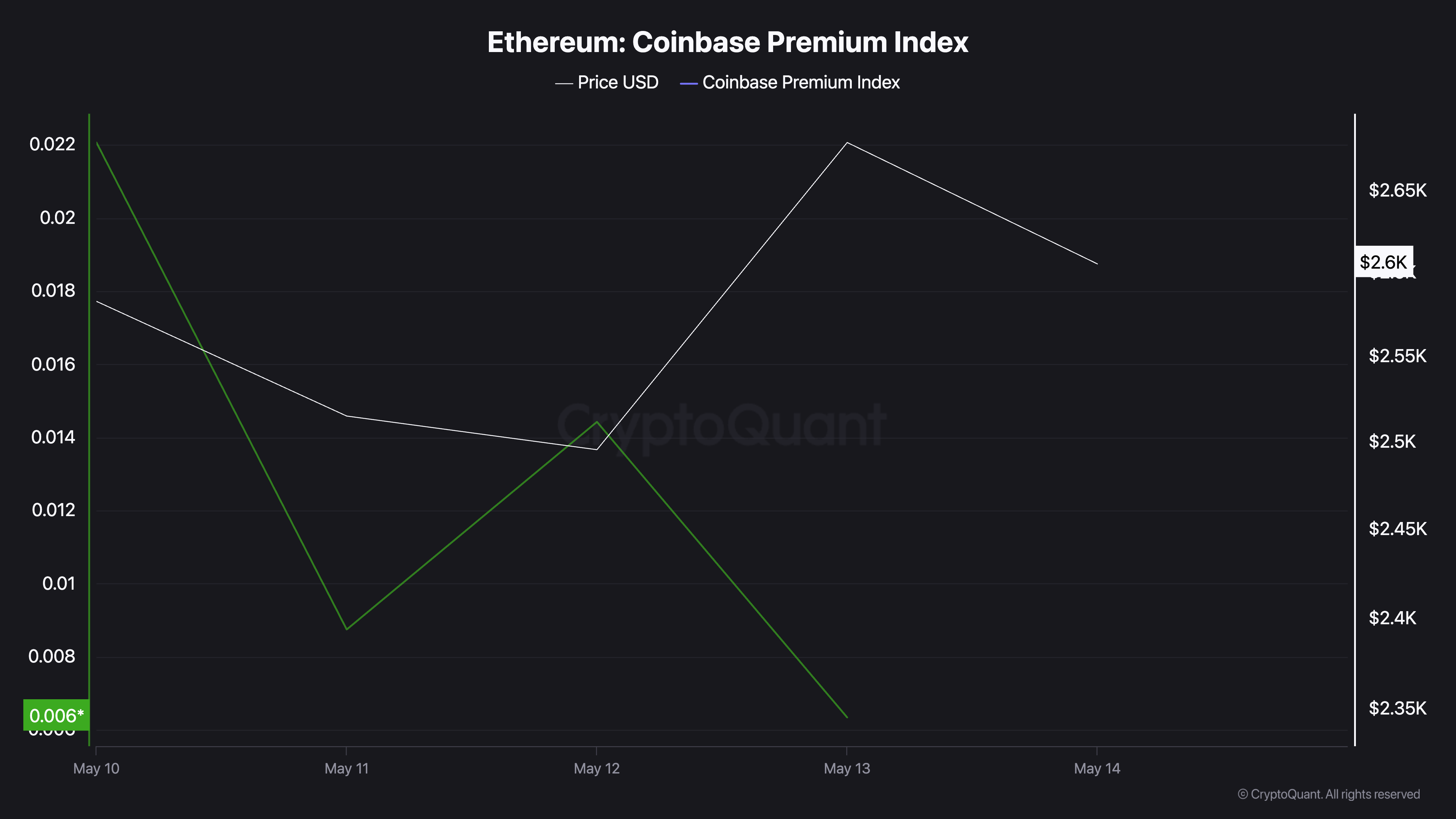

Based on CryptoQuant, ETH’s Coinbase Premium Index (CPI) reached a weekly peak of 0.022 on Might 10 and has since trended downward. As of this writing, the metric sits at 0.0063.

