The Federal Reserve referred to as shares and actual property dangerous investments on Friday, dropping the warning simply in the future after loosening its grip on crypto guidelines.

The Monetary Stability Report, launched by the Federal Reserve, stated asset costs had been nonetheless “notable” although some markets took hits earlier this month.

In response to the report, “even after current declines in fairness costs, costs remained excessive relative to analysts’ earnings forecasts, which regulate extra slowly than market costs.” The report additionally made it clear that Treasury yields throughout all maturities stayed close to the very best ranges anybody has seen since 2008.

The Federal Reserve additionally pointed to leverage available in the market as an enormous problem and stated funding dangers nonetheless appeared severe. The report, overlaying market situations as much as April 11, stated funding markets stayed sturdy by means of the tough patches in early April, however that didn’t imply every part was fantastic.

The central financial institution made positive to say that honest worth losses on fixed-rate property had been nonetheless “sizable” for some banks and that these losses had been very delicate to modifications in rates of interest.

Federal Reserve highlights asset costs, debt, and leverage bother

The Monetary Stability Report broke down how unhealthy issues appeared throughout 4 massive areas. Beginning with asset valuations, the Federal Reserve stated shares stayed expensive in comparison with earnings even after April’s selloffs.

Treasury yields stayed stubbornly excessive, and spreads between company bonds and Treasurys stayed reasonable. Liquidity issues constructed up by means of the tip of March and obtained worse in April, however buying and selling nonetheless labored.

On the true property facet, house costs stayed excessive, and the ratio of home costs to rents hovered close to file peaks. Business actual property indexes, adjusted for inflation, confirmed some indicators of leveling off, however the Fed warned that refinancing wants may nonetheless trigger issues quickly.

Debt didn’t look significantly better. Enterprise and family debt as a share of GDP dropped to the bottom level in twenty years. However enterprise leverage stayed excessive, and personal credit score offers saved rising.

Supply: The Federal Reserve

Family debt appeared tame in comparison with current historical past. Most mortgages are fixed-rate and have low-interest charges, and general debt service ratios are a bit higher than earlier than the pandemic. Nonetheless, the Fed flagged that bank card and auto mortgage delinquencies are up, particularly for folks with non-prime credit score scores and decrease incomes.

When it got here to leverage, the Federal Reserve stated banks nonetheless appeared sound, with capital ranges above regulatory minimums. Nonetheless, losses on fixed-rate property saved hitting some banks laborious. Some banks, insurance coverage corporations, and securitization outlets saved piling into industrial actual property, too.

The Fed stated that financial institution lending to nonbank monetary corporations saved climbing, thanks partly to raised monitoring strategies. Hedge fund leverage sat close to the very best ranges of the previous ten years and was largely packed into bigger funds. Some leveraged buyers began dumping positions throughout the April volatility to cowl margin calls, with hedge funds in relative worth trades being among the hardest hit.

Federal Reserve flags funding dangers and ongoing market fragility

The Federal Reserve stated funding dangers slid to reasonable ranges over the previous yr however didn’t vanish. Runnable money-like liabilities stayed close to historic medians, nonetheless posing a long-term risk. Banks reduce down their dependence on uninsured deposits because the highs of 2022 and 2023.

Prime cash market funds appeared higher, however different money autos with the identical dangers saved rising. Bond and mortgage funds, holding property that may flip illiquid quick below stress, noticed bigger-than-usual outflows throughout early April’s market stress.

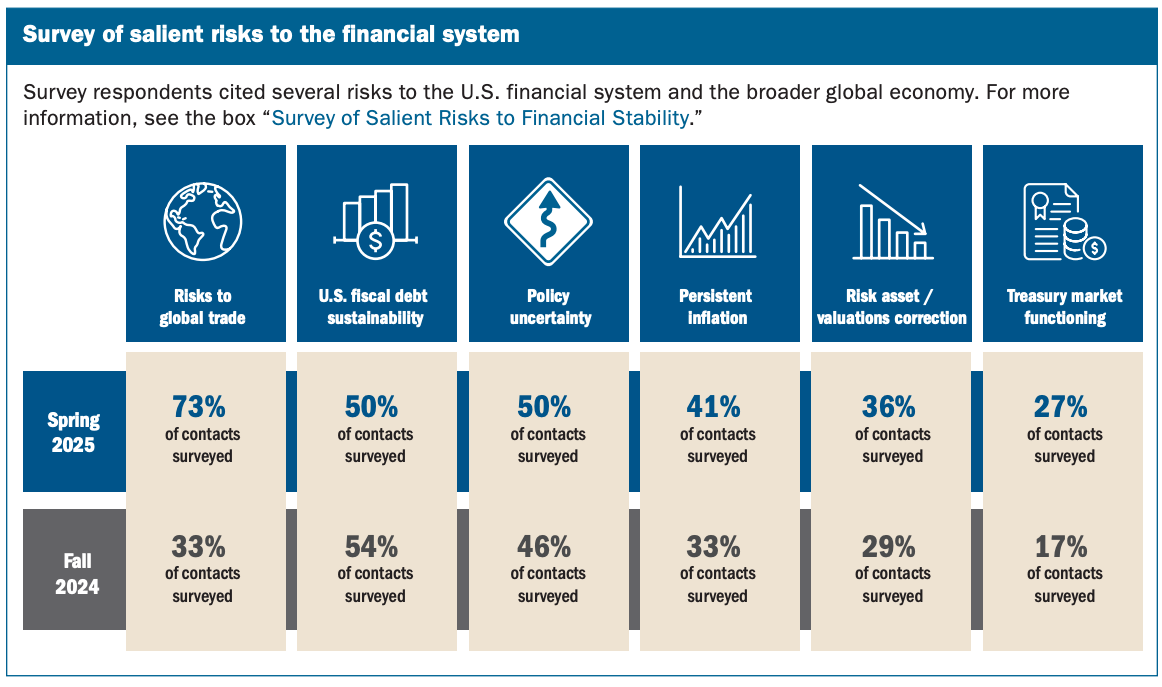

The Monetary Stability Report additionally stated world commerce dangers, debt issues, and inflation had been getting worse. It added, “a variety of respondents additionally cited persistent inflation and corrections in asset markets as salient dangers,” and a lot of the suggestions was collected earlier than April 2.

Only a day earlier than blasting shares and actual property, the Federal Reserve rolled again years of crypto restrictions. It dropped earlier guidelines that advised banks to get pre-approval earlier than doing something in crypto. Within the Thursday announcement, the Federal Reserve stated, “these actions make sure the Board’s expectations stay aligned with evolving dangers and additional assist innovation within the banking system.”