Ethereum Coinbase Premium Index. Supply: CryptoQuant

This metric has famous a decline regardless of ETH’s 5% worth rally throughout the identical interval. This implies elevated promoting strain from US buyers, a pattern that may weigh closely on the altcoin’s worth.

ETH’s CPI measures the distinction between the coin’s costs on Coinbase and Binance. It’s a good indicator for monitoring US investor sentiment.

When the CPI rises, it means ETH is buying and selling at a premium on Coinbase in comparison with worldwide exchanges, reflecting stronger shopping for strain from US-based institutional and retail buyers.

Conversely, when the CPI falls—or worse, turns detrimental—it indicators that demand on Coinbase is lagging behind world markets, resulting from profit-taking or waning curiosity amongst US consumers. ETH’s falling CPI amid its worth rally signifies that American buyers are exiting their positions and realizing positive aspects, slightly than shopping for into the rally.

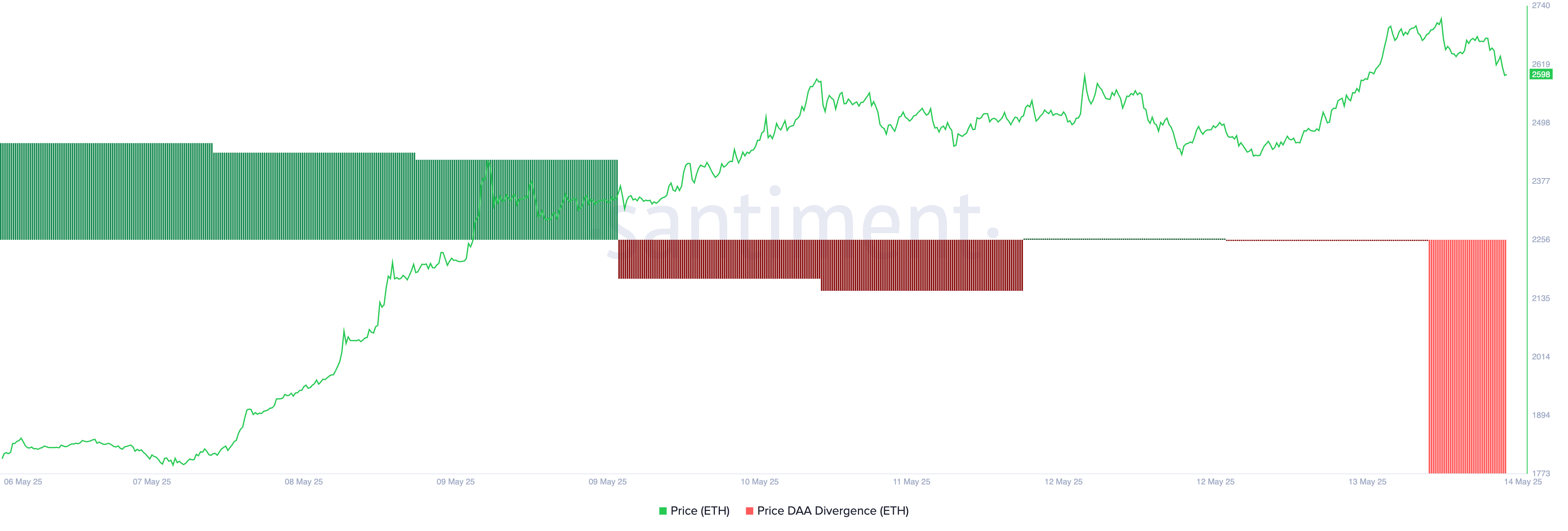

Furthermore, readings from ETH’s Worth-to-Each day Energetic Addresses (DAA) divergence, an on-chain metric that compares worth motion with community exercise, affirm this bearish outlook. Per Santiment, the metric has been detrimental over the previous few days whilst ETH’s worth climbs. As of this writing, it’s at -58.2%.

Ethereum Worth DAA Divergence. Supply: Santiment

This detrimental worth signifies {that a} corresponding rise in person engagement doesn’t help ETH’s current worth positive aspects. In essence, not sufficient demand is driving ETH’s rally, therefore it dangers a pullback within the close to time period.

Will Bulls Reclaim $2,745 or Is a Deeper Drop Forward?

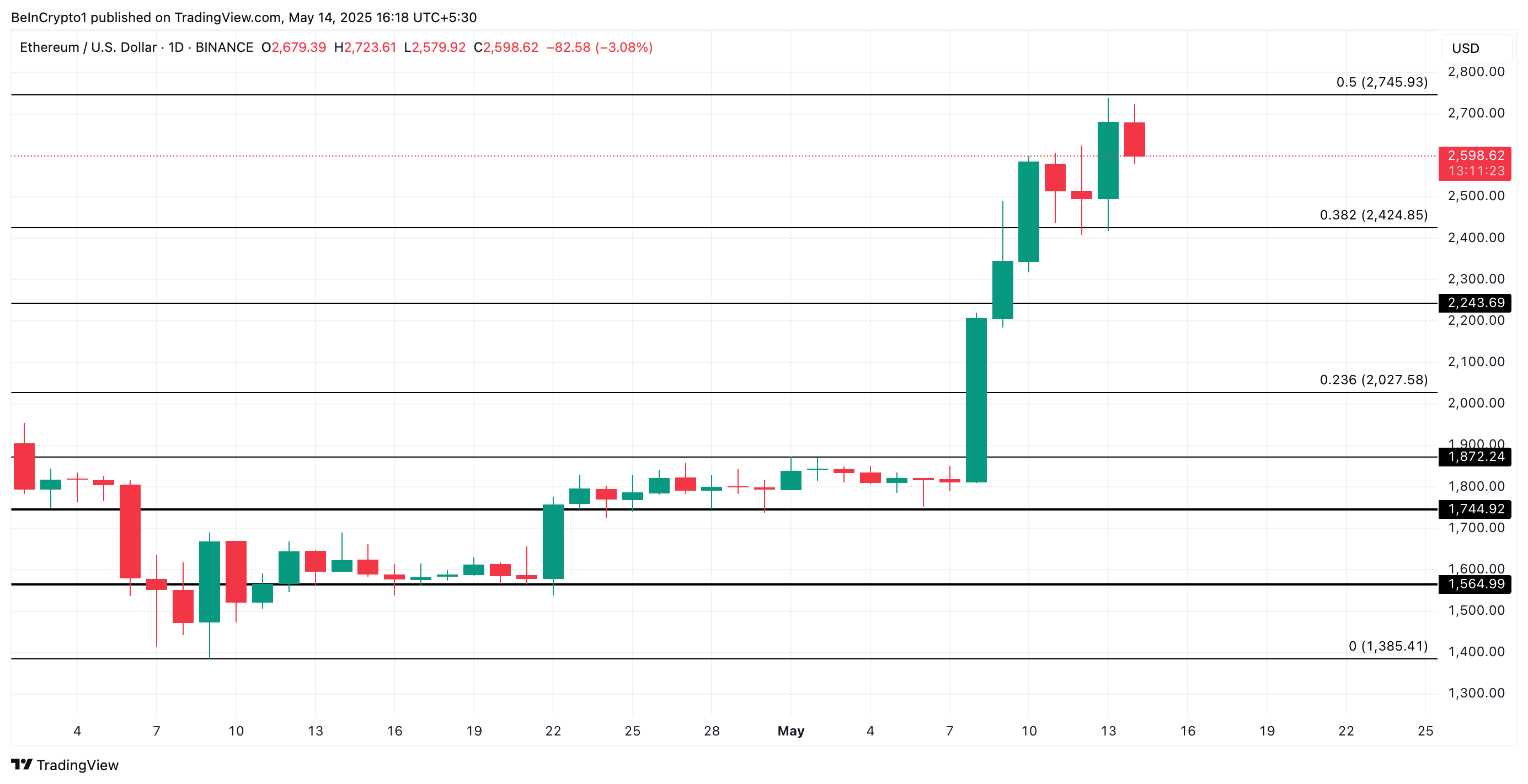

ETH trades at $2,598 at press time, resting slightly below the multi-month resistance shaped at $2,725. As US-based buyers lock in earnings, downward strain on ETH is intensifying and will push its worth towards $2,424.

If the bulls fail to defend this degree, the coin’s worth may plummet additional to $2,243.

ETH Worth Evaluation. Supply: TradingView

Nonetheless, if bullish strain strengthens, ETH may make one other try to climb again to $2,745.